Project Summary

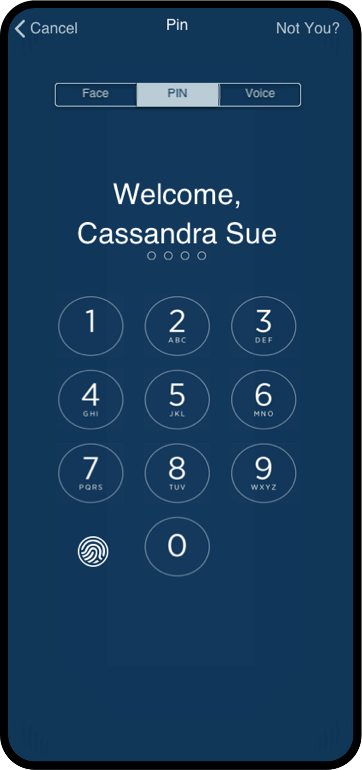

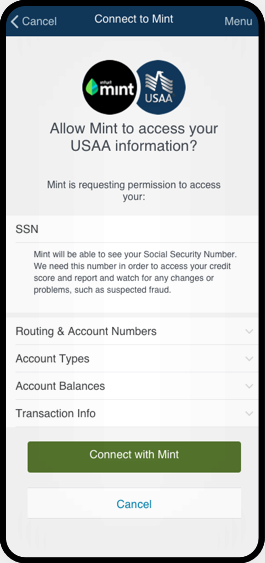

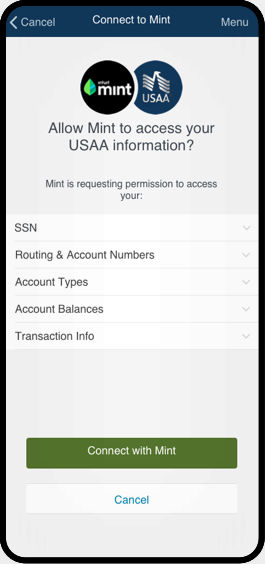

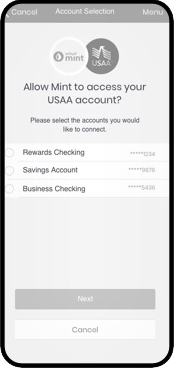

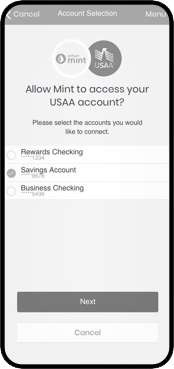

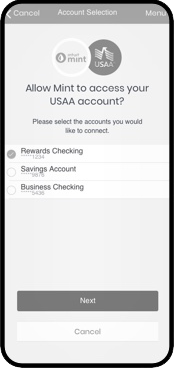

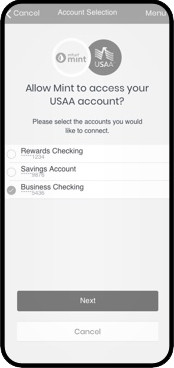

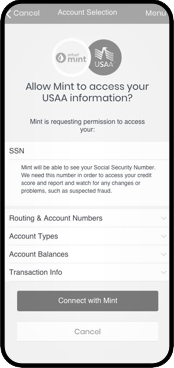

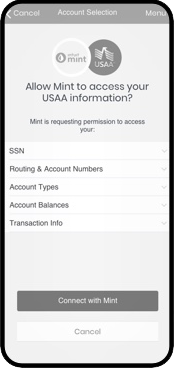

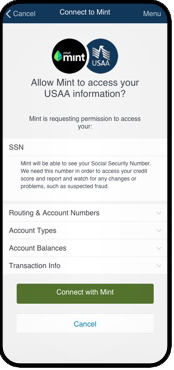

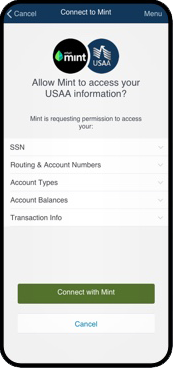

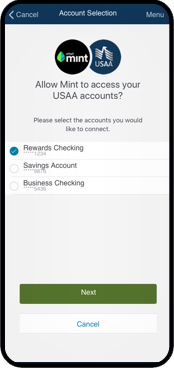

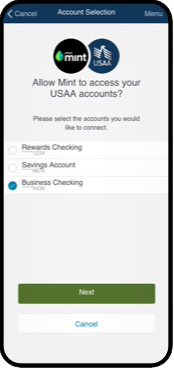

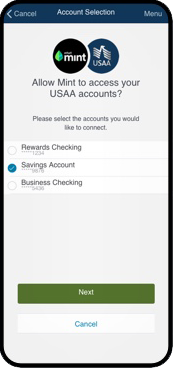

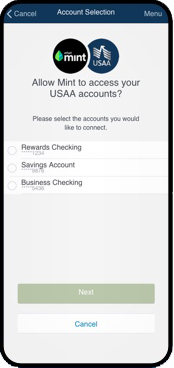

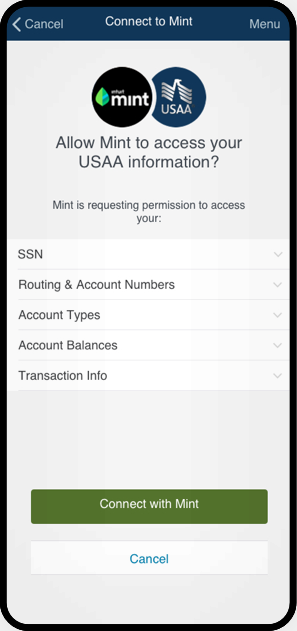

Financial institutions through FDX have reached agreements to share data with application programming interfaces, or APIs. These solutions often will benefit the banks and end-users by allowing information to flow more securely between financial entities or by presenting a holistic view of the user's data and finances to help them make better spending decisions. Through FDX guidelines for transparency, USAA's goal was to disclose to the consumer on what data is being shared, with whom, for what purpose, and for how long.

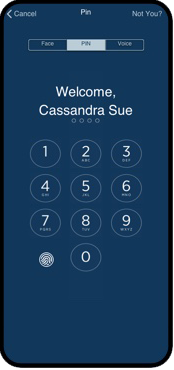

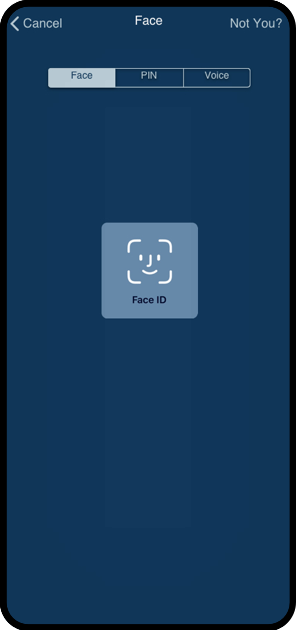

(With its traditional, conservative color scheme, and use of classic symbols and firm right angles, USAA Bank emphasizes credibility and consistency. The UI design would reflect this emphasis on long-standing and consistent service -- while also educating users about financial data sharing and helping them make well-informed consent).

Project Objective

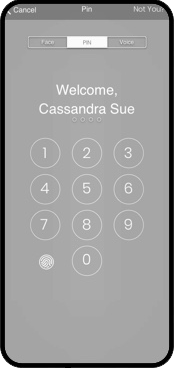

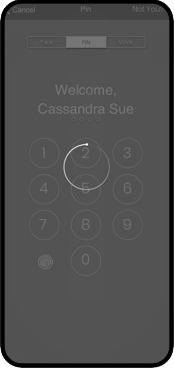

Our task was to develop the USAA banking consent-giving experience within the Financial Data Exchange platform. What will the experience design look like for members of the military, veterans, and their family members who are eligible to use USAA Bank products? How will the process of disclosing data look? What choice architecture design methods will be used to decide where and when their information is displayed and what the user journey will be like?