Overview

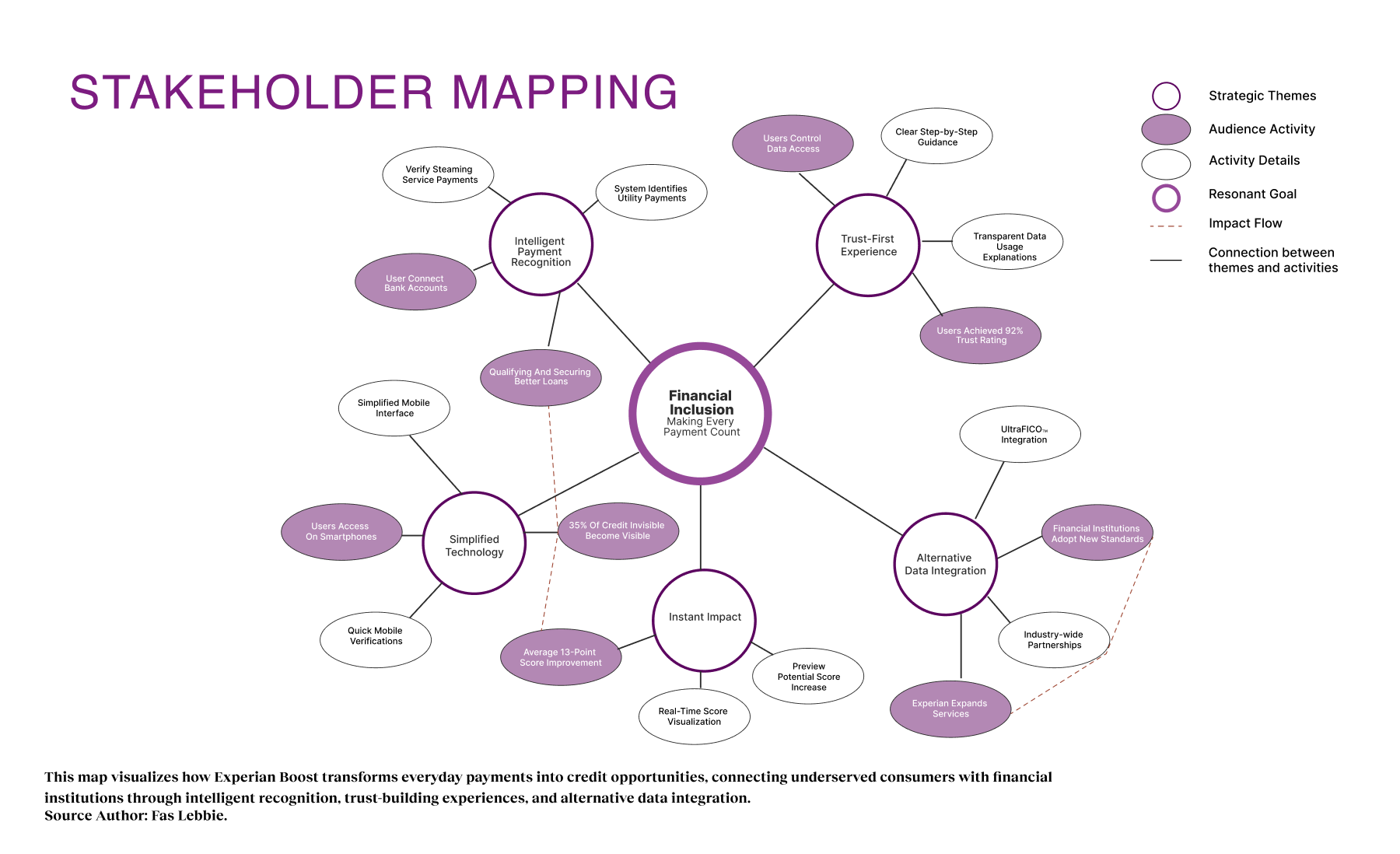

What if paying for your Netflix subscription could help you buy a home? We turned this question into reality with Experian Boost, improving the opportunities for everyday bill payments to build credit scores. By recognizing the bills people have already paid from utilities to streaming services, we have helped millions of credit-invisible Americans be recognized for their financial responsibility and unlock financial opportunities that were previously out of reach. Launched in 2019, this initiative sought to address two problems: the exclusion of reliable consumers from the credit economy and the stagnation of lender growth. By integrating alternative data sources like utility and rent payments into the FICO® Score model, we aimed to expand financial inclusion for “credit-invisible” consumers while unlocking a new, low-risk user base for Experian’s partners. This resulted in an average 13-point improvement in scores for more than 35 million Americans.

RESEARCH & DESIGN

Design research · Mobile-first product design · Fintech regulatory compliance · Secure banking integration · Regulatory UX (FCRA/SOC 2) · Brand Mirroring

- Duration: 2019

- Partners: Finicity / MasterCard Partners: Experian, FICO®

- Team: Fas Lebbie, John Adam(VP of Design), Brian Burgess( Design Manager), Experian Design Team

Confidentiality: This case study reflects my design perspective and approach. Details have been modified to protect sensitive information while showcasing methodology.

WHAT I BROUGHT

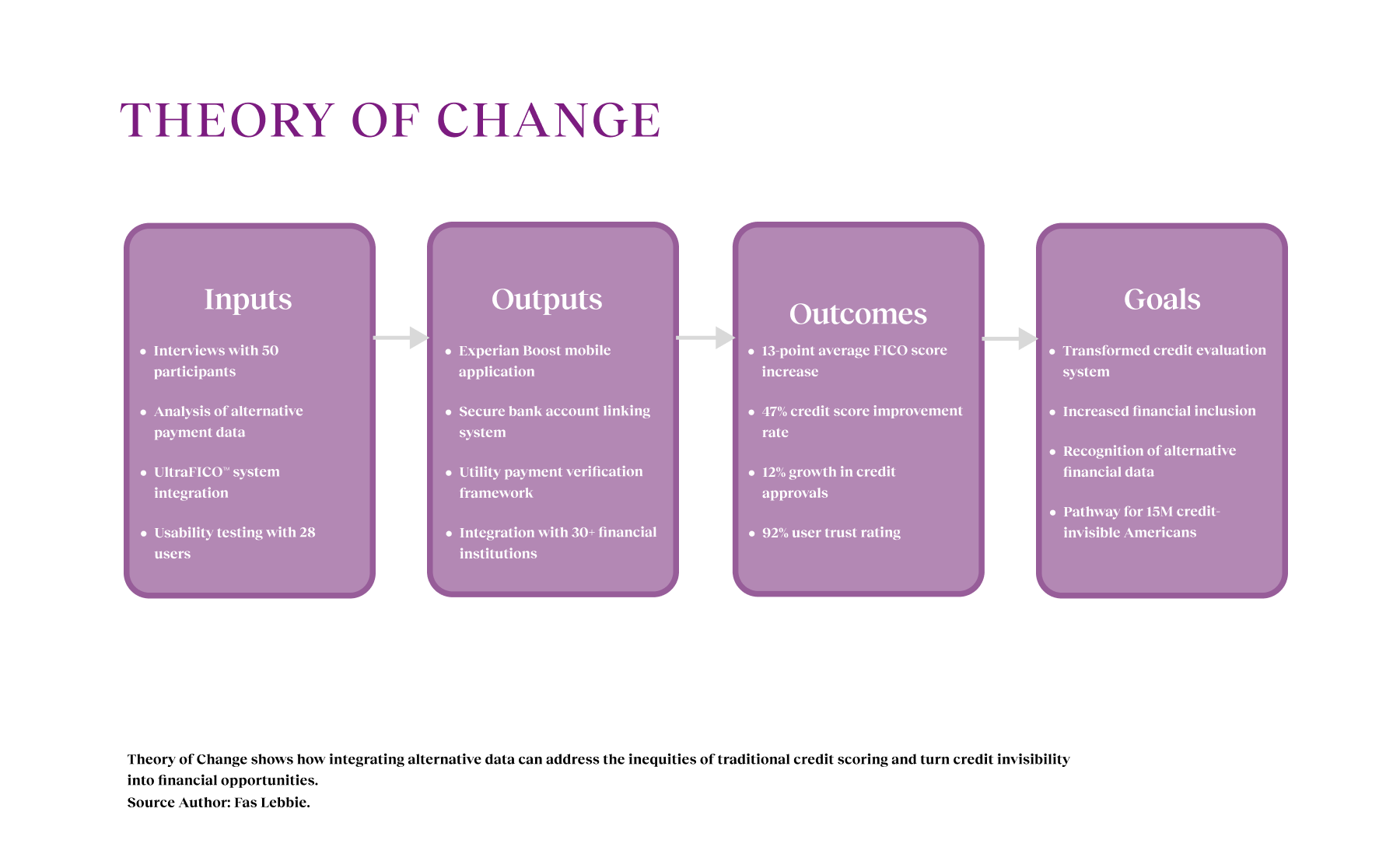

I conducted the foundational research strategy with 3 other researchers, moving beyond surface-level data to conduct investigative-style 1:1 interviews with 50 participants. This approach allowed us to reframe the problem from a "data shortage" to a "recognition gap," validating that 90% of our target users had consistent payment histories. We synthesized these signals into a "reliability index" concept that grounded our roadmap in verifiable user behavior.

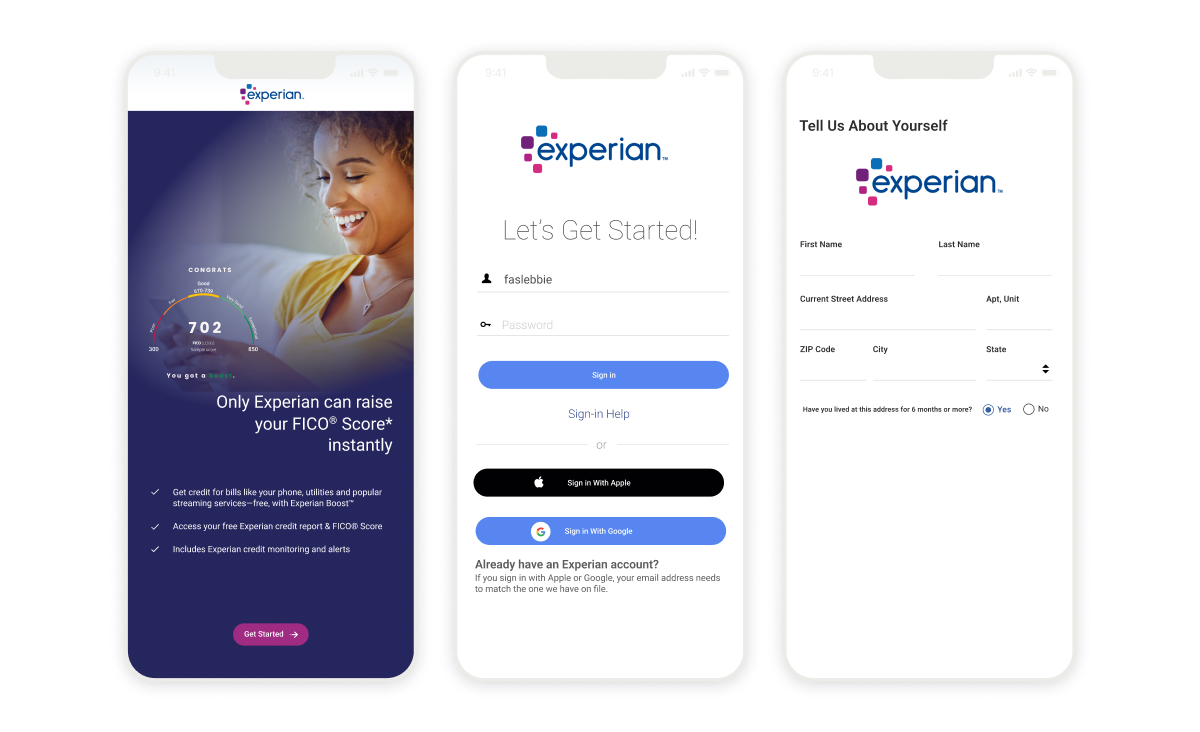

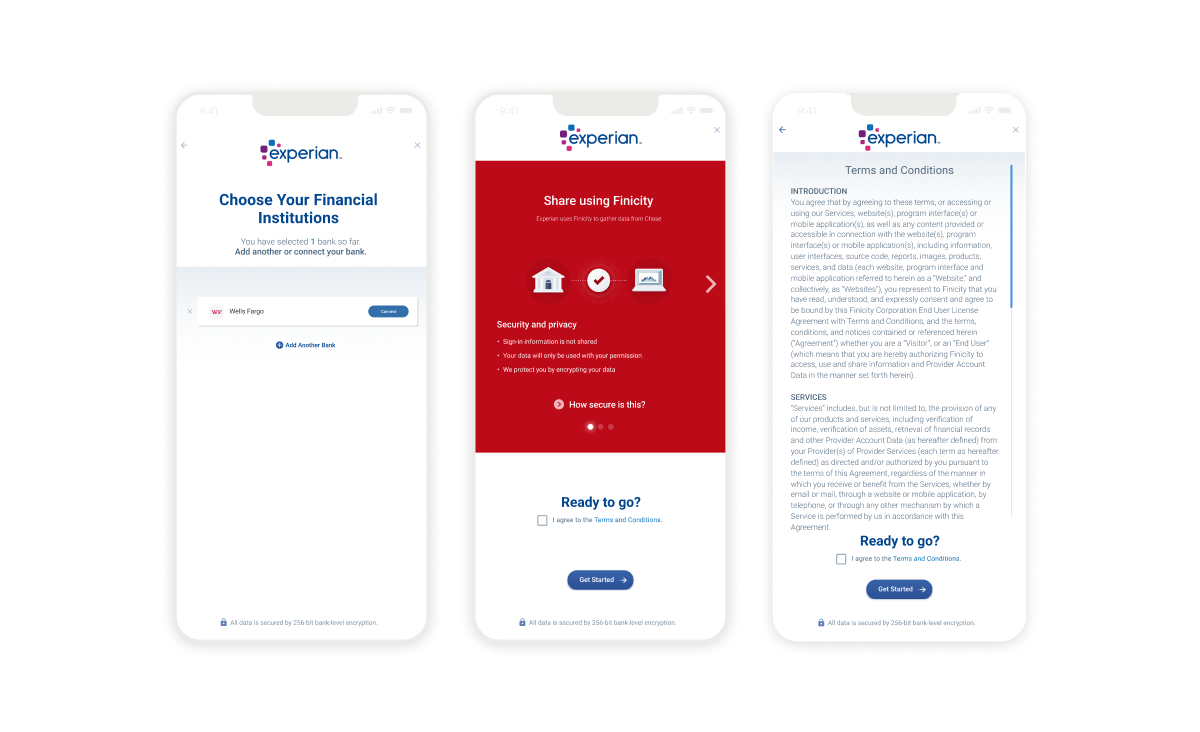

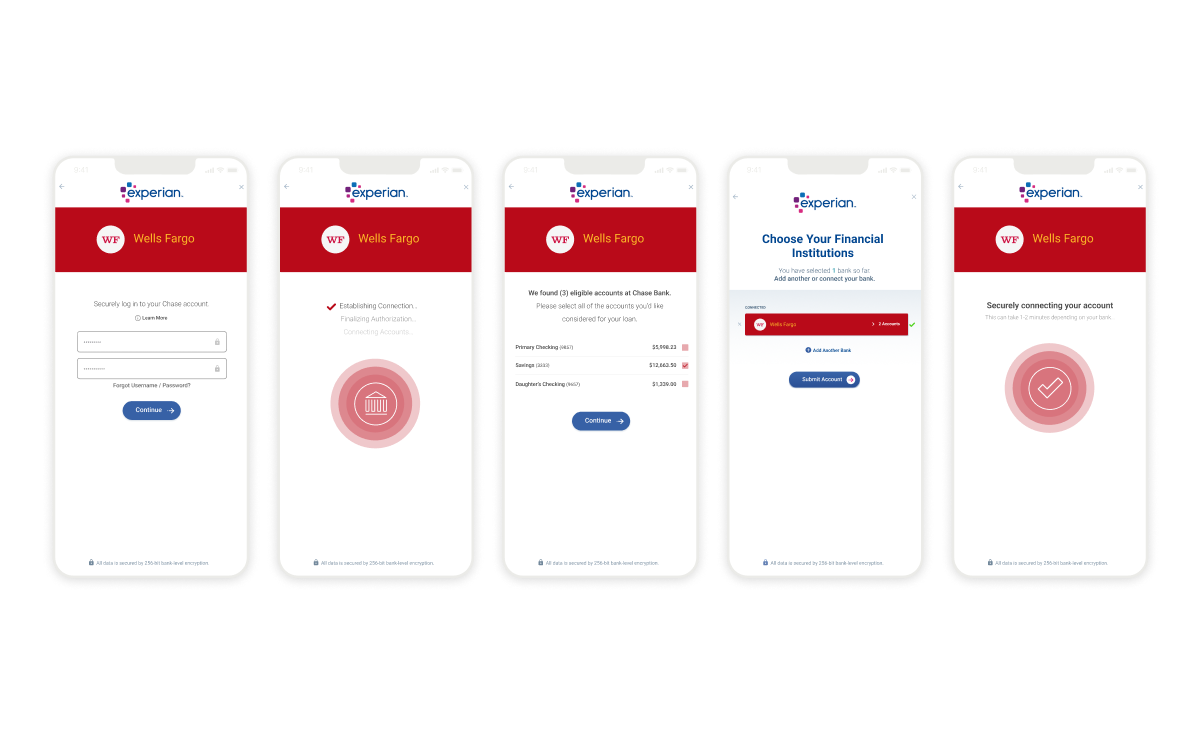

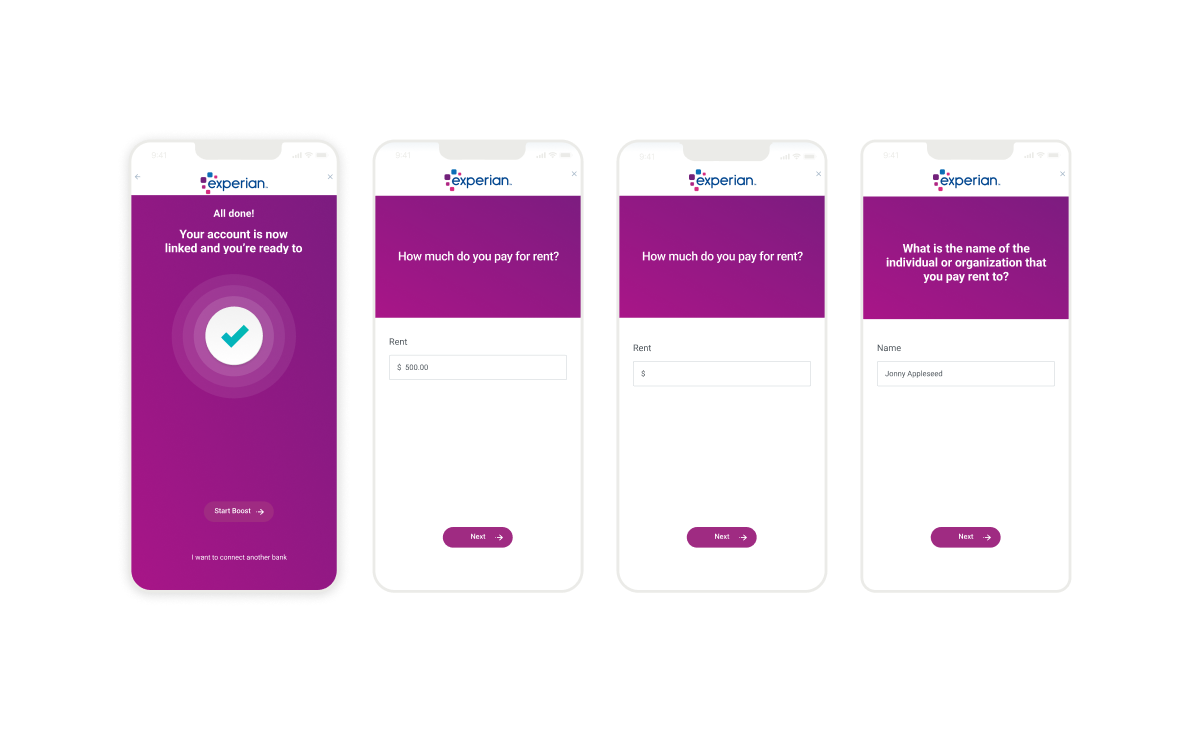

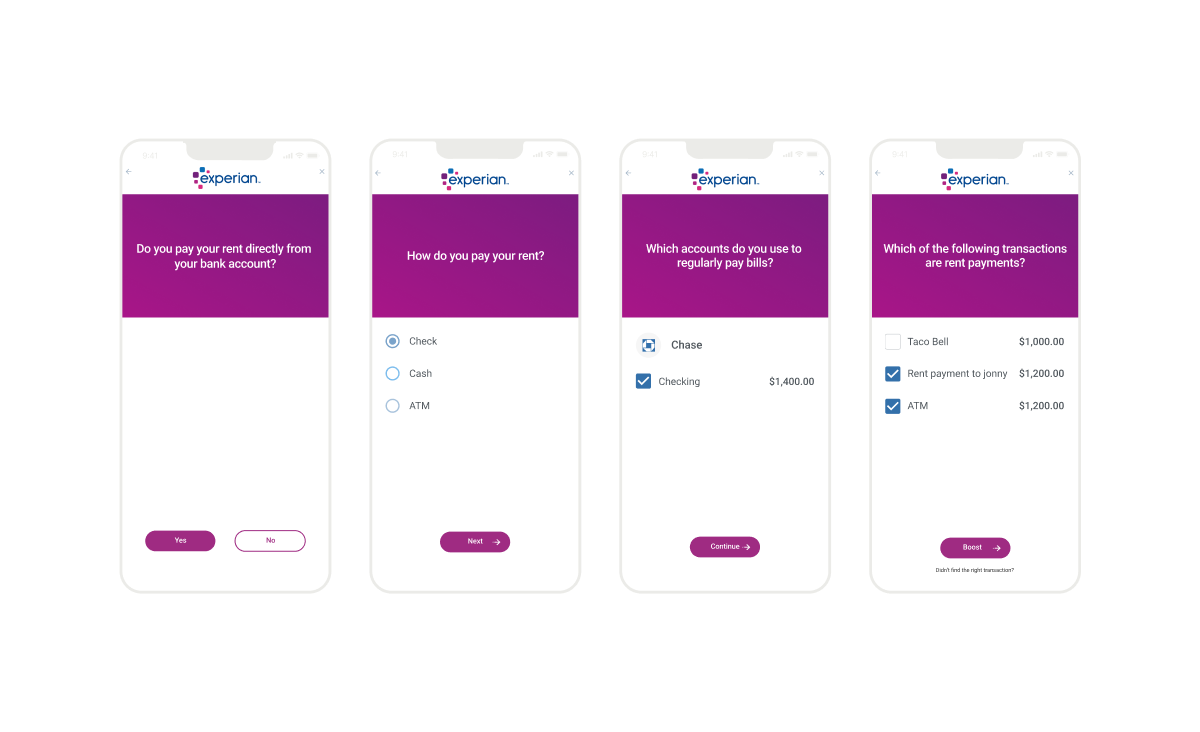

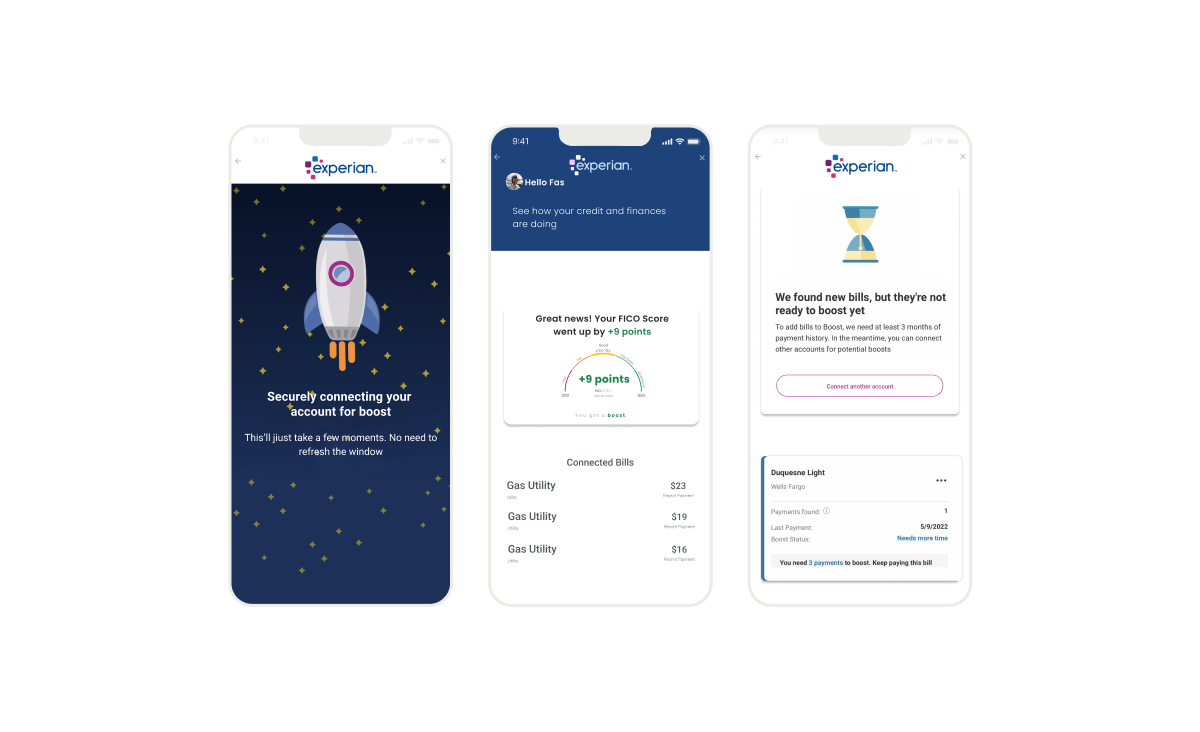

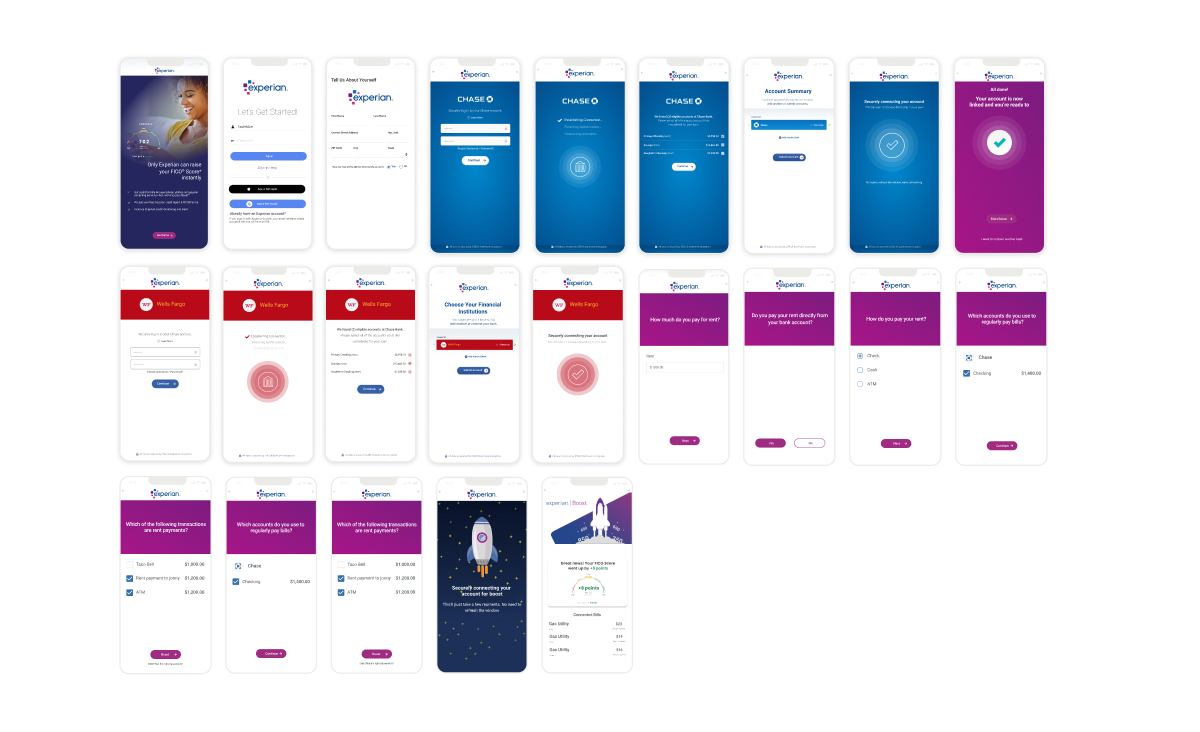

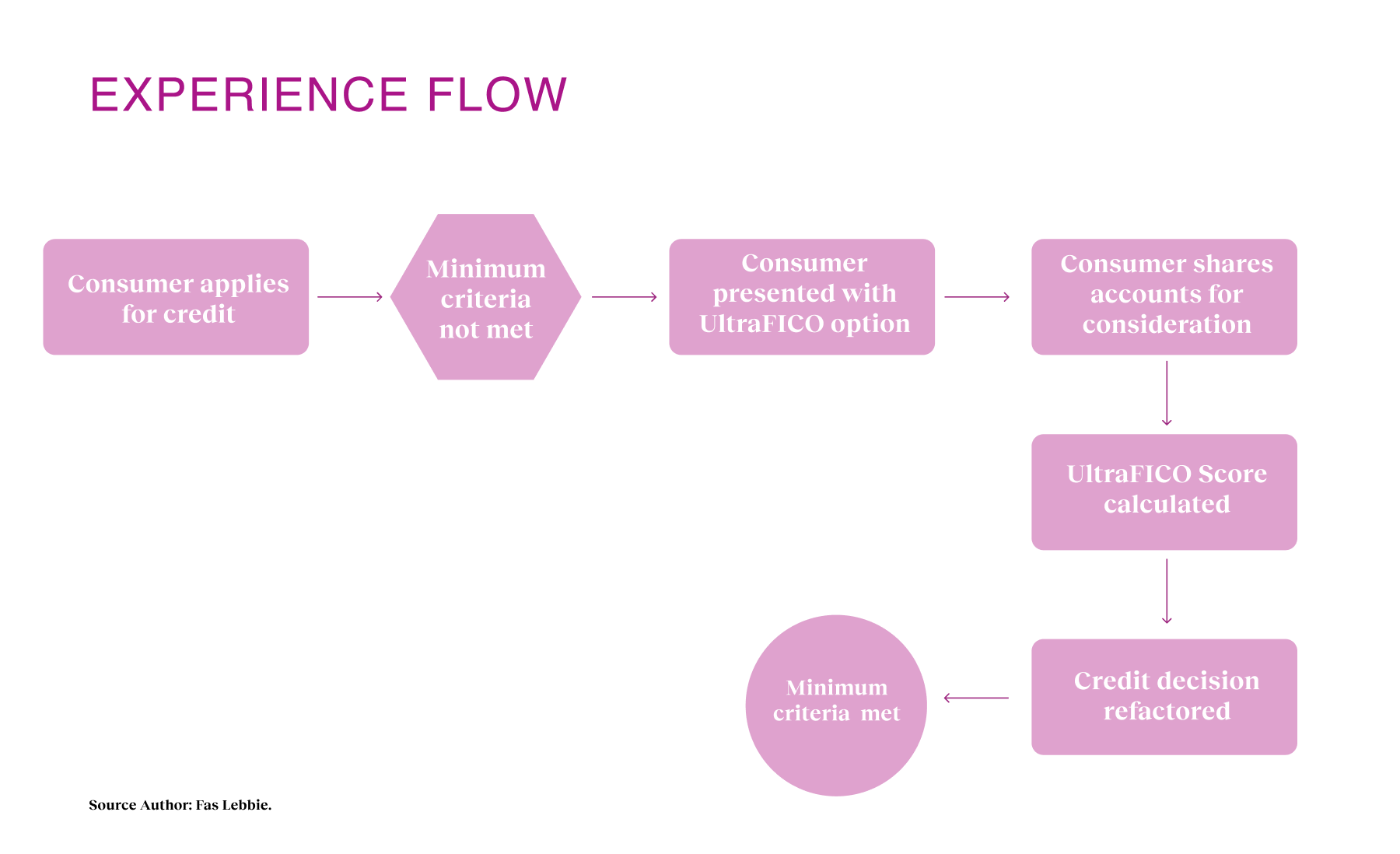

I architected the end-to-end web and mobile interfaces for Boost, focusing heavily on the high-friction conversion moments of bank account integration. I designed flows that visualized the complex UltraFICO™ Score system in a way that was intuitive for consumers, creating a visual system dictated by authentic user moments. This systemic approach reduced cognitive load during consent flows, directly supporting higher authorization rates.

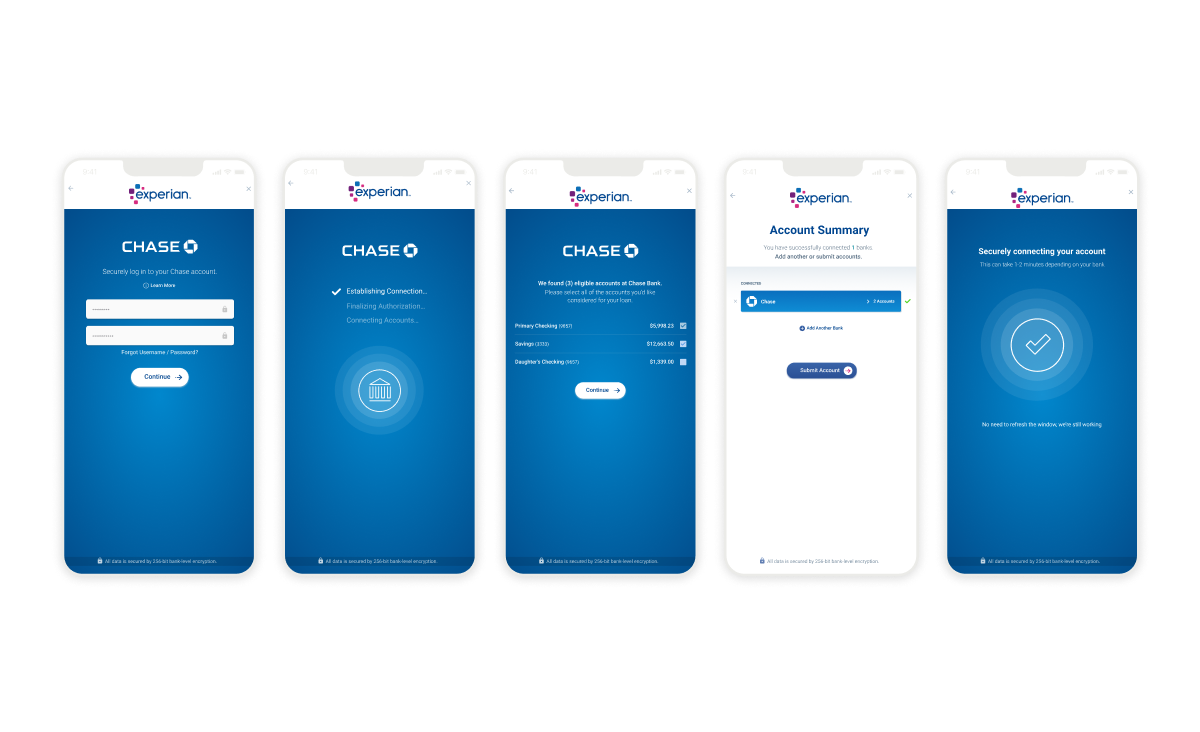

I led cross-functional collaboration among engineering, data science, and product teams and navigated a complex partnership among Experian, FICO, and Finicity to shift traditional credit models toward recognizing alternative data. I utilized a KPI Impact metric to map user "jobs-to-be-done" (building credit) to lagging business indicators (loan origination timelines). This translation enabled engineering partners to prioritize latency reduction in the API, resulting in a 33% reduction in overall processing time.

Problem Context

The U.S. credit system creates a paradoxical cycle: to get credit, you need credit. This systemic flaw leaves approximately 53 million consumers with “thin files” and disadvantages another 79 million who hold FICO® scores below 680. These aren’t necessarily risky borrowers; many are reliable payers whose financial behaviors, paying rent, electricity, and mobile bills, simply don’t count in traditional models. This discrepancy arises from a credit evaluation framework that is not aligned with contemporary practices, resulting in inequitable credit access. From a business perspective, this represented over $50 billion in unacknowledged payments, a massive, untapped reservoir of data that lenders were blind to.

My Approach

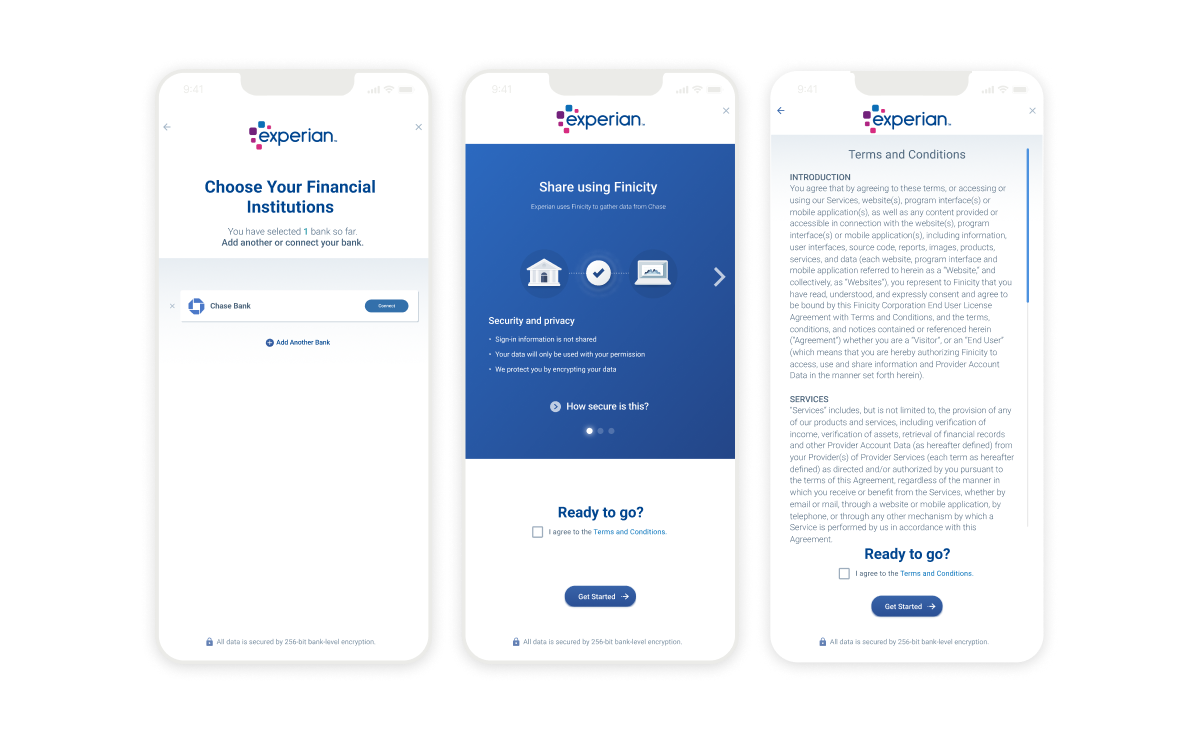

The design team approached this challenge not as a data engineering problem, but as a crisis of trust. We reframed the experience from “submitting financial records” to “claiming earned credit,” shifting the power dynamic to the user. My execution strategy centered on transparency, using brand mirroring verification to turn high-anxiety compliance hurdles into rewarding moments of agency.

Design Process

Starting this project came with the key foundational premise that 35% of Americans were making payments that didn’t build their credit. For these users, the financial system felt like a black box that ignored their positive actions.

From a product perspective, the starting line was equally challenging. We were dealing with a landscape in which users were naturally wary of sharing banking credentials. We had 0% verified alternative data at the start. We had to validate $50 billion in overlooked annual payments but lacked established user flows to capture this data securely. The initial context was defined by this tension: a massive reservoir of potential credit data that was currently inaccessible due to technical fragmentation and a lack of consumer trust.

We couldn’t design for a population we didn’t understand, so I pivoted our strategy away from pure market analytics toward deep, investigative ethnography. We (3 researchers) conducted 1:1 interviews with 50 participants, focusing specifically on marginalized groups, young adults, immigrants, and low-income users, to understand the emotional weight of financial exclusion.

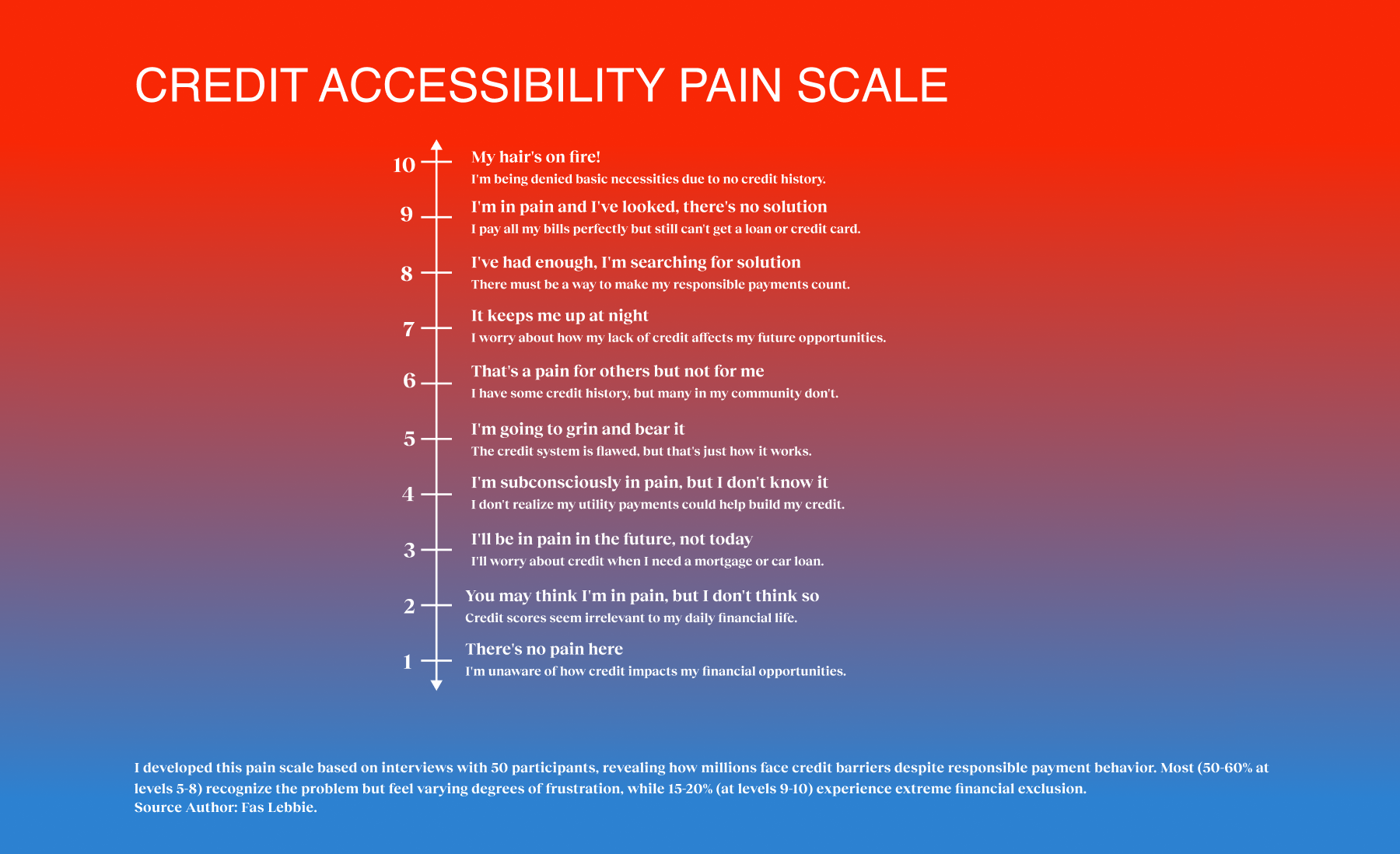

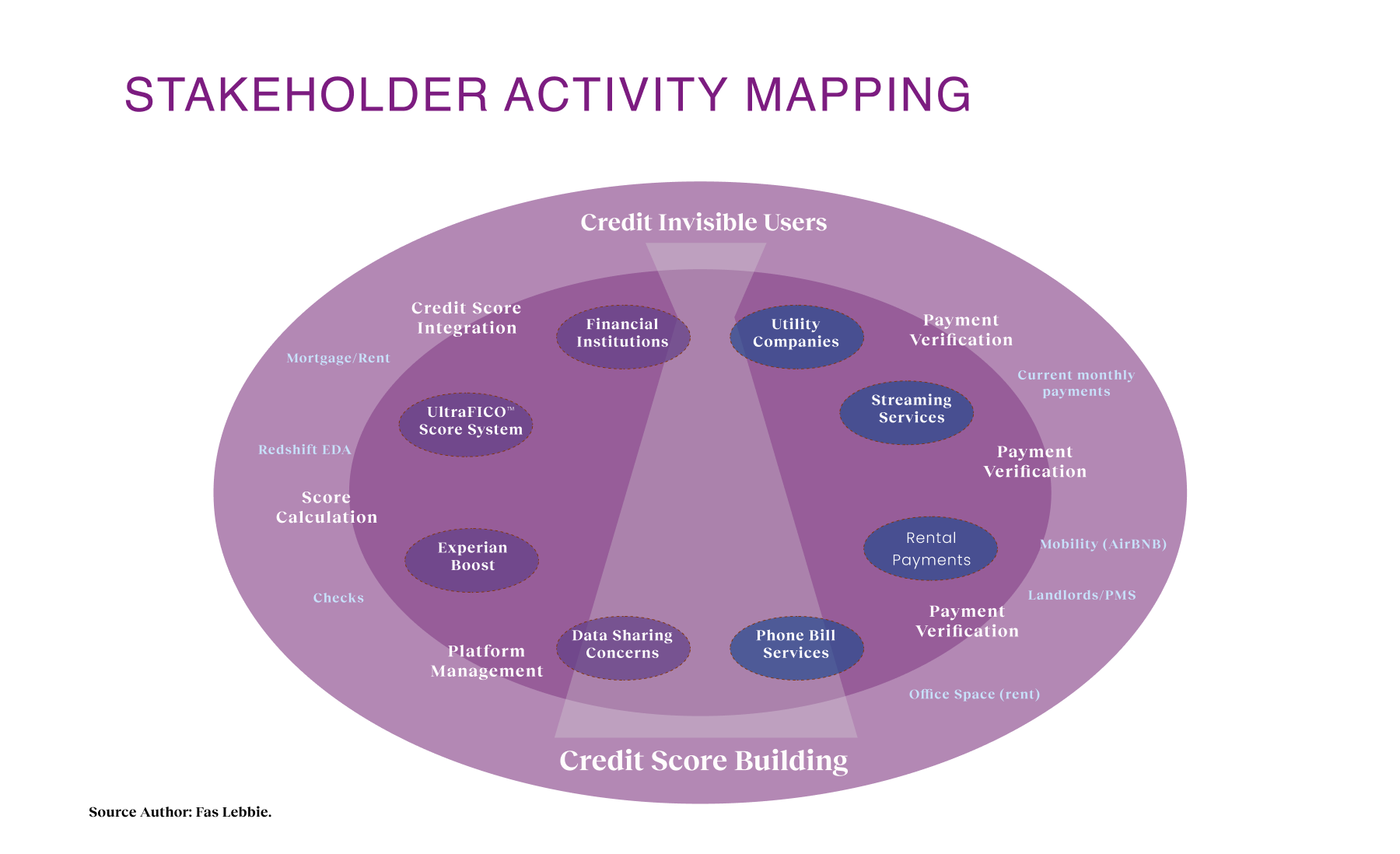

This qualitative work was paired with rigorous quantitative analysis to validate the scale of the opportunity. We used frameworks like the Customer Pain Scale, which revealed that the emotional barrier around “credit invisibility” was a staggering 10/10 for many participants. However, we also encountered the “Messy Middle”: stakeholders were skeptical that users would actually consent to deep bank linking. To address this, we used Stakeholder Mapping to expose the misalignment between perceived user risk and actual user desperation for credit.

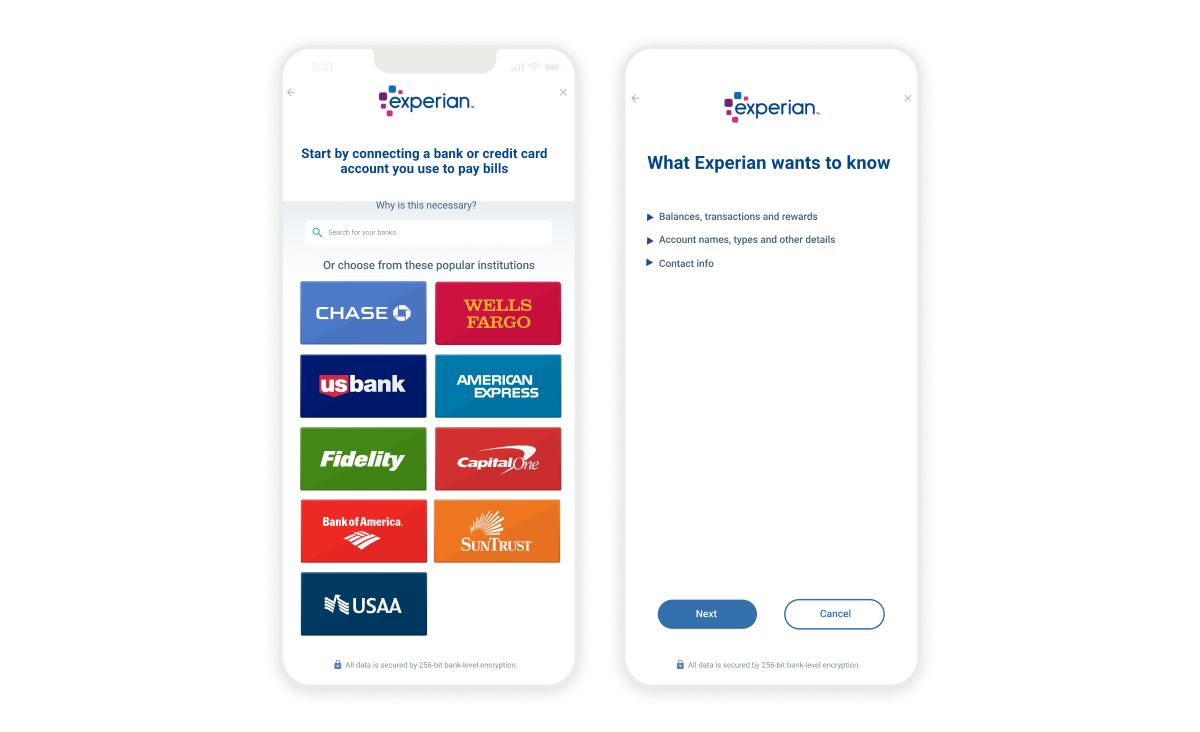

The insights that emerged forced us to shift our direction. Initially, we thought the problem was technical: how to pipe data from utility companies to Experian. But the research showed it was a Trust & Value Exchange problem. Users were terrified of linking their bank accounts. We conducted iterative usability testing with 28 users to refine our approach, discovering that transparency was a functional requirement for conversion.

- Insight: Reliability is already there, it’s just invisible. Our research showed that 90% of participants consistently made utility or rent payments, yet they remained “thin-file” consumers. They weren’t risky; they were just undocumented by the current system. Implication for Design: The design needed to function as a data validation layer, not a behavior modifier. We didn’t need to teach users to pay bills; we simply needed a mechanism to authenticate the payments they were already making.

- Insight: Transparency is the currency of trust. Meaning: In usability testing, 92% of users explicitly valued transparency over speed or visual polish. The “Conversion Cliff” was located exactly at the bank login screen. Implication for Design: We had to over-communicate. The design flows needed to be explicit about what data was being accessed, why, and how it would be used, and to adhere strictly to privacy standards to mitigate the perceived risk.

- Insight: The solution must be mobile-first. Meaning: 88% of our target demographic preferred managing their finances via mobile devices. Implication for Design: The complex task of linking bank accounts and parsing transaction histories had to be simplified into a linear, thumb-friendly mobile flow. We streamlined the IA to reduce decision fatigue, ensuring the experience felt as lightweight as a text message.

Early on, to measure the design objectives, our team at Finicity had to understand the product team’s goal at Experian and their key objectives. From our sessions together, we realized early on that we couldn’t just track “sign-ups”; we needed to measure the health of the entire funnel from a design perspective.

- UX Quality KPIs (The Input): At the foundational level, we focused on Trust Signals and Ease of Integration. We measured this using usability metrics, aiming for a 92% trust rating for the sensitive bank-linking flow. If the “Perceived Security” score dropped here, the funnel would break before data capture could begin.

- Experience Performance KPIs (The Output): Moving up the tree, we looked at Link Success Rate and Time-to-Data-Capture. We aimed for a 10% higher completion rate in the onboarding flow. Crucially, we measured the “Match Rate”—the percentage of scans that successfully identified a utility payment. This was our proxy for “Product Value,” confirming the system was delivering on its promise.

- Business / Organizational Impact KPIs (The Outcome): Finally, these fed into the hard metrics: Origination Velocity and Partner Adoption. By validating data upfront, we aimed to reduce loan origination timelines by 8–12 days. This reduction in “Time-to-Decision” was the metric that secured buy-in from our institutional partners, effectively lowering their operational costs.

The path from concept to reality was paved with iterative prototyping loops, where we constantly balanced user desire for simplicity with the rigid constraints of fintech compliance. We started with low-fidelity flows focused entirely on the “handshake”—the moment a user consents to link their bank account.

We prioritized prototyping the secure bank linking and score visualization features first. Testing these early prototypes with 28 users revealed that while users wanted the “boost,” they were skeptical of the mechanism. This led to a significant refinement: we introduced “progressive disclosure” flows that visually demonstrated privacy and compliance (FCRA, SOC 2) before asking for credentials.

Collaboration with engineering was tight. We established a “Design-to-Dev” handshake to ensure our flows could interface with 30+ financial institutions via Finicity’s API without latency spikes. We also implemented a “Brand Mirroring” strategy in the UI. As users selected their bank, the interface would subtly adapt to that institution’s specific color palette (e.g., shifting to Wells Fargo red or Chase blue). This visual continuity reduced the cognitive dissonance of the “handshake,” making the third-party connection feel like a native extension of their own banking app.

The implementation strategy was phased. We rolled out with utility payments first, deliberately narrowing the scope to ensure we could deliver on the promise of an instant score boost. This “crawl, walk, run” approach allowed us to iron out the complexities of data integration without overwhelming the user. Ultimately, the prototypes evolved into a live product that not only solved users’ needs but also integrated seamlessly into partner ecosystems, directly impacting the “Time-to-Decision” KPI.

How it works

The UltraFICO™ Score incorporates transactional data from consumers' checking, savings, and money market accounts, extending the scorable population and refining prediction accuracy to broaden financial inclusion.

Outcomes

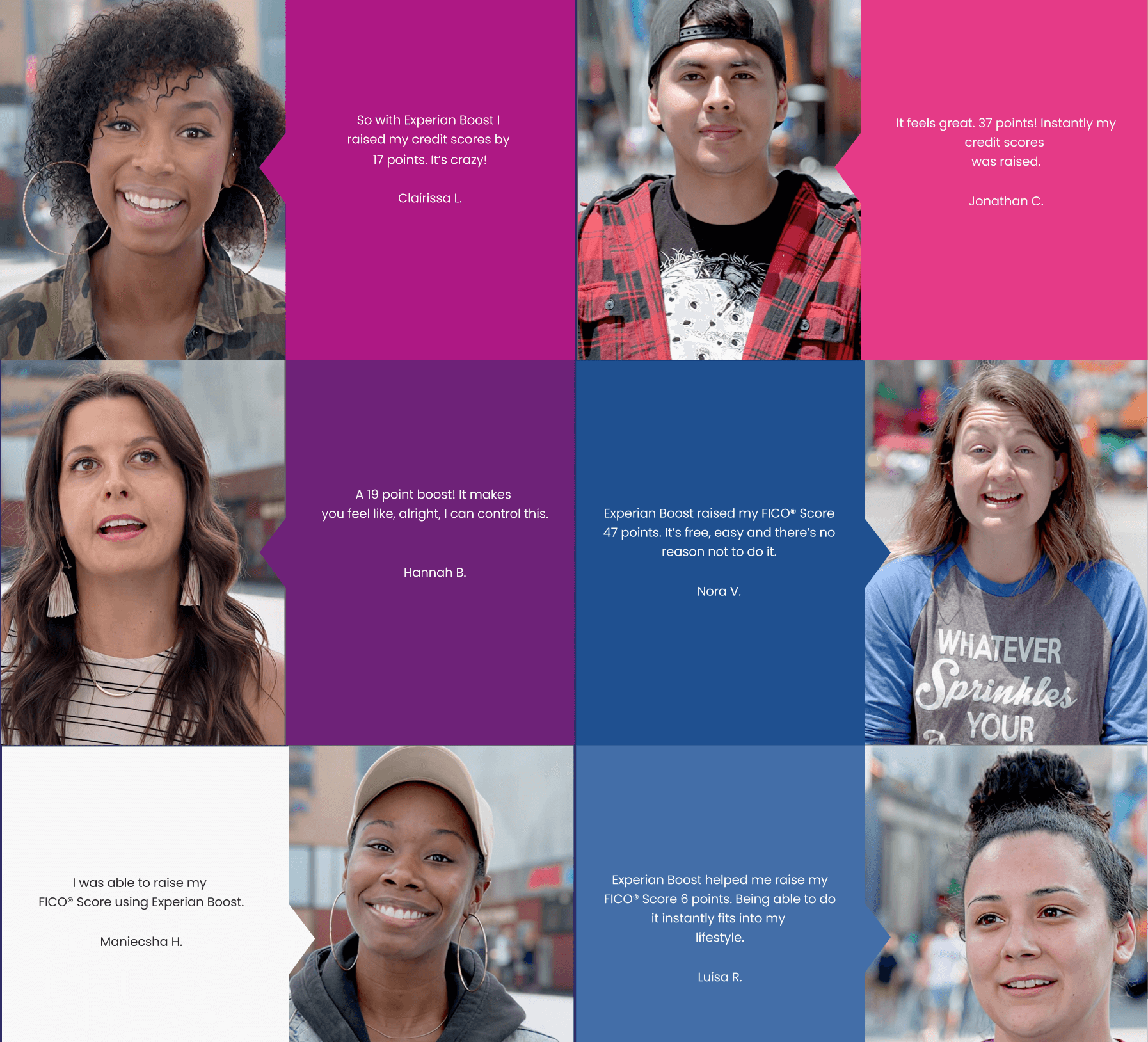

Users share stories of credit score transformations, from 6-point to 47-point improvements, representing millions of Americans gaining financial recognition and opportunity.

Users Impacted

Transforming financial opportunities for credit-invisible Americans and expanding the total addressable market (TAM) for lenders.

Average Increase

Credit score improvement, helping users qualify for apartments and better loans.

Improvement Rate

Thin-file users are experiencing meaningful credit growth and financial recognition.

Short & Long-term Impact

To understand the design’s impact, we connected design decisions directly to financial outcomes. We linked the clarity of the consent flow to “Time-to-Data-Capture,” proving that reducing anxiety increased authorization rates. This focus on trust delivered tangible results: we unlocked credit access for 86% of thin-file users, increased average scores by 19 points, and slashed partner loan origination timelines by 33%.

This efficiency created a strategic moat for Experian. By validating consumer-permissioned data at scale, we accelerated the adoption of FDX standards across 36+ institutions. We turned a regulatory constraint into a competitive advantage, proving that in regulated fintech, a transparent user experience is the most effective lever for operational growth.

Our 92% trust rating confirmed we built something people believed in. Beyond the metrics, meaningful stories emerged of individuals qualifying for their first apartments and securing better loans. Experian Boost didn’t create new financial behaviors; it simply gave credit where credit was due. Ultimately, this initiative benefits over 7 million consumers, providing a critical pathway for the 53 million Americans who have been historically excluded by traditional models. Collectively, our partnership built something people believed in, reminding us why we design: to make complex systems work better for everyday people.

Next Steps

Following our MVP launch, key opportunities included:

- Expand data ingestion by integrating streaming and telco data to increase the “Match Rate” for younger demographics with limited utility history.

- Refine Re-verification by gamifying the monthly re-scan process to boost “Retention Rate” and ensure credit scores remain dynamic.

- Scale brand mirroring and extend the UI adaptation framework to regional credit unions to maintain high “Consent Rates” across smaller institutions.