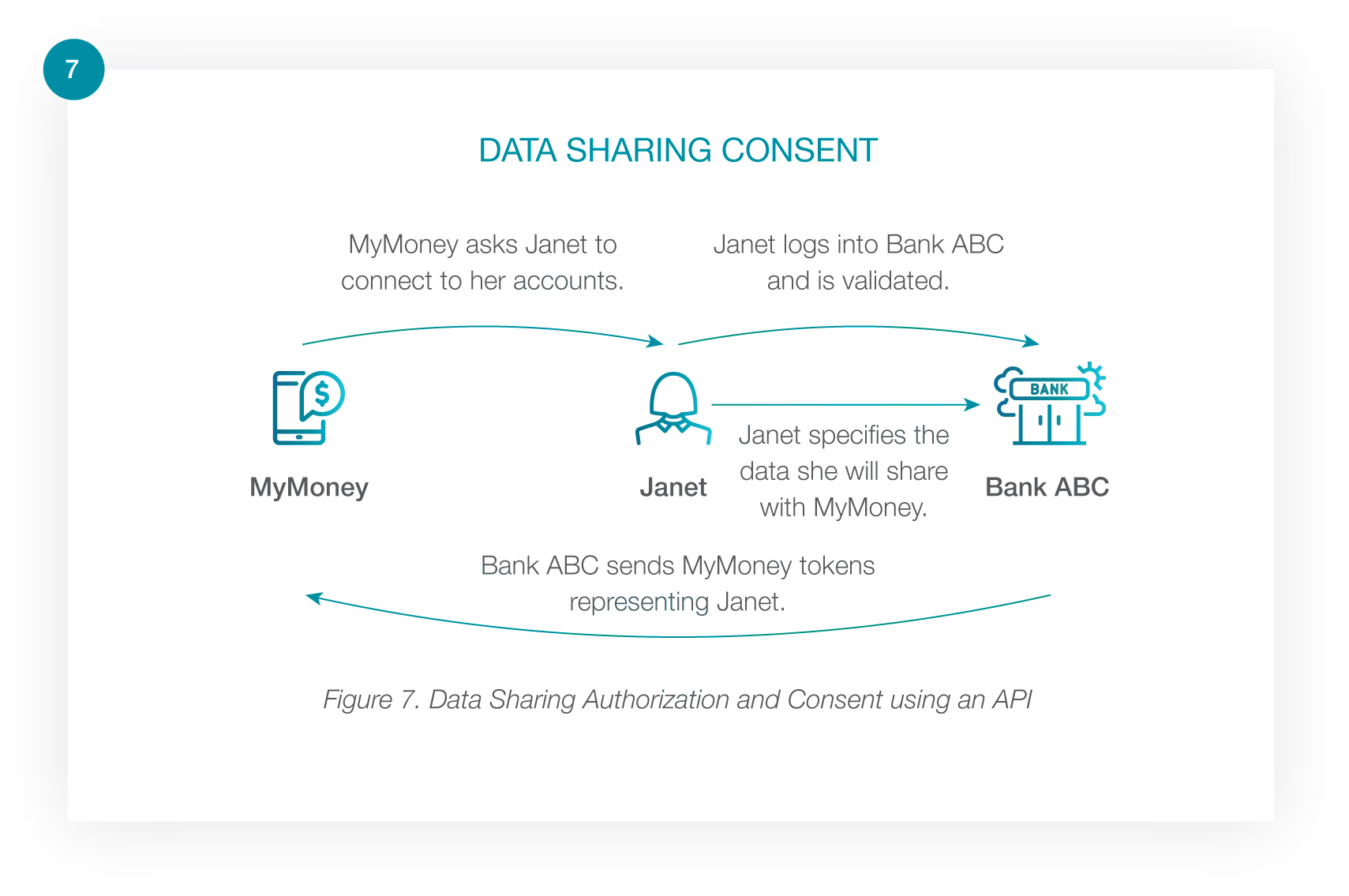

Let’s say two companies want to share account and transaction information for Janet. Using the FDX API, they know how to request data and what it will look like coming back. The conversation between two computer systems might look like this if they were using the FDX API:

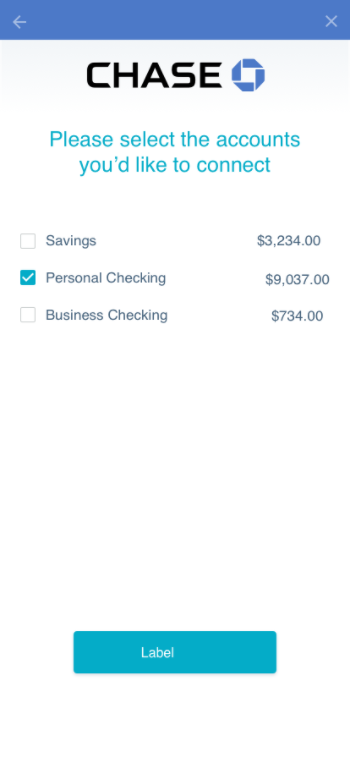

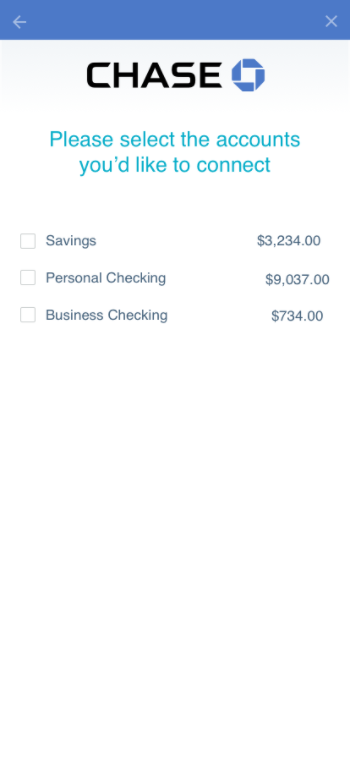

Financial App: Hi, Bank ABC, I’m looking for all of Janet’s available accounts.

Bank ABC: Here is a list of her accounts: 1, 2, 3, 4, 5.

Financial App: For account 1, can I get her account details?

Bank ABC: Account 1 is a checking account with current balance of $100.

Financial App: For account 1, can I get transactions for the last 7 days?

Bank ABC: Account 1 had 10 transactions:

1) Check 1091 for $20 on May 5th

2) ATM withdrawal for $30 on May 6th

3) etc. ….

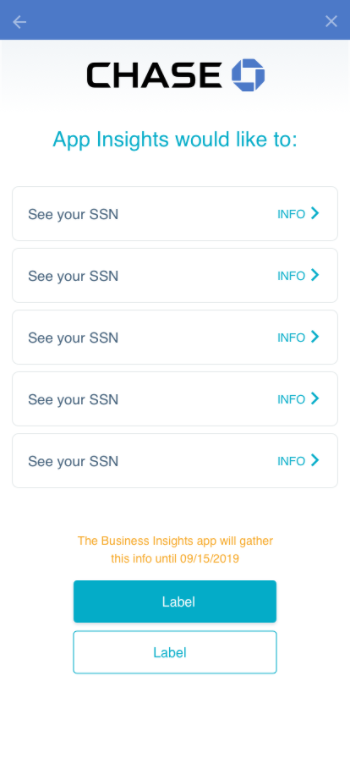

APIs allow apps to borrow functionality and data from one another and become reusable building blocks to new apps. For example, Uber leverages several APIs to offer its service, including payment apps such as PayPal to pay its drivers, Google Maps to pin point where drivers and passengers are, and instant messaging APIs to communicate with them.