Conclusion

Up to 35% of Americans could instantly improve their FICO credit scores using Experian’s Boost service. Experian Boost is free, so potential users are missing out, either because they do not know about the benefits, they do not feel they have time, or other reasons.

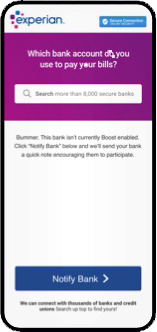

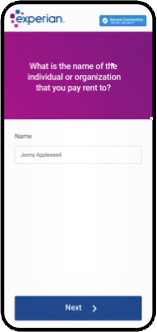

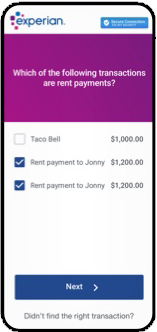

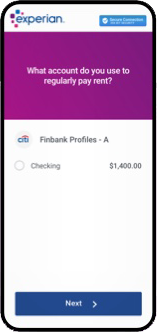

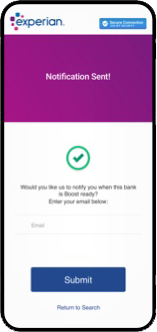

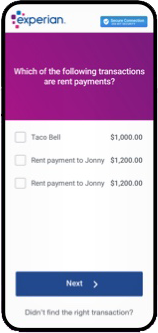

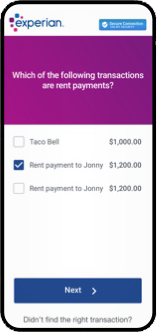

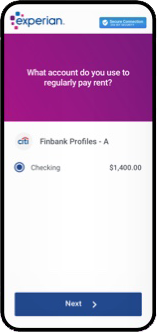

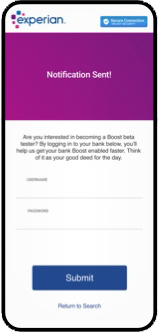

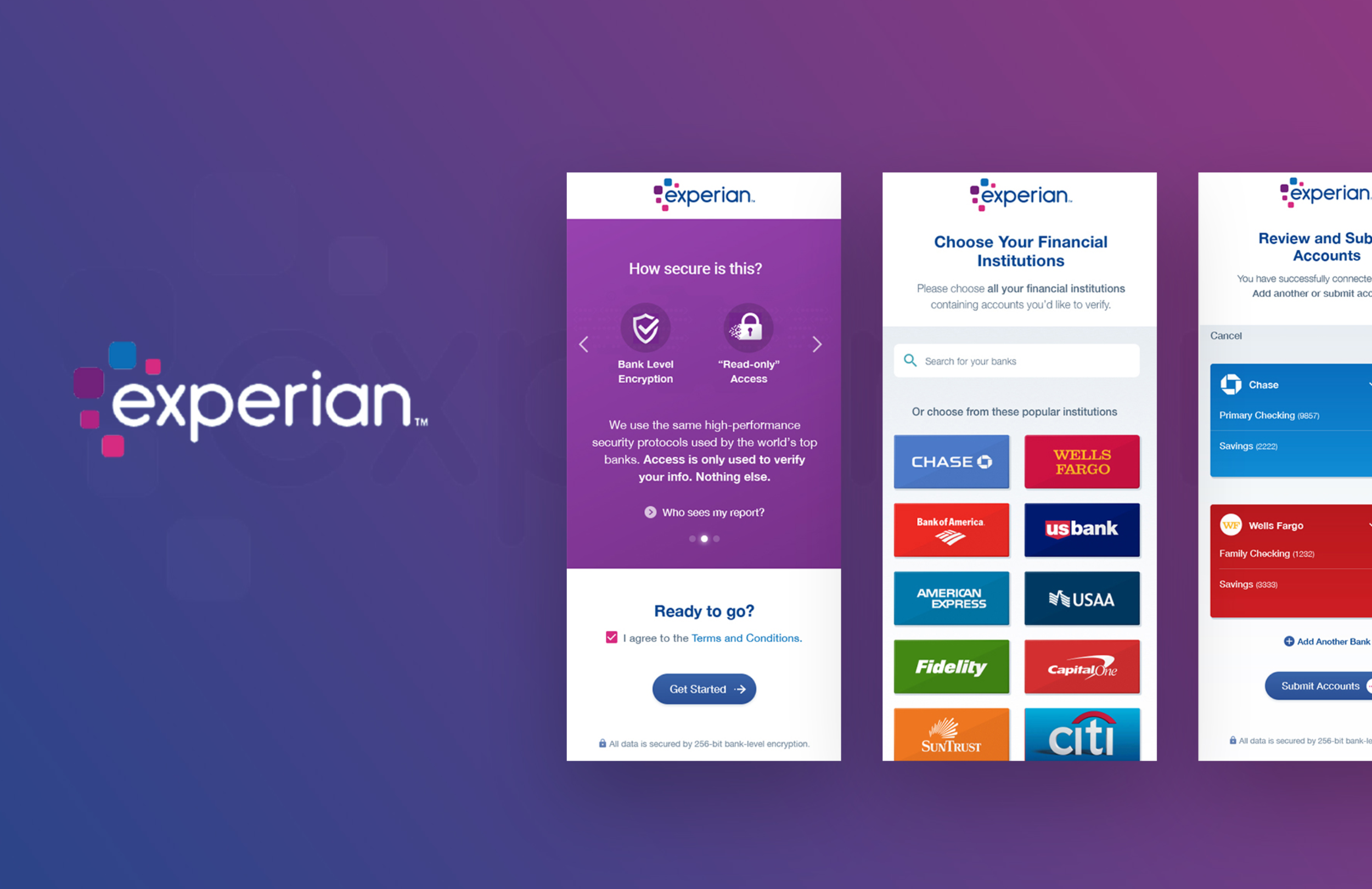

The Experian Boost App responds to this problem by creating a seamless, easy-entry app, allowing users to securely and conveniently link their accounts to Experian Boost. The UI design is simple, yet each step educates the user about the process and allows control over financial information and rent transaction history. Users can easily begin the process without previous preparation, removing some potential users’ objections.

Brainstorming, market research, and competitive analysis led to a strategizing process. The design team responded to current problems and responded to competitors’ weaknesses. Then, the most important features were mapped into a low-fidelity mockup. From there, user interface and other design features were incorporated into high-fidelity mockups and prototypes. The complete app offers a streamlined interaction that captures Experian’s Three Experience Pillars.