Overview

Mortgage lending has historically been a gate-kept fortress of paperwork. By shifting from manual document uploads to a consumer-permissioned data model, we replaced days of friction with minutes of certainty. Acme Lending, a mid-to-large tier financial institution, found itself at a friction point between legacy banking traditions and a rapidly evolving workforce. While the organization aimed to streamline loan origination, the reality was that 98 million of the 156 million full-time workers in the U.S. were paid through third-party payroll providers or gig platforms. The existing system effectively penalized modern employment, creating a bottleneck in which borrowers had to act as their own data couriers, manually collecting and scanning PDF documents. My role as the senior product designer for Finicity/Mastercard is to implement a digital Verification of Income and Employment (VOIE) solution. This wasn’t just a UI refresh; it was a fundamental shift in how we established trust. We moved from an artifact-based verification process to a data-stream process using API integrations called TX Verify.

Research & Design

Product Design · UX strategy · Design Research · API Design · Consumer banking experiences · API Experience (DX) · Fintech Compliance (FCRA) · Consumer Lending

- Duration: 2019

- Partners: Acme Lending, Finicity/Mastercard, Acme Lending (Client / LOS Provider)

- Team: Fas Lebbie · John Adams (Collaborating across Product, Engineering, and Compliance)

Confidentiality: This case study reflects my perspective. Specific details have been modified to protect sensitive information while showcasing my design approach.

My Role

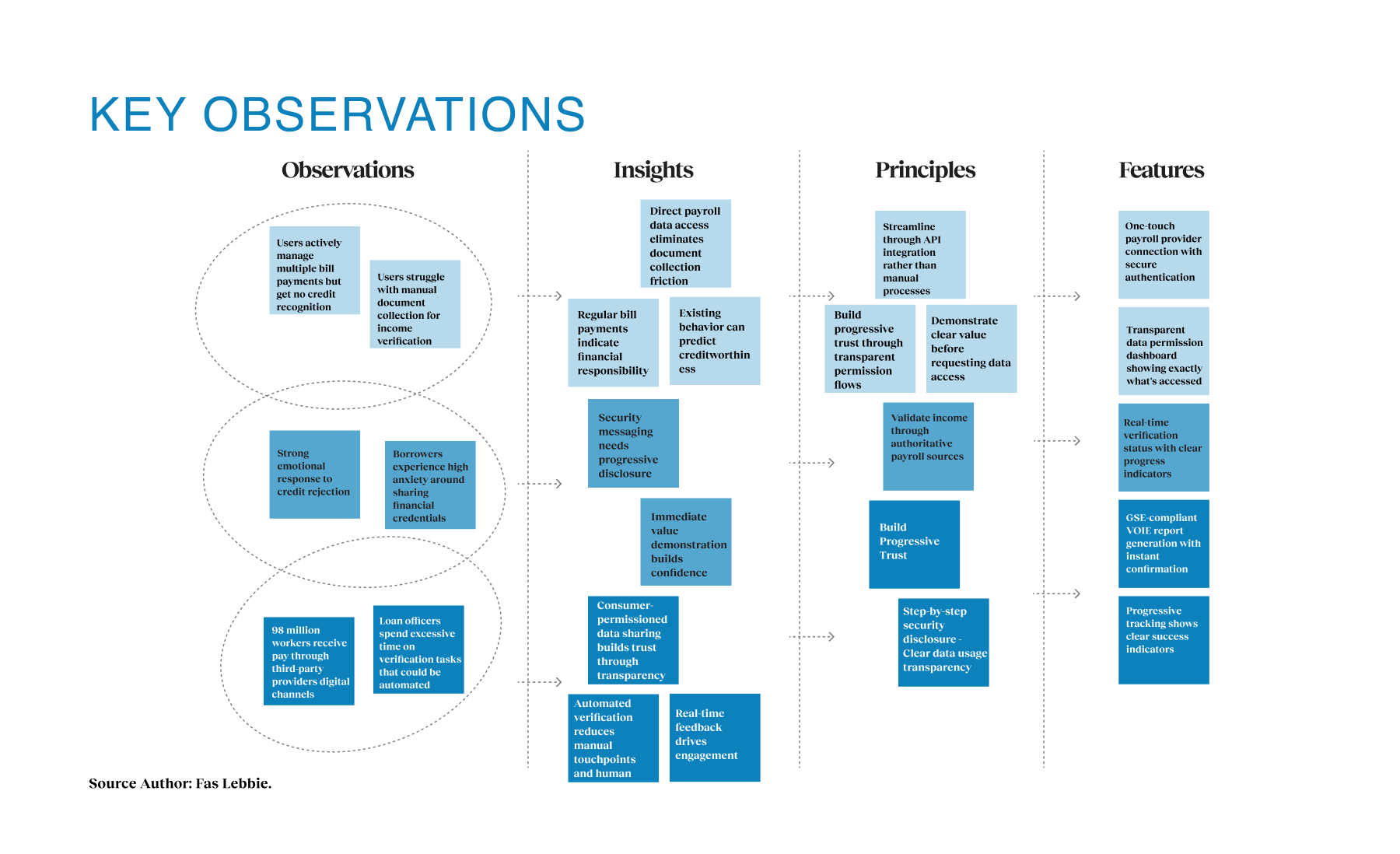

I conducted interviews with borrowers and loan officers to uncover the specific anxieties around connecting bank accounts. I synthesized these findings to challenge the assumption that "thin file" borrowers were high-risk, reframing them as data-rich users who simply lacked the traditional W-2 artifacts our systems demanded.

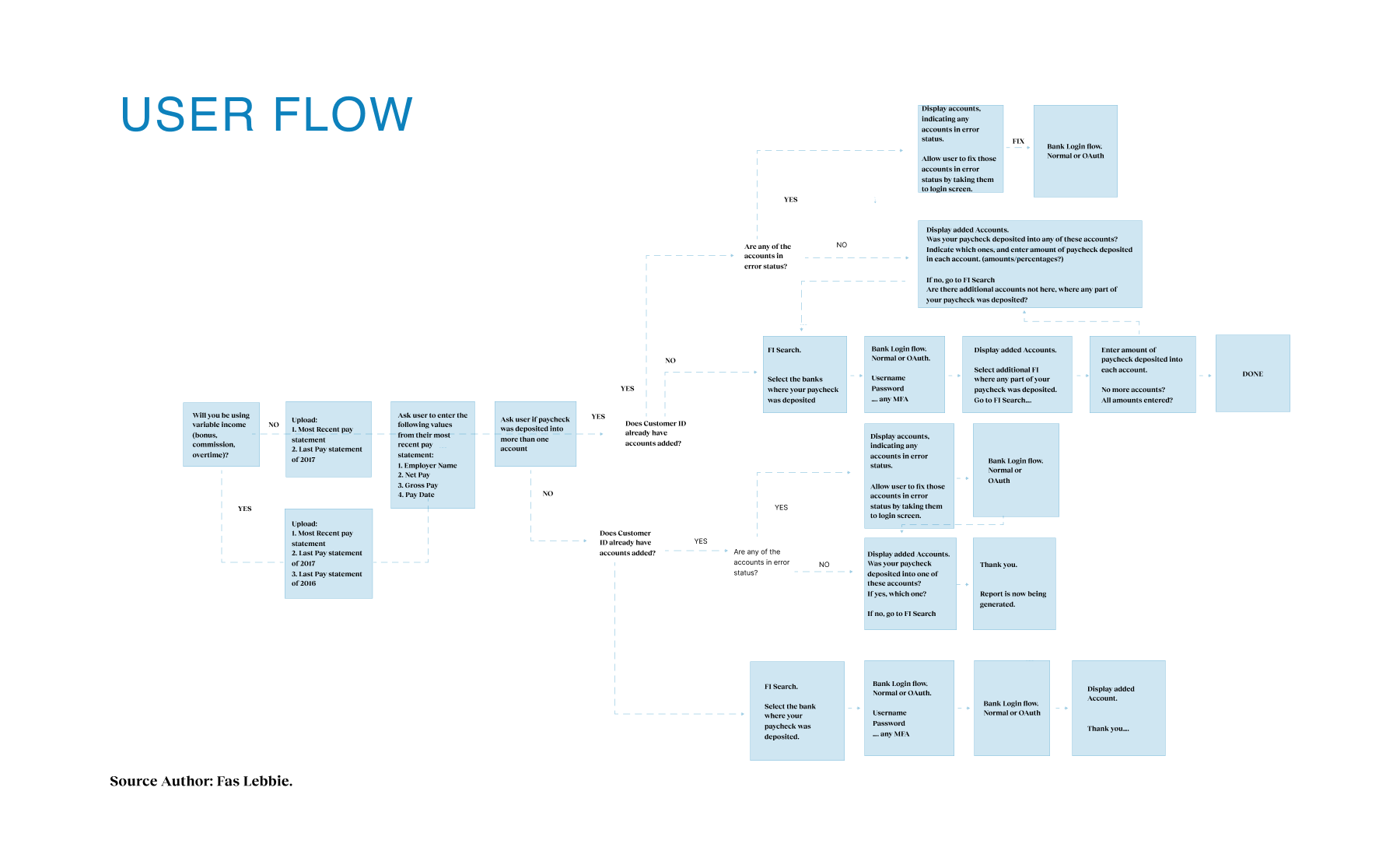

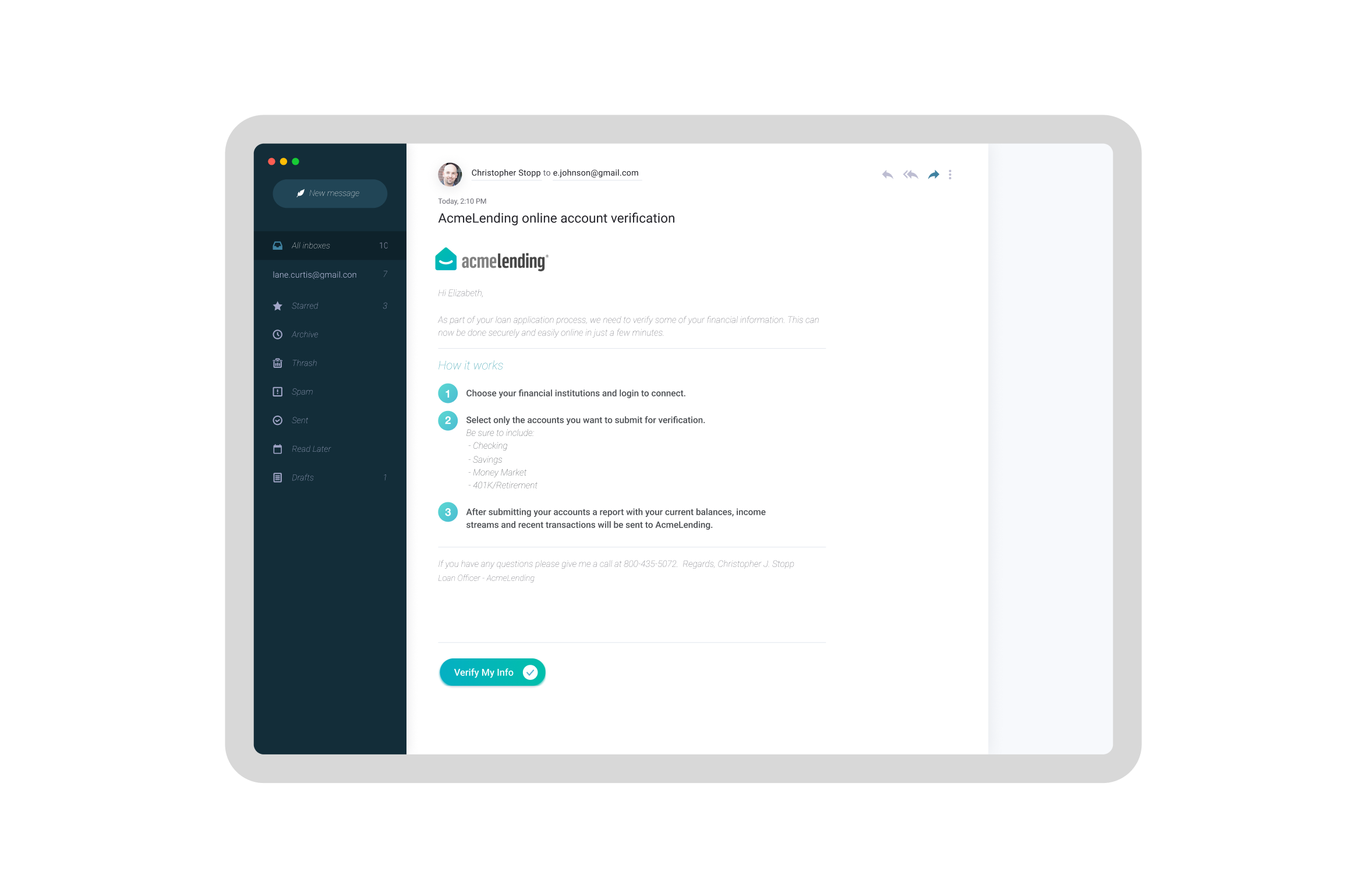

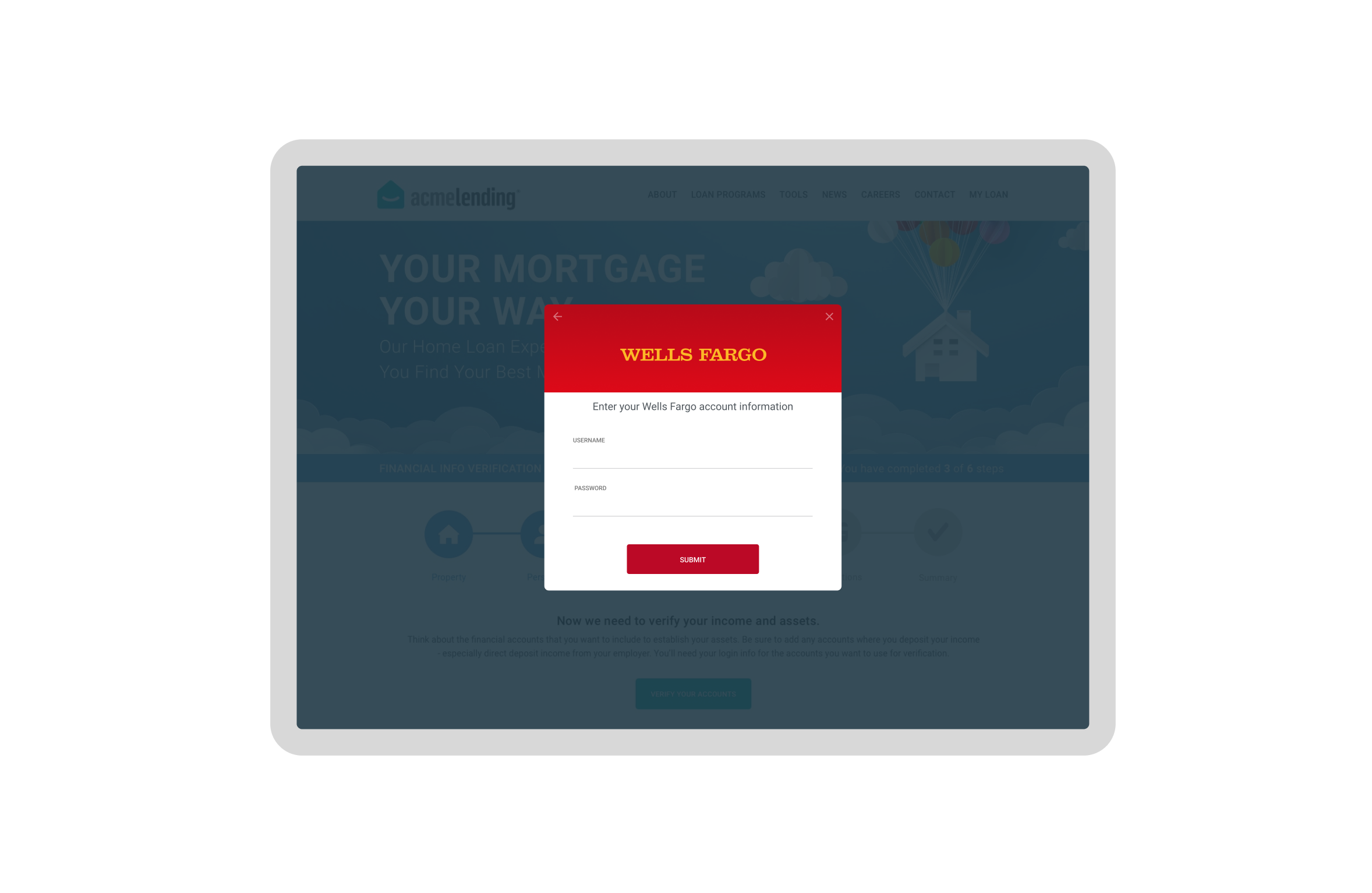

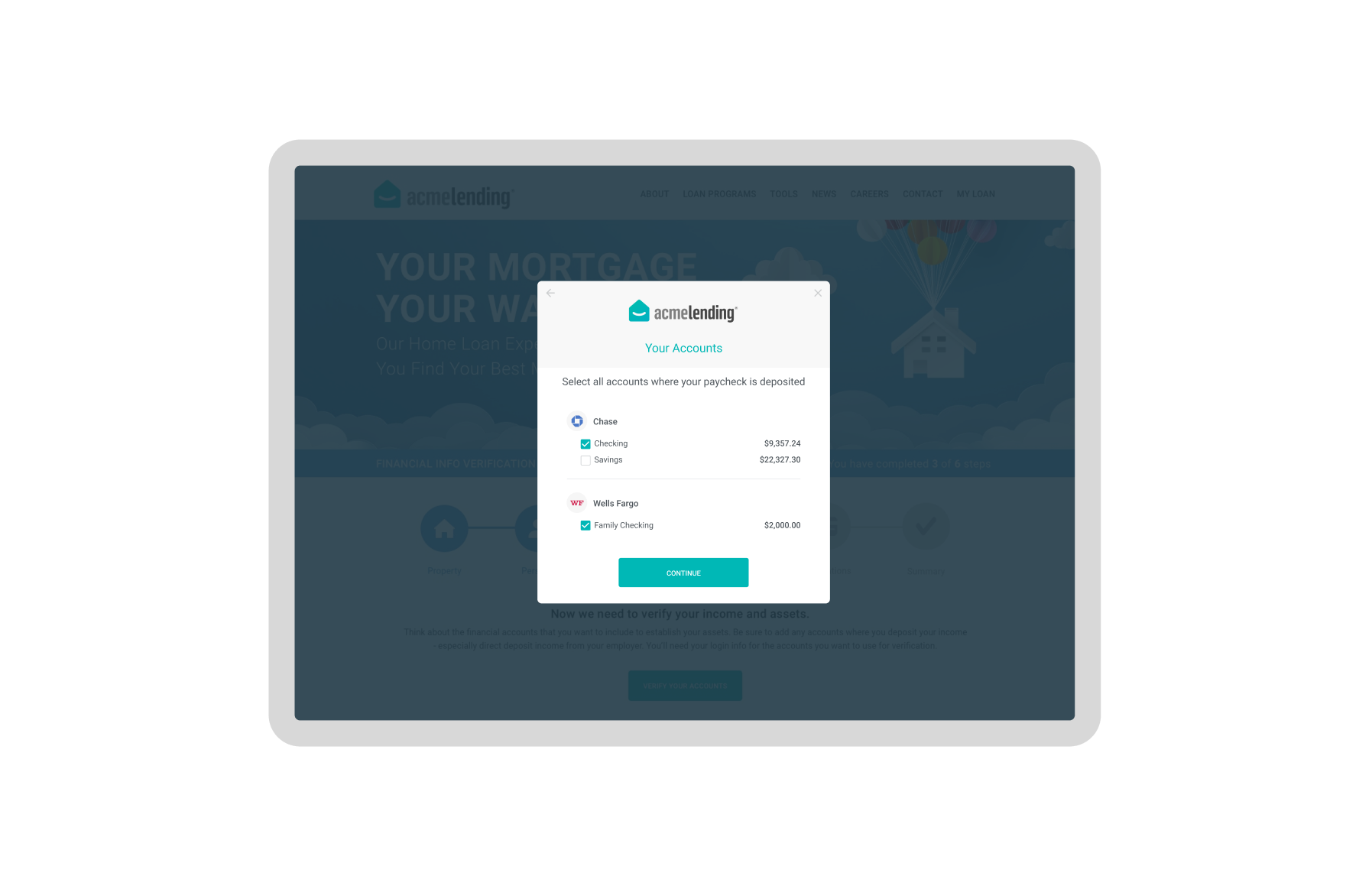

I designed the end-to-end UX interfaces and API integration strategies based on key use cases identified, with a heavy focus on the "trust layer" between the borrower, Acme, and Finicity. I designed the logic for error handling, specifically the "MFA Handoff," to reduce anxiety during multi-factor challenges, ensuring that the "sad paths" provided clear, human-readable recovery options rather than dead ends.

Problem Context

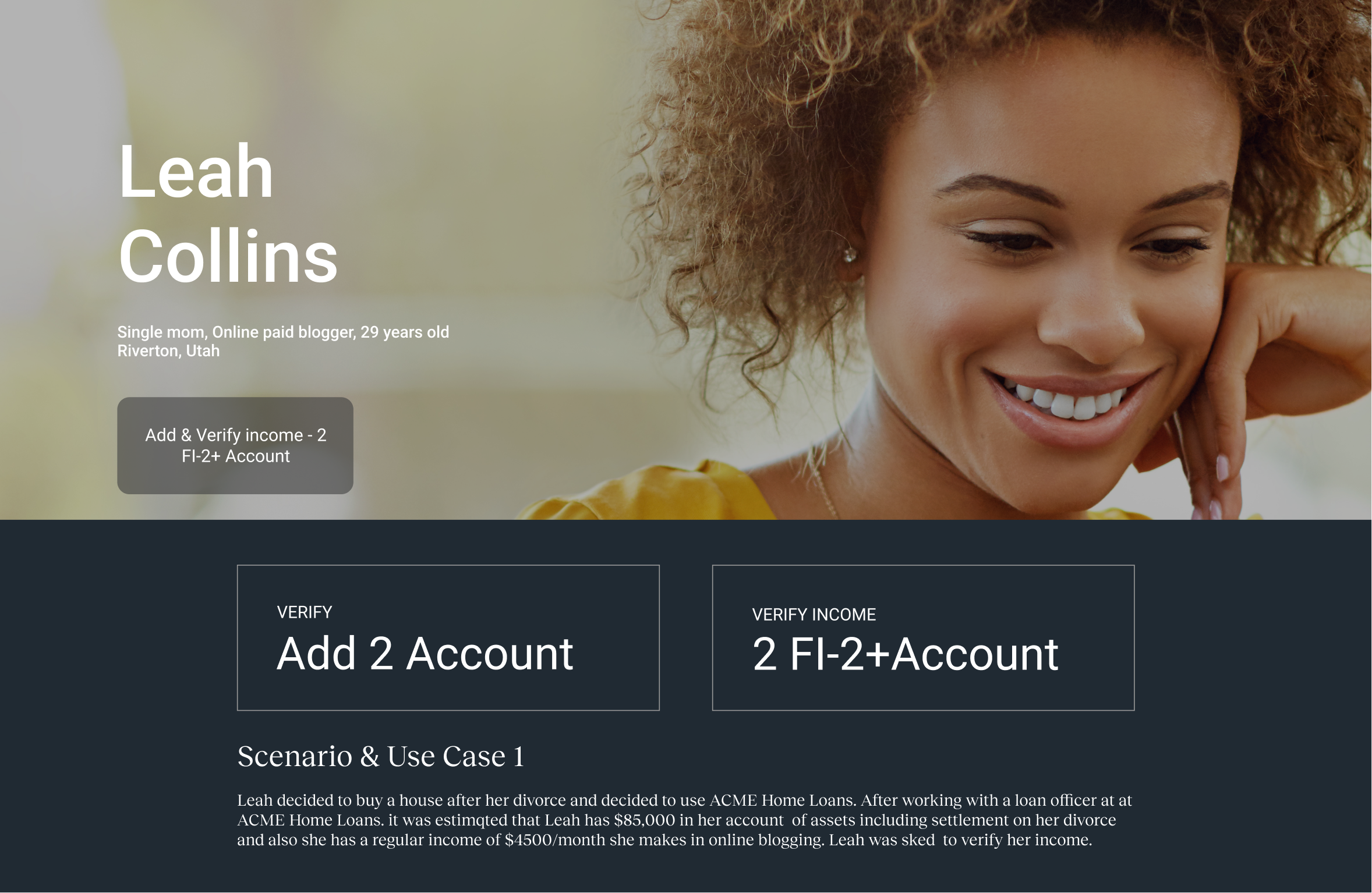

The mortgage industry has long operated under a “guilty until proven innocent” model for income verification. At Acme Lending, the traditional verification process was not just time-consuming; it was fundamentally broken for a massive segment of the population. We were asking users to perform manual labor by collecting, scanning, and uploading physical documents in an era where their financial lives were entirely digital. This friction created a divide. While W-2 employees could struggle through the “happy path,” the 98 million workers paid through disparate payroll providers found themselves in a systemic loop of failure. Take “Leah,” a persona we identified: a gig-economy worker flagged as “high-risk” simply because she couldn’t upload a standard paystub. They were digitally native but institutionally excluded. The system failed to connect seamlessly with modern digital channels, forcing loan officers to spend hours staring at screens, manually verifying the authenticity of PDFs. This manual bottleneck didn’t just delay approvals; it also increased operational costs and reduced lenders’ throughput. With industry averages pegging manual verification costs at $150+ per loan, every manual intervention eroded our margin. A design intervention was needed not just to speed things up, but to rewire the infrastructure of trust.

My Approach

At the core, we realized that for “thin-file” borrowers, the friction wasn’t just the interface but the fear of institutional judgment. We continue to reframe the verification process from a compliance interrogation into a “Data Handshake,” centering the marginalized user through Design Justice principles. This strategy prioritized transparency and revocability, ensuring that the process empowered the borrower’s narrative rather than satisfying the lender’s checklist.

Design Process

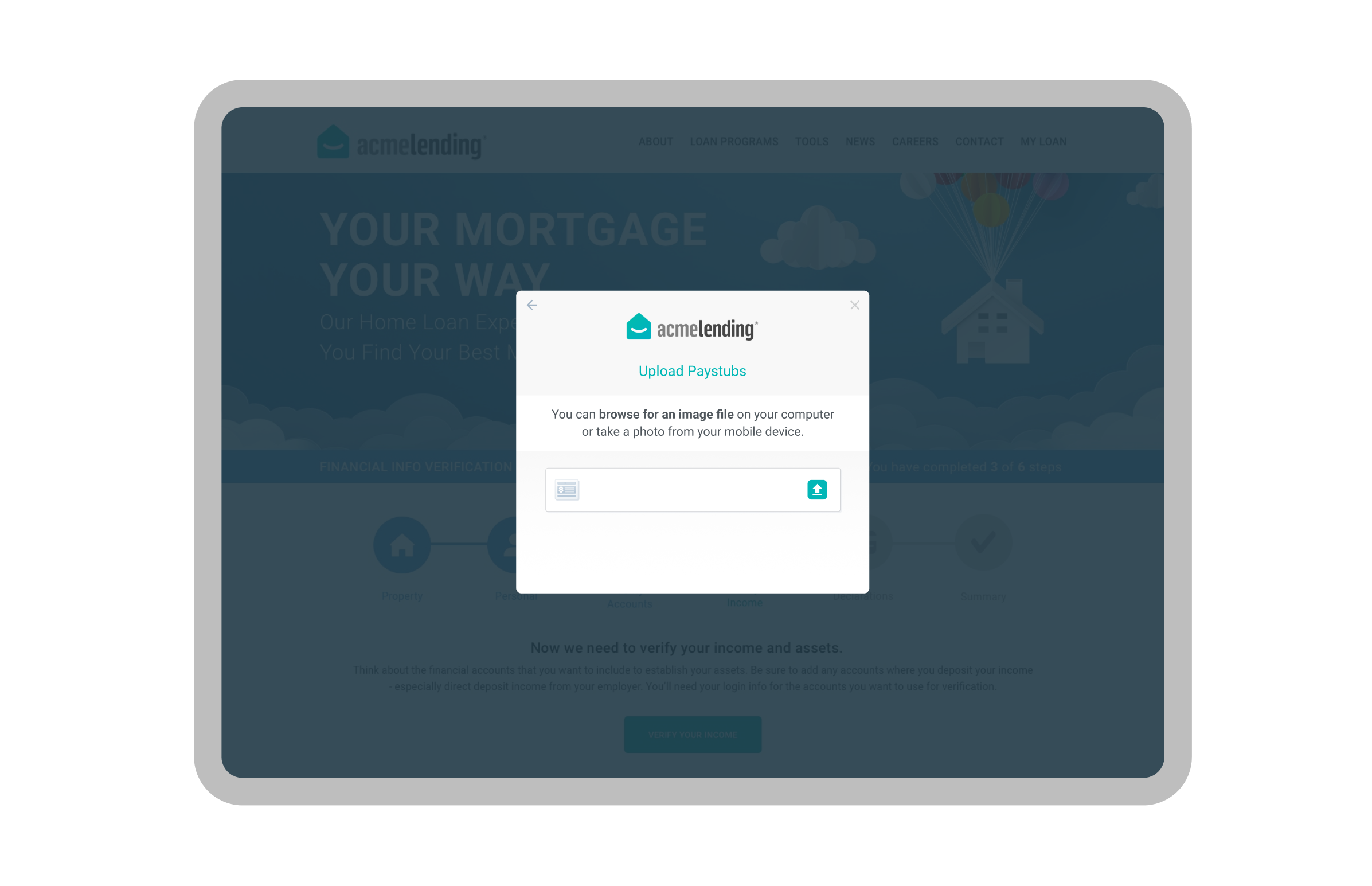

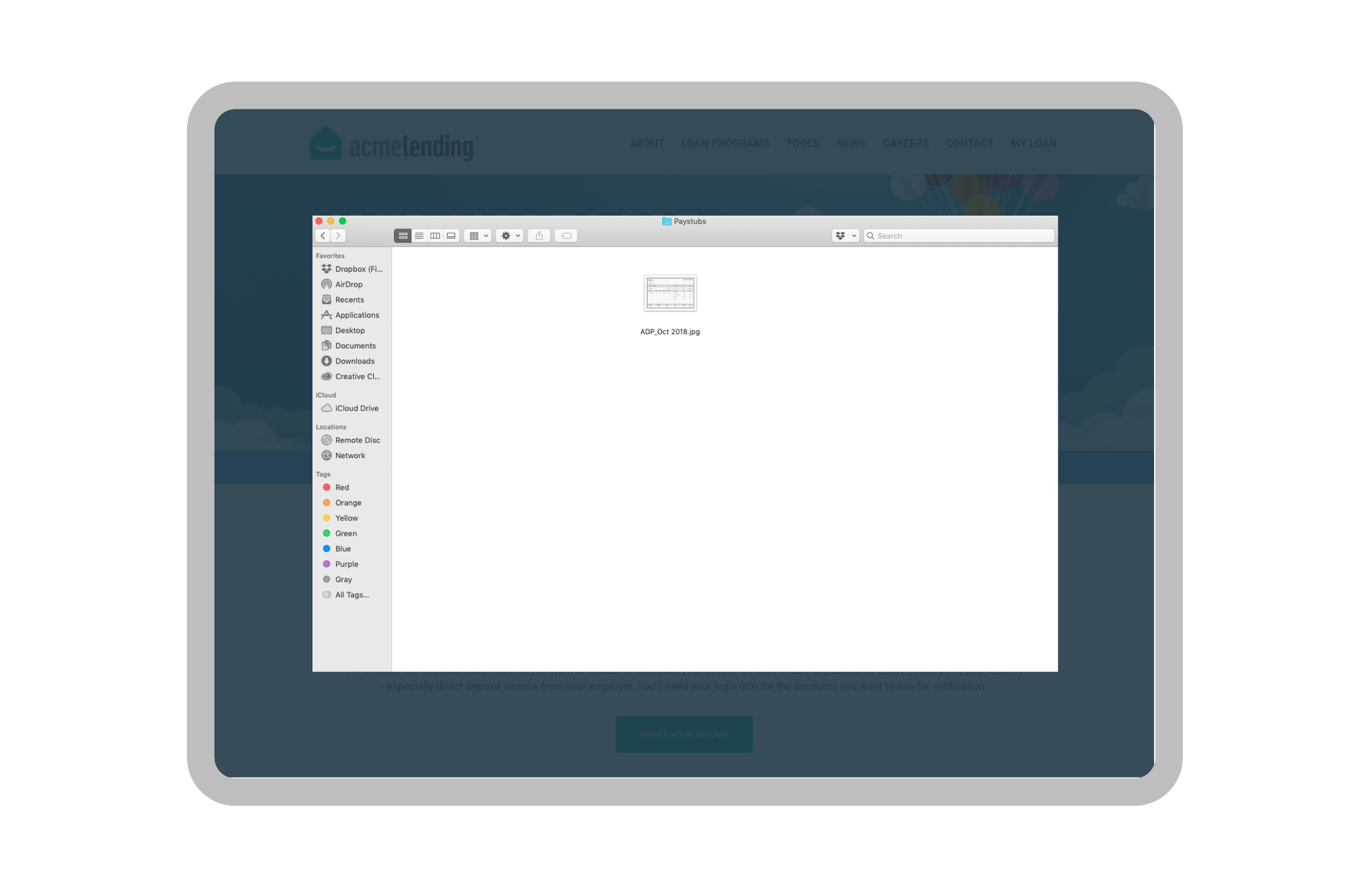

When we started, the verification process was a stare-and-compare exercise where loan officers visually cross-referenced PDF numbers with application data.

The data painted a frustrating picture:

- The Artifact Trap: Paystub verification dominated 75–85% of the loan market. This meant the vast majority of our digital infrastructure was built to ingest static images, not dynamic data.

- The Disconnect: Despite 98 million workers having digital payroll data, our systems had zero connectivity to these sources.

- The Time Sink: Borrowers spent hours hunting for documents, and officers spent days verifying them. The “Time-to-First-Decision” was notoriously slow (industry avg. 45-60 days).

We observed that the system treated every user as a potential fraud risk, creating a hostile environment of “stipulations”—constant requests for one more document. The baseline wasn’t just slow; it was eroding the borrower’s excitement about buying a home.

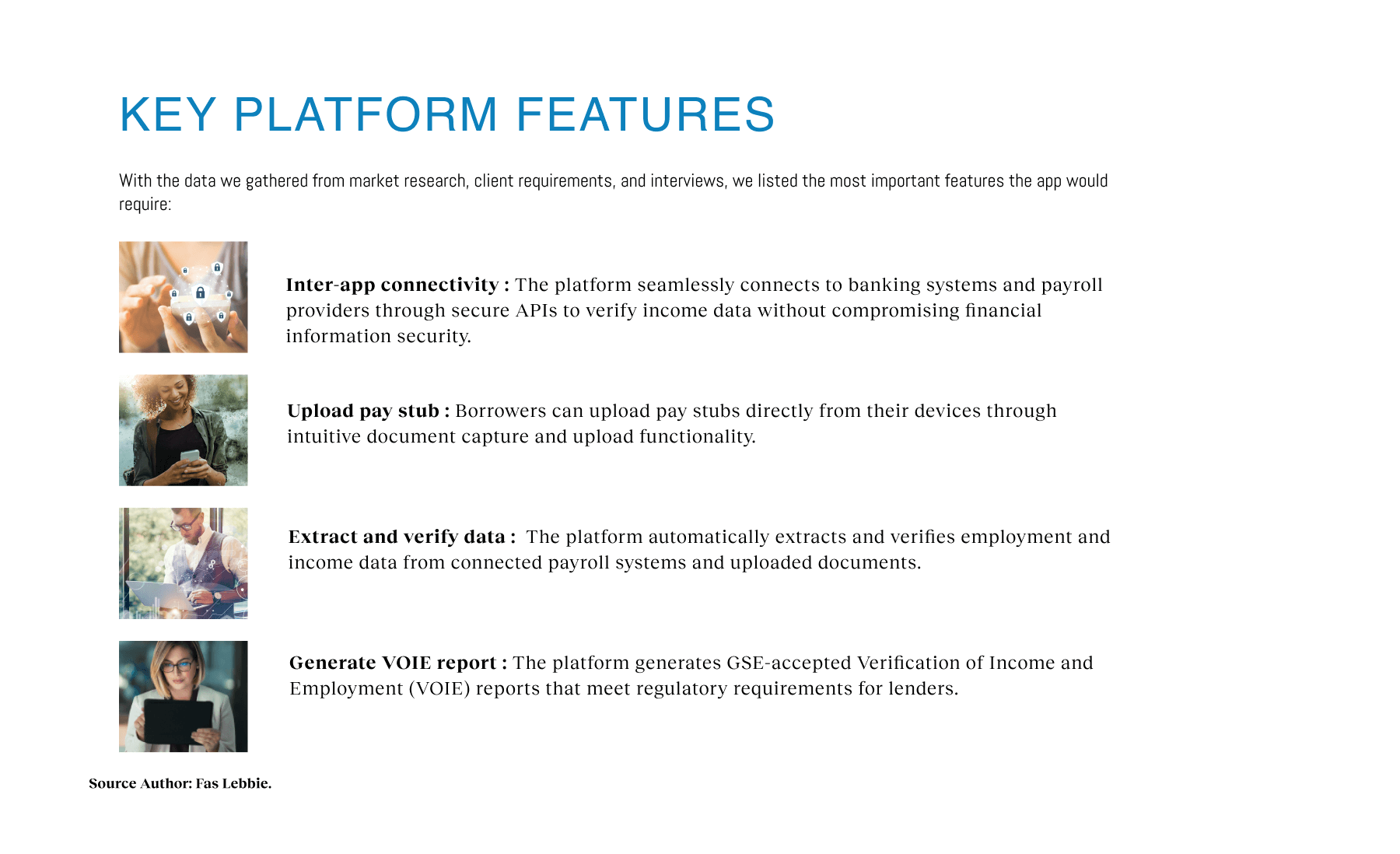

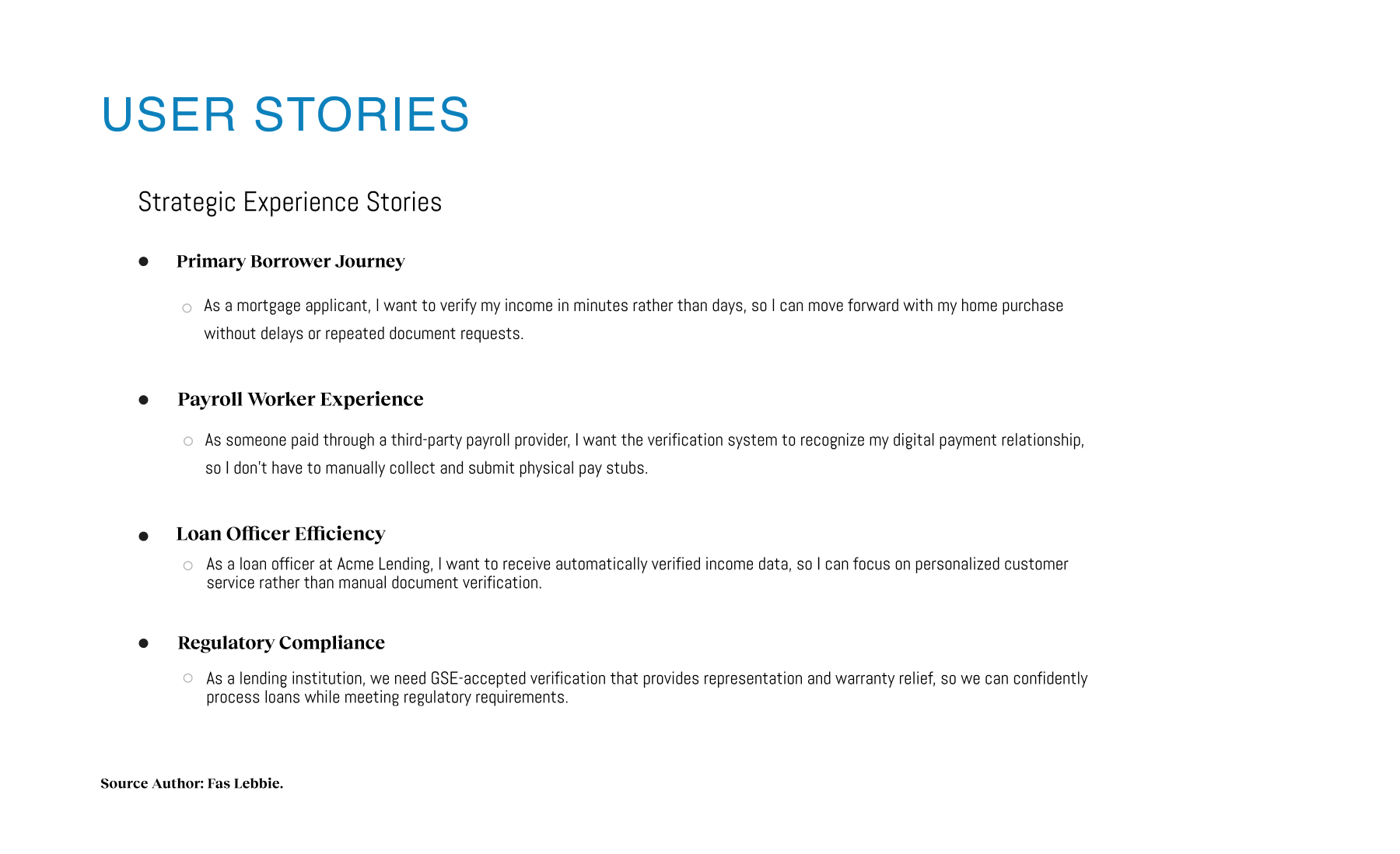

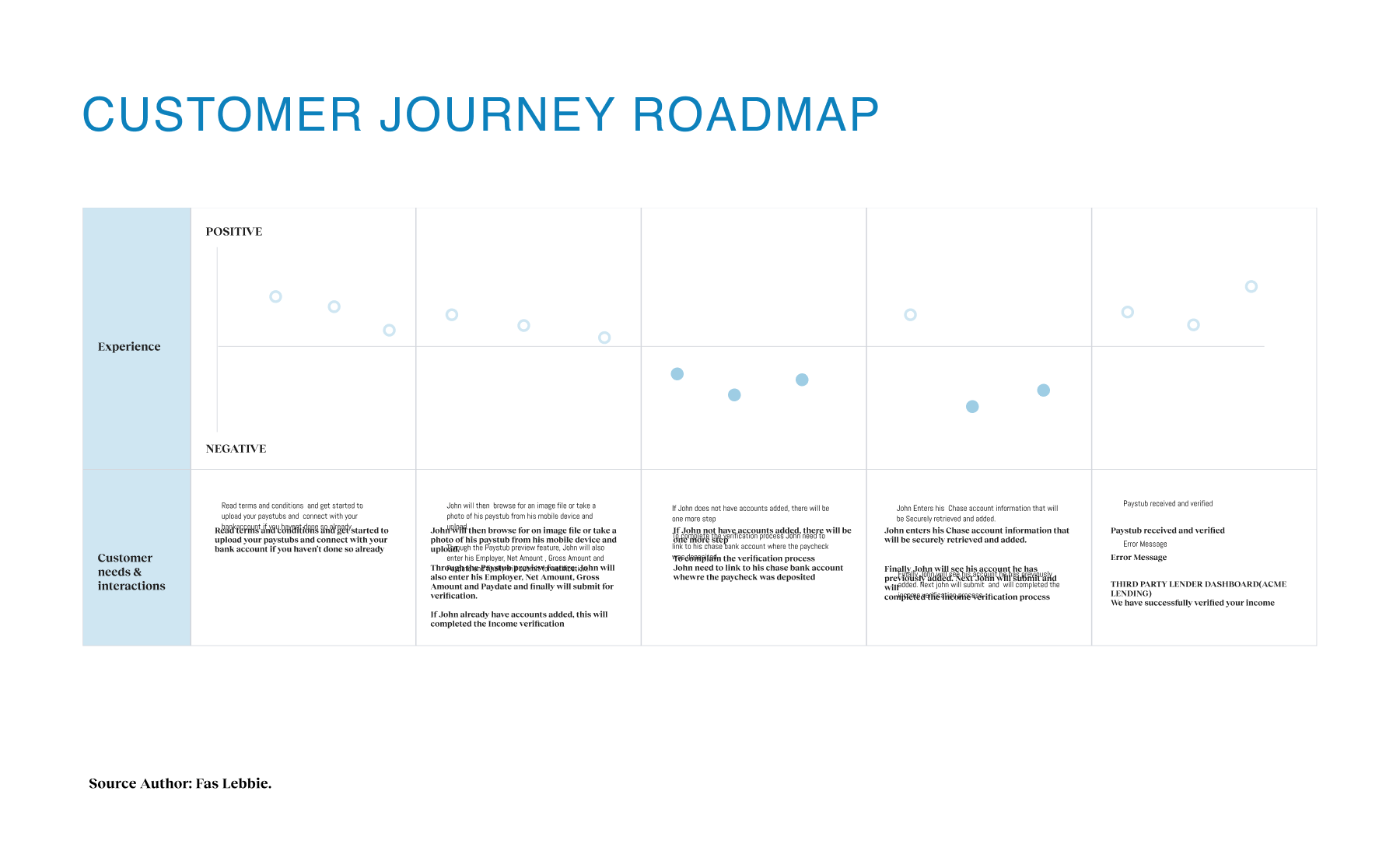

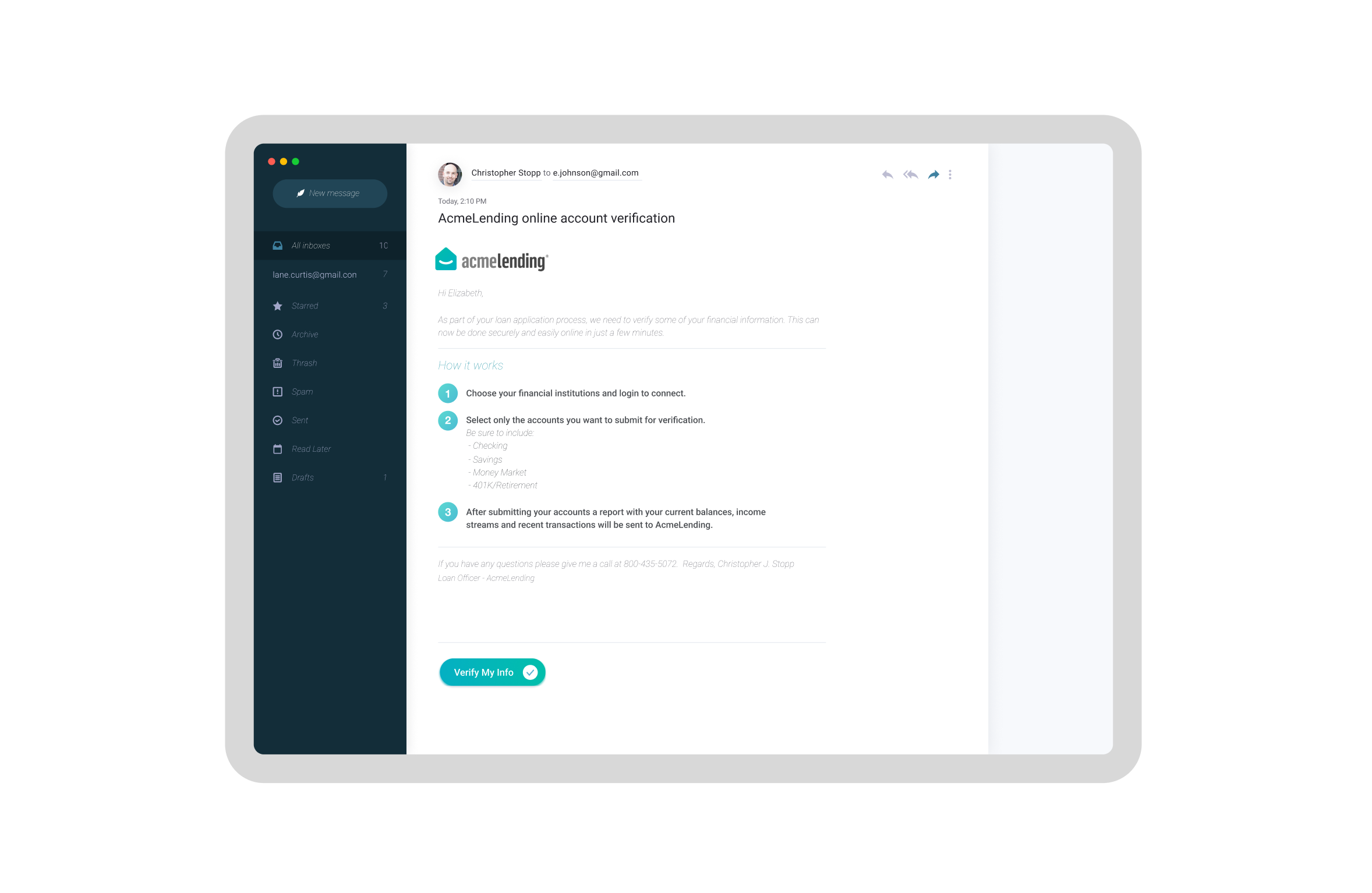

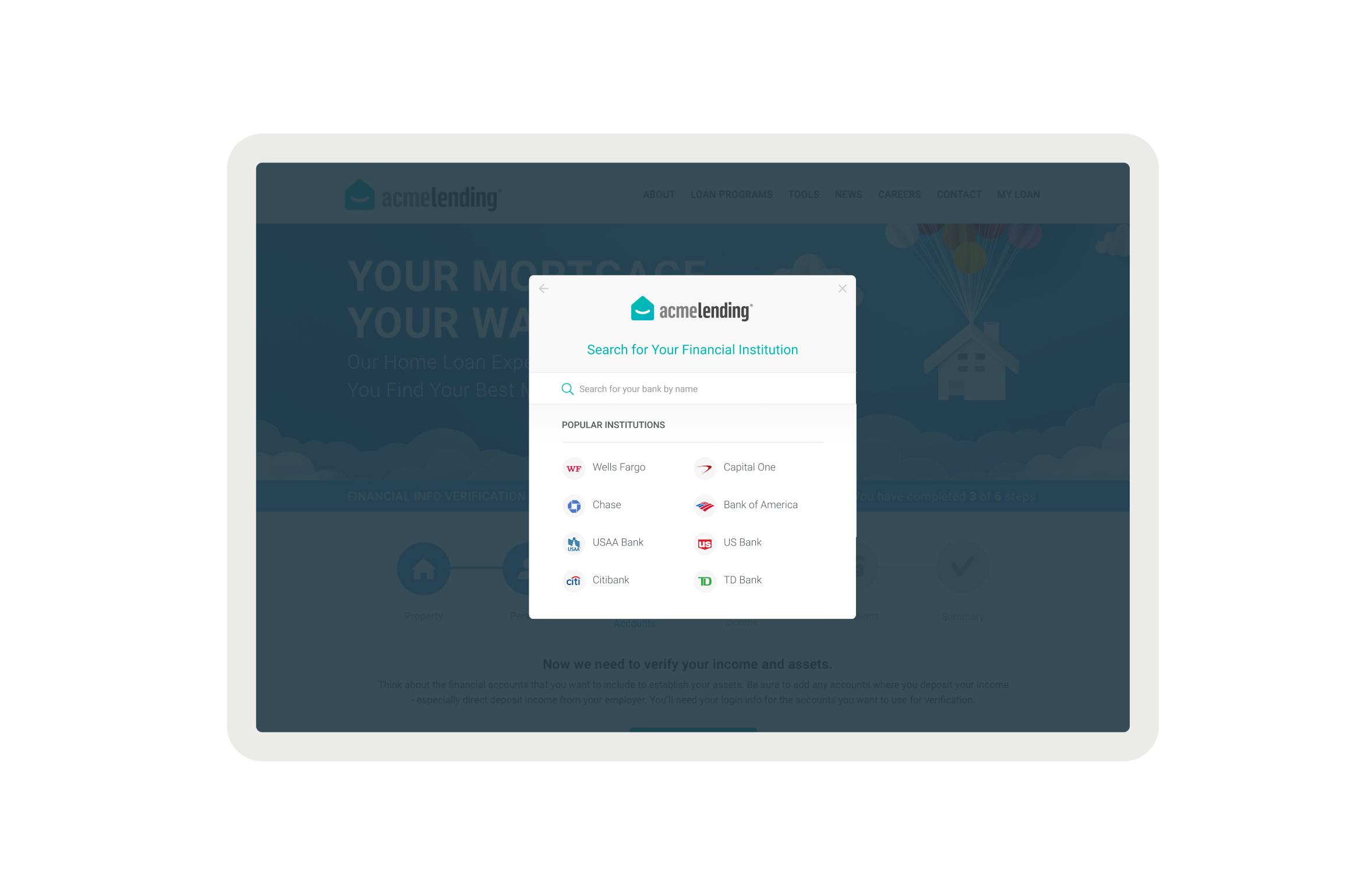

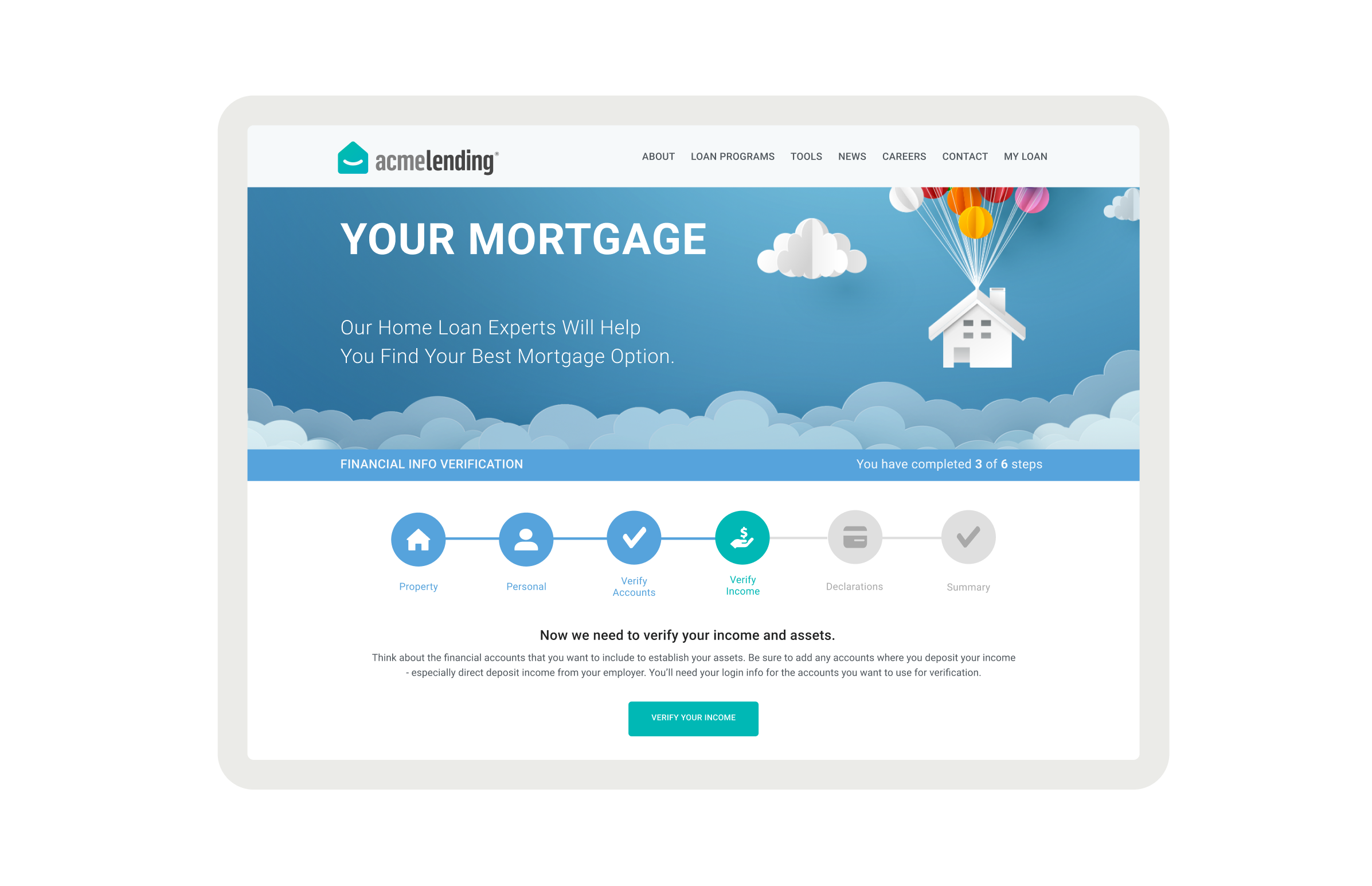

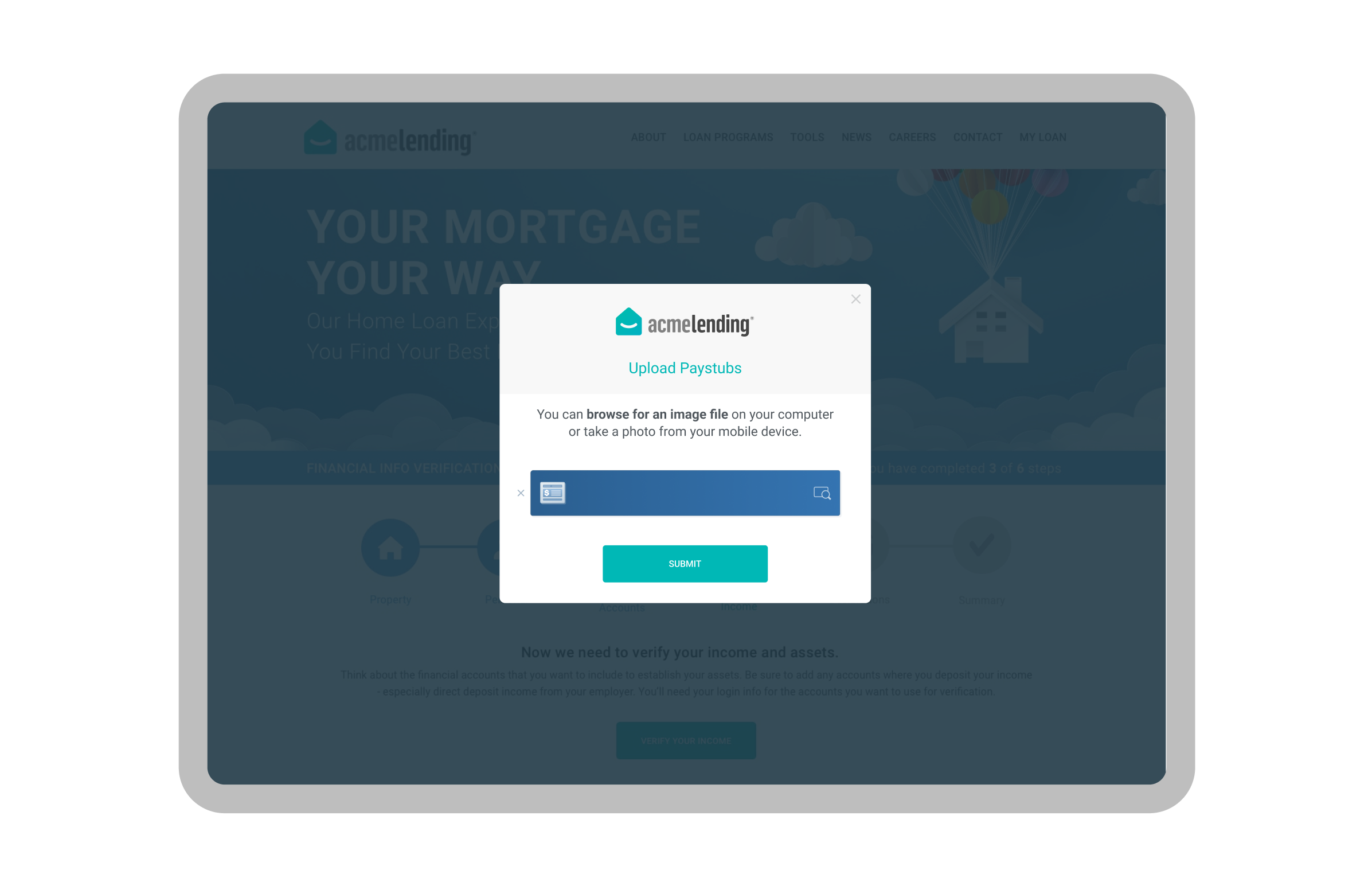

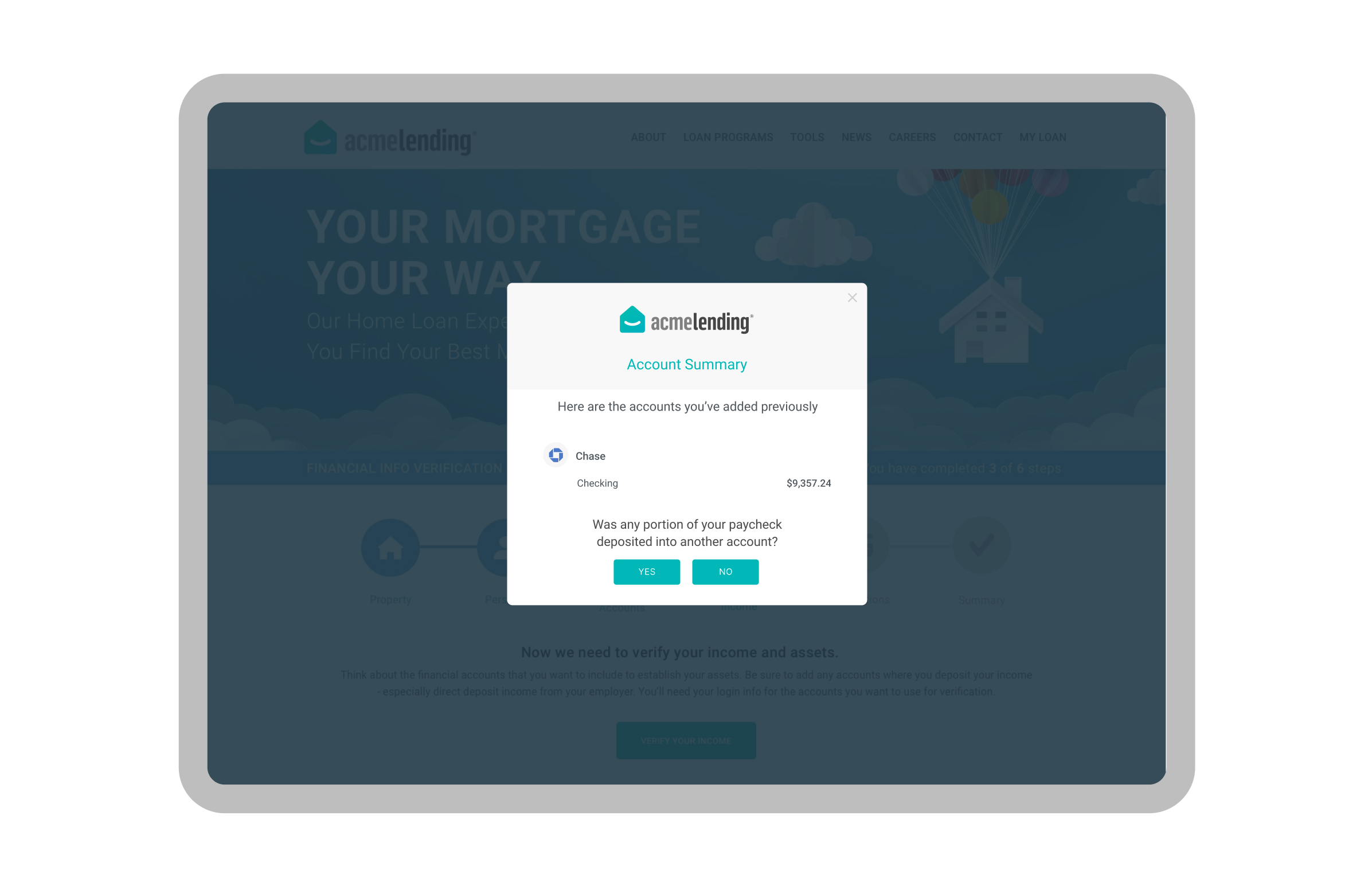

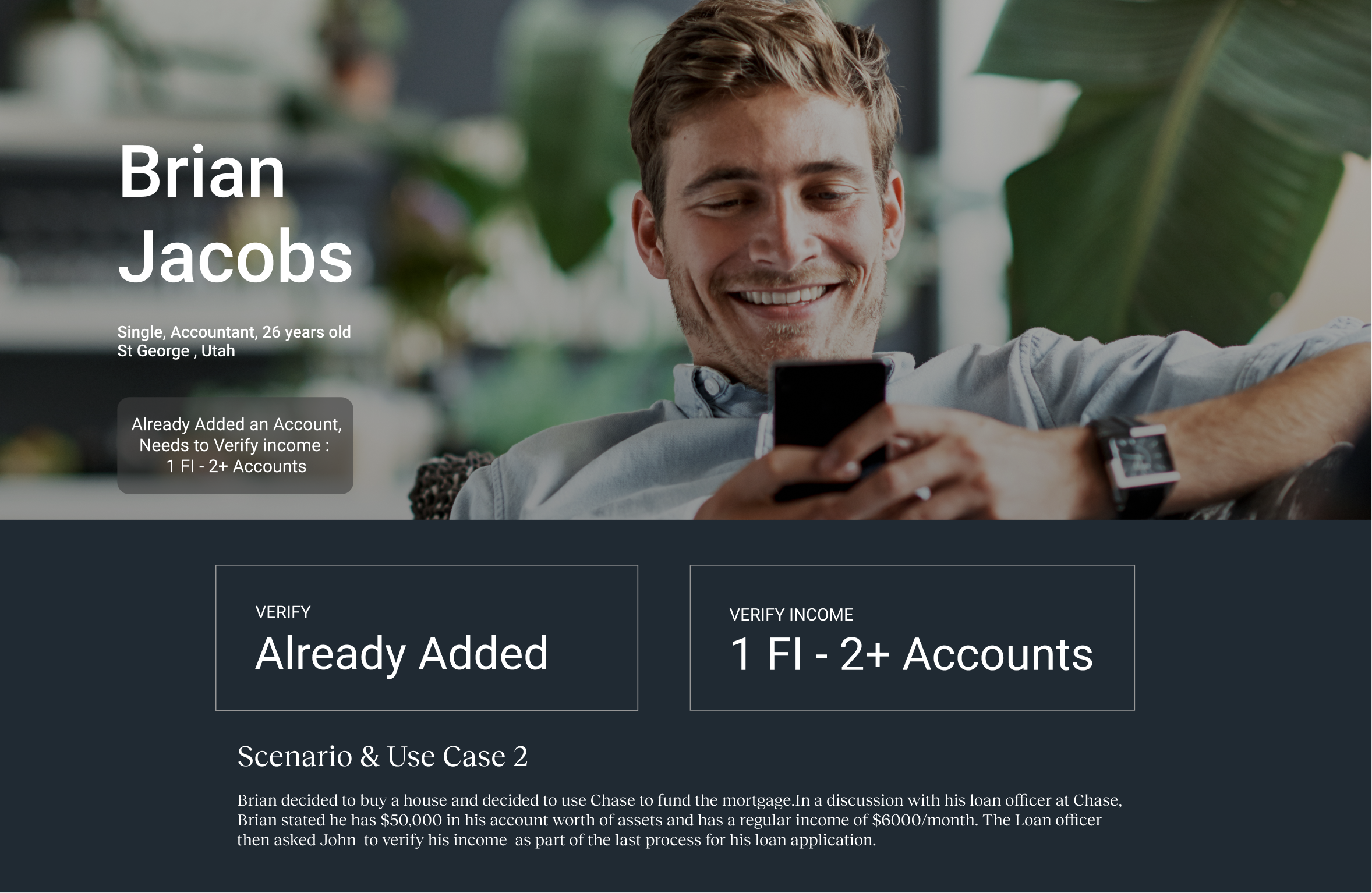

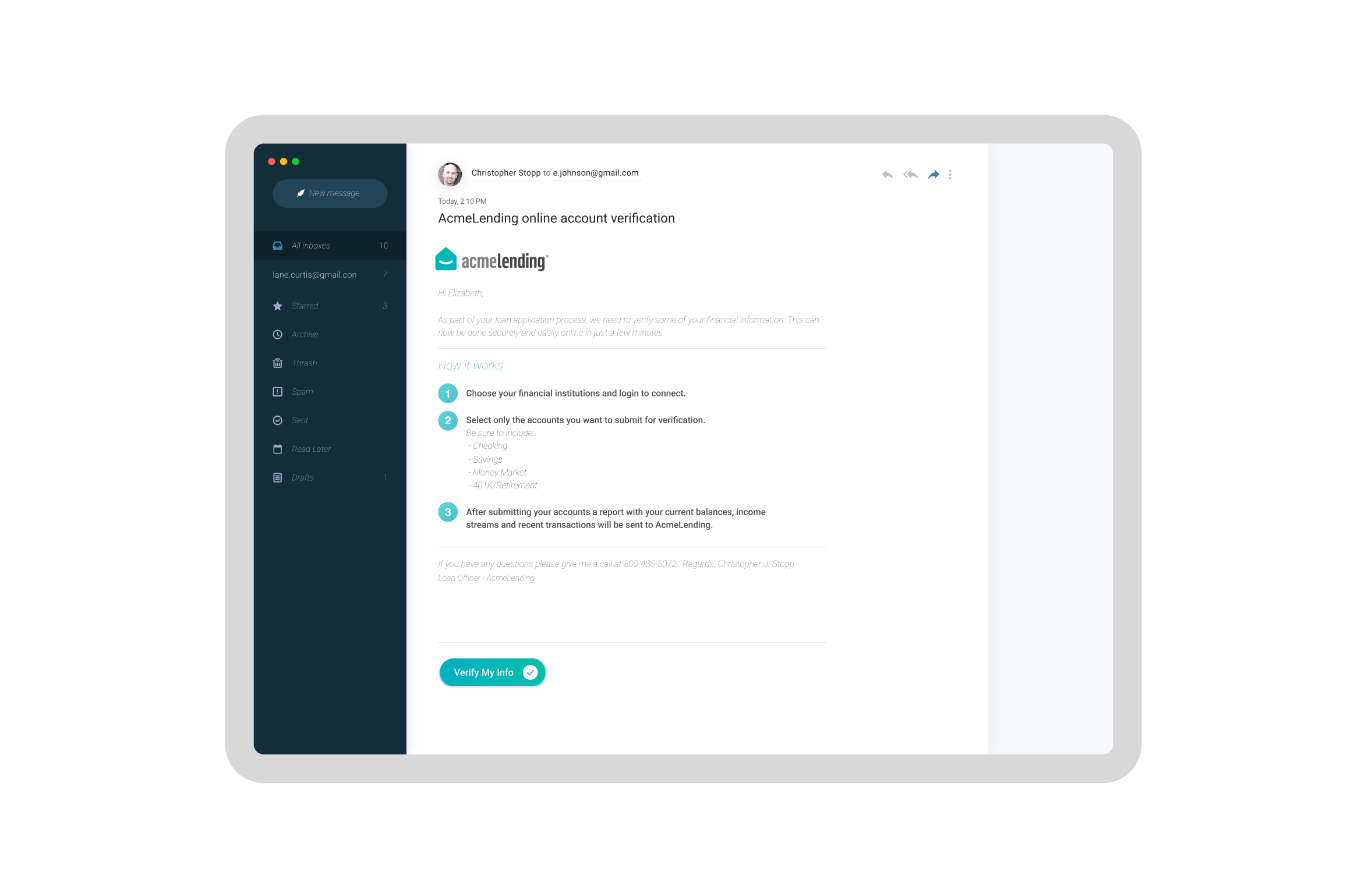

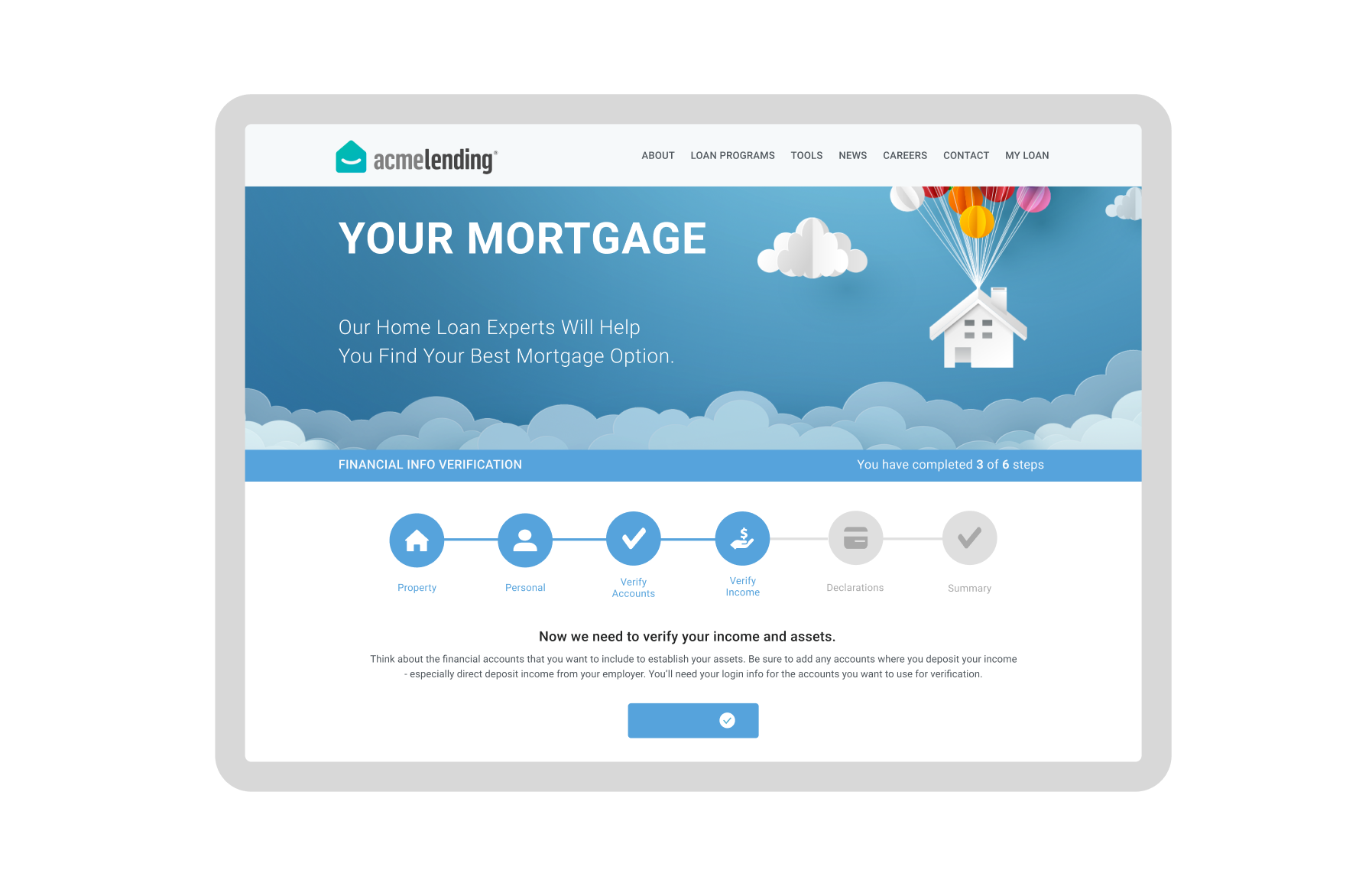

We approached the challenge of improving the loan verification process by focusing on the experiences of both borrowers and loan officers, acknowledging that purchasing a home is one of the most significant financial decisions an individual can make. In the U.S. labor market, 98 million of 156 million full-time workers are compensated through payroll providers or third parties, and pay stub verification accounts for 75-85% of the loan verification market. Based on the data, my team and I decided that a tailored solution was essential. Our design research involved conducting direct interviews with Acme Lending’s customers and staff to uncover their specific needs regarding loan verification. As an independent broker, Acme’s clientele valued a more personalized experience, which emphasized the importance of regulatory compliance in our design solutions. To ensure our design was grounded in real-world use cases, we developed personas representing typical users, including loan recipients and loan officers. Our findings indicate that any verification system must seamlessly integrate with financial regulations while delivering a streamlined, efficient user experience. By conducting usability testing across relevant scenarios, we were able to pinpoint pain points and refine our strategies to meet both user needs and compliance requirements effectively. This strategy helped us pivot from building a better scanner to building a “Data Handshake.” We used a “Jobs to be Done” lens to redefine the user’s goal from “uploading files” to “securing the best rate instantly.”

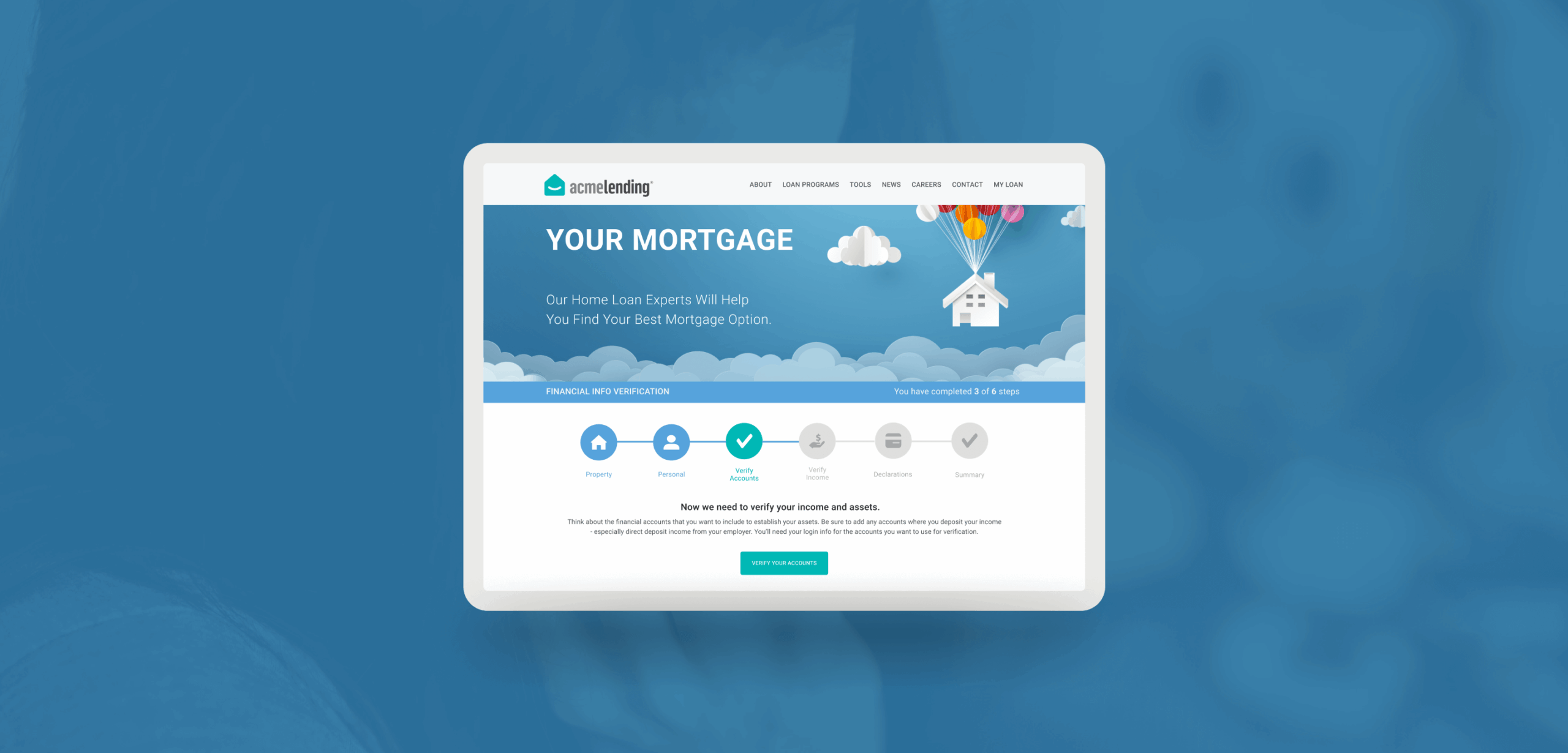

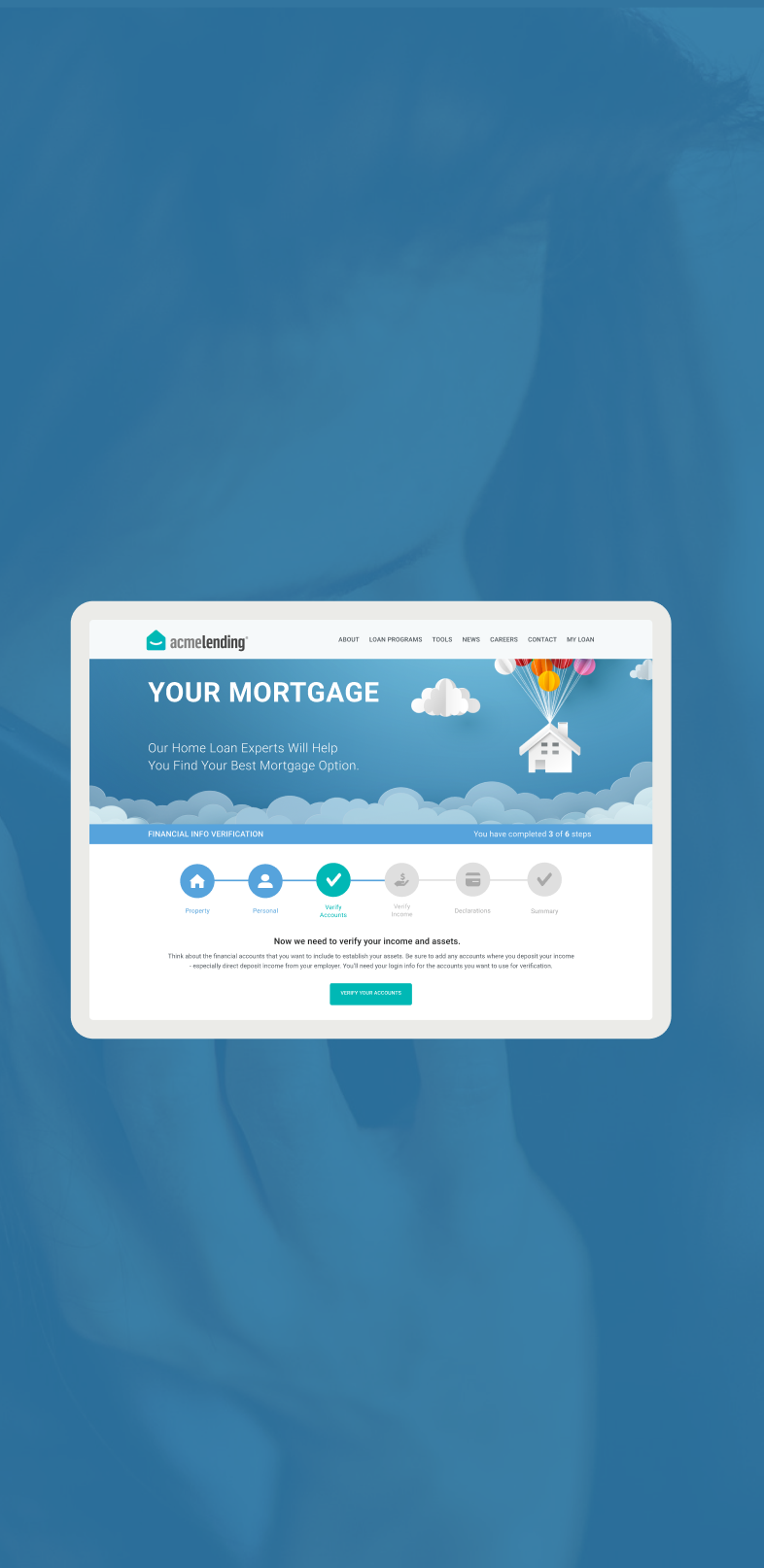

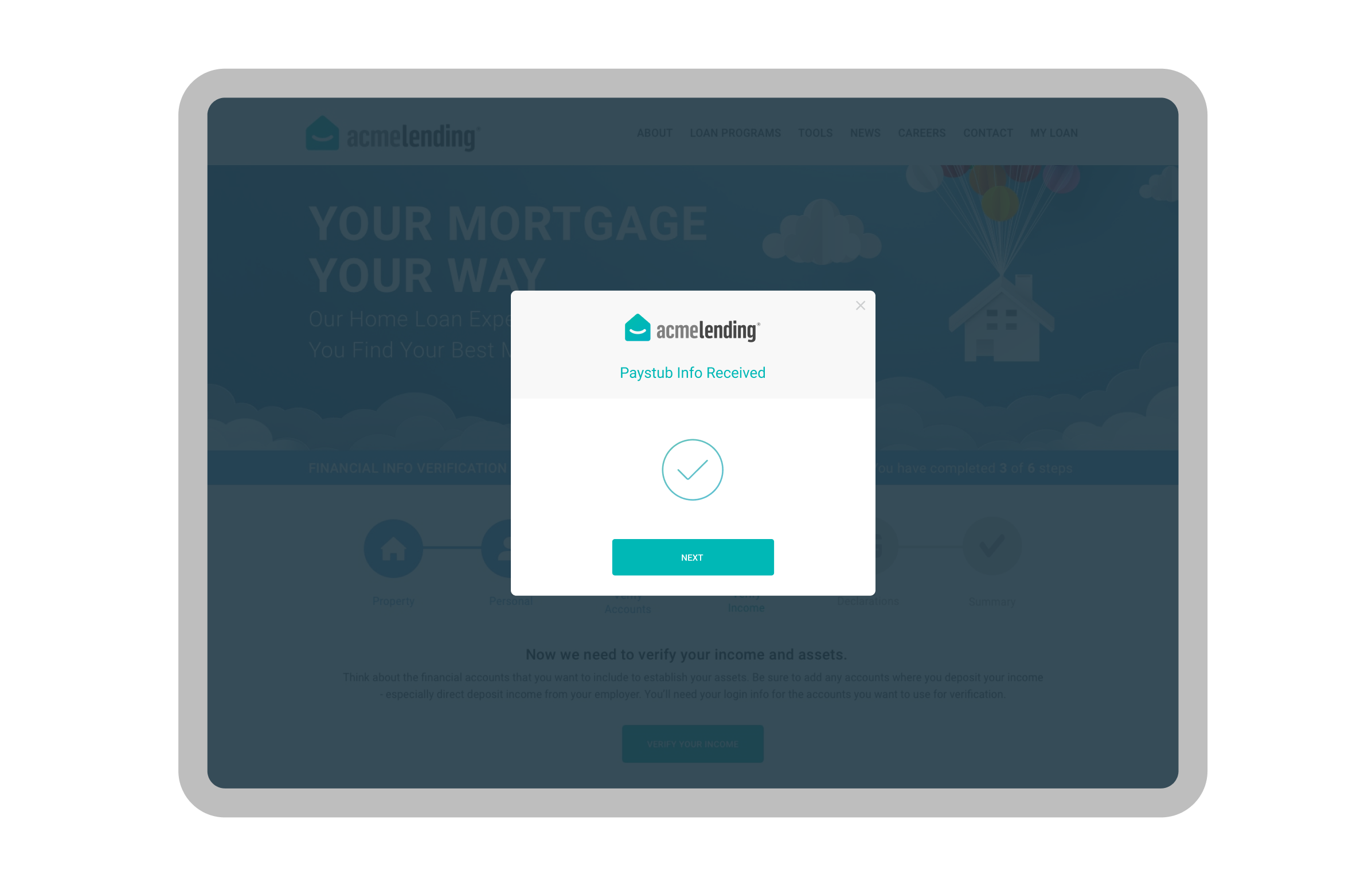

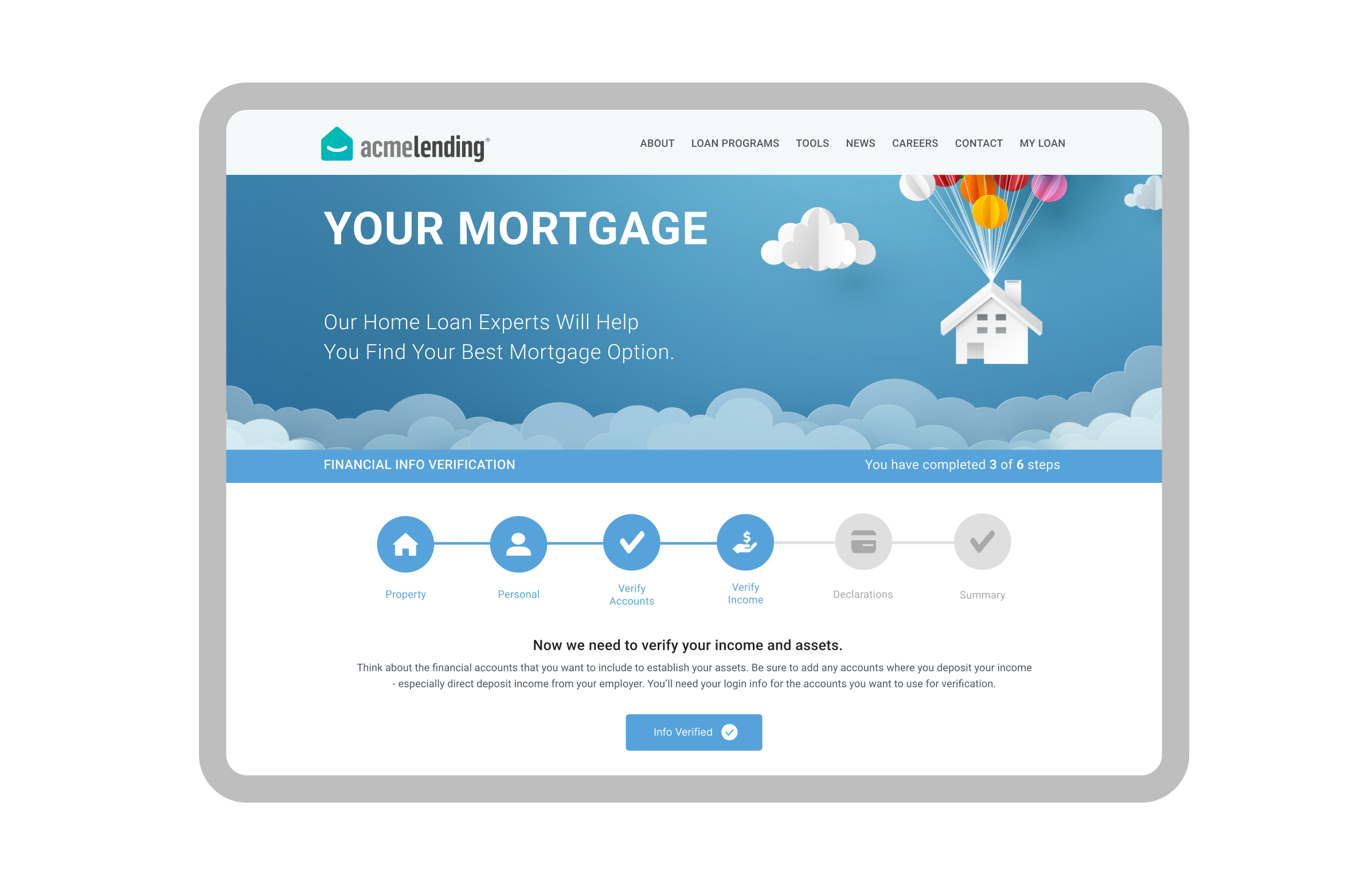

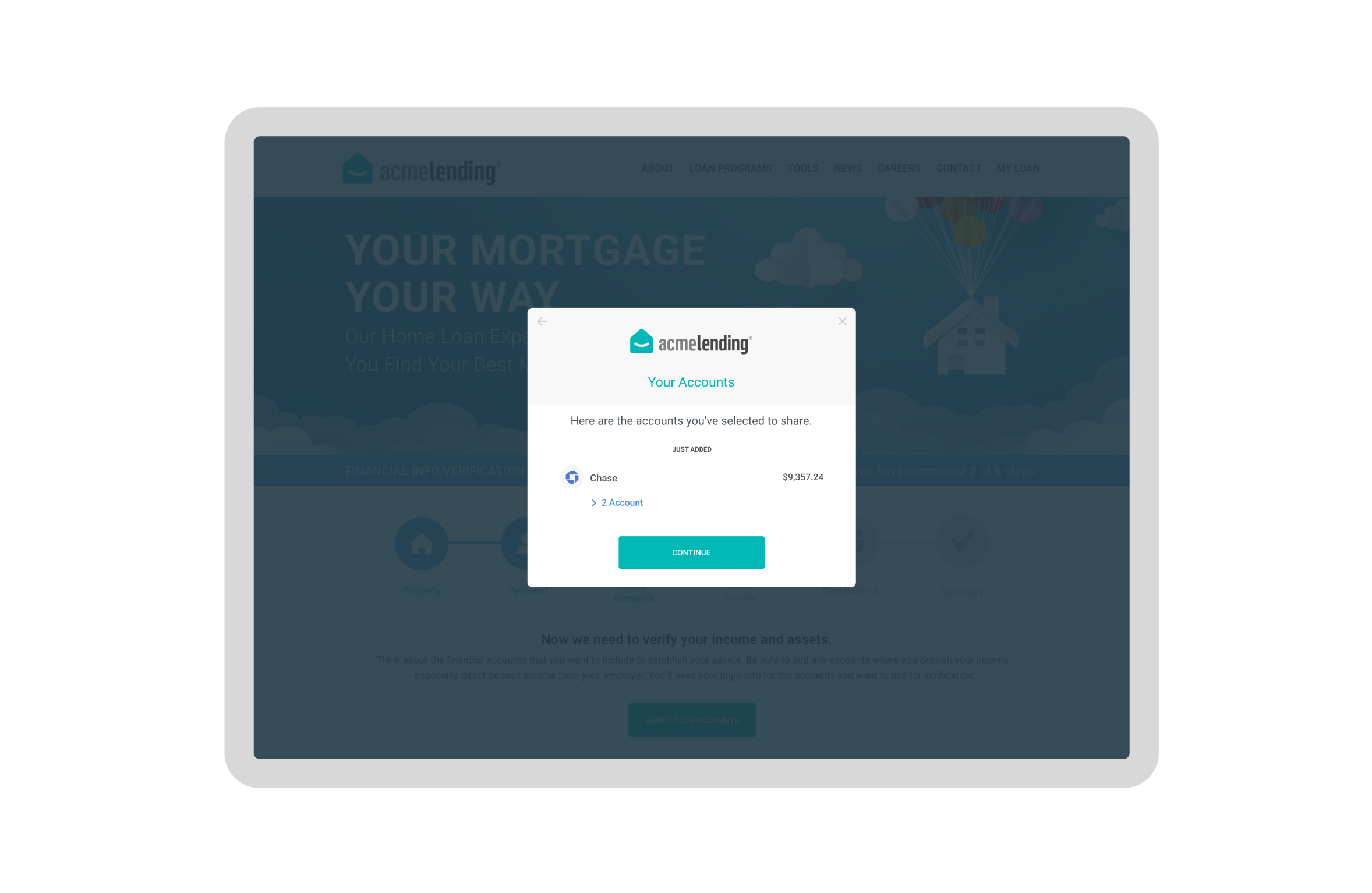

During the research, users faced existing verification methods that failed to recognize digital financial relationships. Although participants demonstrated strong financial responsibility, the traditional income verification processes caused substantial frustration, particularly due to cumbersome document requests. Based on these issues, my team and I identified three key use cases: single-account verification, multiple-account verification, and error handling during verification. The new experience design screens for the verification journey were tested and refined, ensuring high-fidelity designs aligned with Acme Lending’s visual brand style. The implementation strategy emphasized creating secure data-permissioning flows that empower borrowers by giving them control over their financial information.

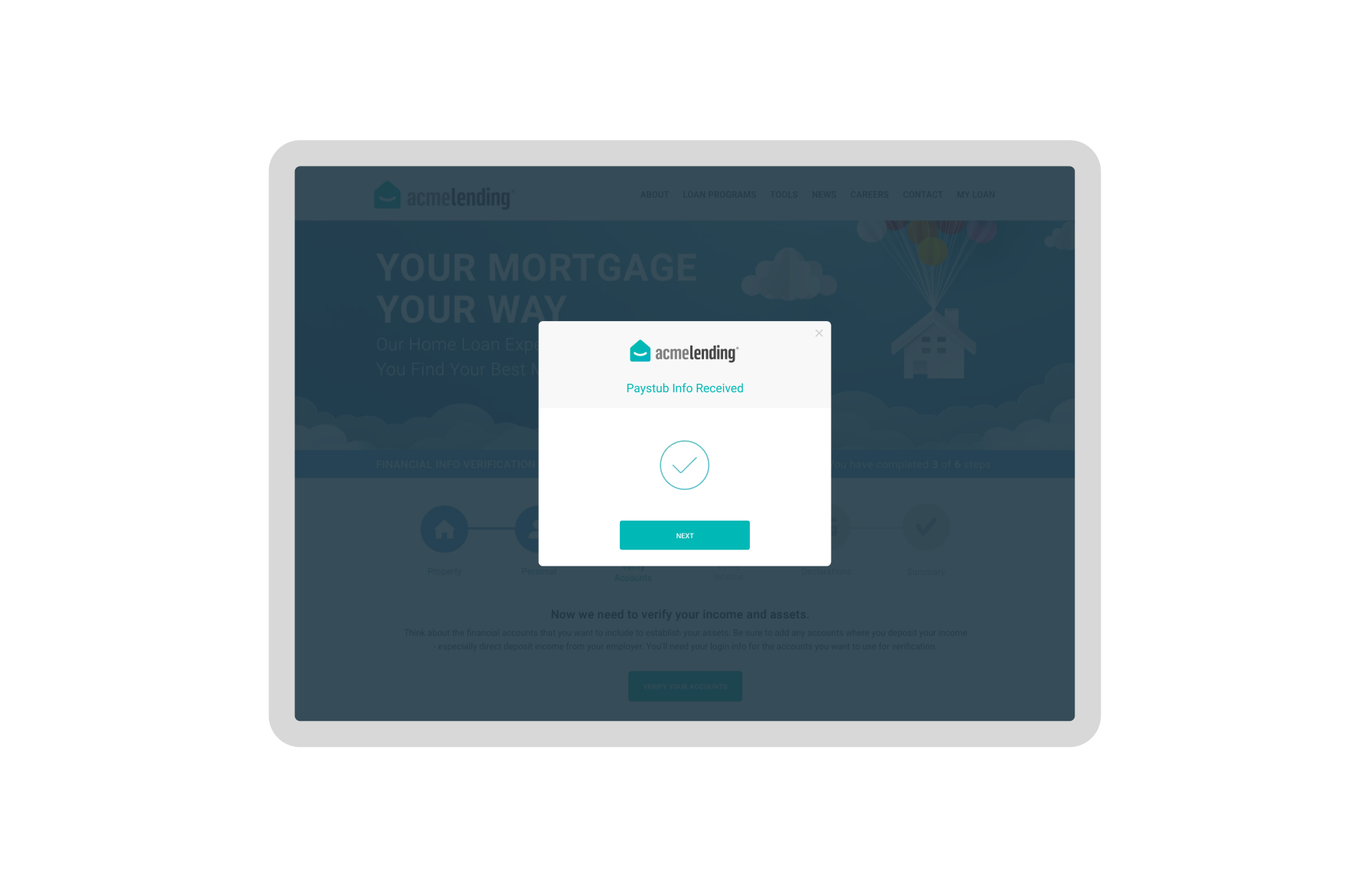

Through testing, we realized users struggled with the terminology of “income verification.” We refined the language to focus on “connecting accounts,” which matched their mental model of other fintech apps. The MVP strategy focused on enabling a one-touch verification experience that allows borrowers to grant access to multiple data sources, such as bank accounts and payroll providers, in a single interaction, eliminating the need for repeated document requests. This validation cycle enabled us to link early UX signals, such as session drop-off rates, to the business objective of reducing origination time.

We modeled UX design goals/KPIs success across three dimensions: Quality, Performance, and Impact.

-

UX Quality KPIs (The Trust Signal) We measured “Perceived Security” and “Permission Clarity.” Since we were asking users to log in to their banks via a third party, trust was our currency. We tracked “Consent Screen Abandonment” as a proxy for trust failure, ensuring the experience felt empowering rather than extractive.

-

Experience Performance KPIs (The Efficiency Signal) Here, we looked at “Time-to-Verification” and “Digital Completion Rate.” The baseline was hours or days of manual uploads. We needed to compress that into minutes. We specifically targeted the “Search Query Iteration” count to reduce the number of attempts needed to find a bank, and tracked the “Automated Success Rate” to reduce manual fallbacks.

- Business / Organizational Impact KPIs (The Bottom Line). Ultimately, design had to move the business. We connected our work to “Loan Origination Timeline” reductions and “Cost per Verification” (moving from ~$150 manual to <$40 digital). By reducing the days to close, we could prove that inclusive design wasn’t just a moral good—it was a revenue accelerator.

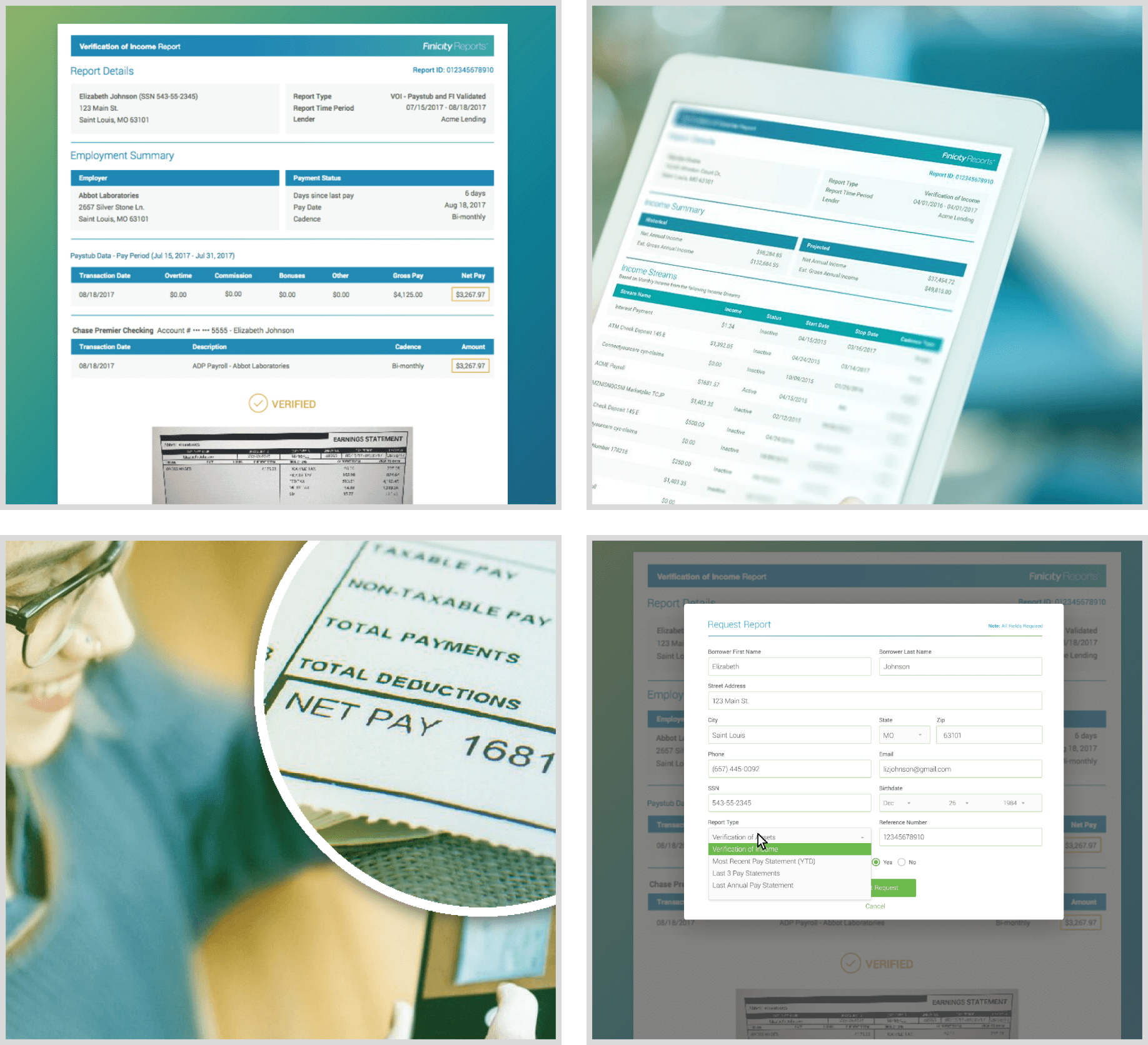

Acme Lending Income Verification Demo

Shows how TX Verify API integration replaces manual document uploads with secure, user-authorized data access, reducing verification friction.

Verification Time Reduction

The average processing time dropped, with cumulative efficiency shaving 3-5 days off the total time to close a loan, bringing Acme Lending closer to industry-leading efficiency standards.

Cost-to-Serve Reduction

Operational costs per loan dropped from ~$150 to <$40 via digital automation.

Digital Completion Rate Increase

More borrowers successfully completed verification digitally, reducing manual intervention and improving overall loan origination throughput.

Reflections & Impact

Acme Lending aims to leverage digital connections between payroll systems and banks through consumer-permissioned data access, improving the loan process with a GSE-accepted solution that dramatically reduces time-to-close. Our digital verification solution delivered immediate operational improvements for Acme Lending while creating broader industry transformation. Borrowers experienced streamlined verification, with transparent data permissions and instant confirmation, while loan officers reported fewer stipulations and fewer back-and-forth documentation requests. The GSE-accepted solution provided lenders with representation and warranty relief, establishing new industry standards for automated income verification. By leveraging direct deposit payroll data, the platform achieved higher success rates than traditional methods, demonstrating how digital financial relationships could revolutionize lending verification. This work democratized access to capital for the gig-economy workforce while cutting verification costs by nearly 80%, securing “Day 1 Certainty” for the business.

Next Steps

- Expand experience design and interface integration with additional payroll providers and financial institutions.

- Develop new designs for international verification capabilities for non-U.S. income sources.