Overview

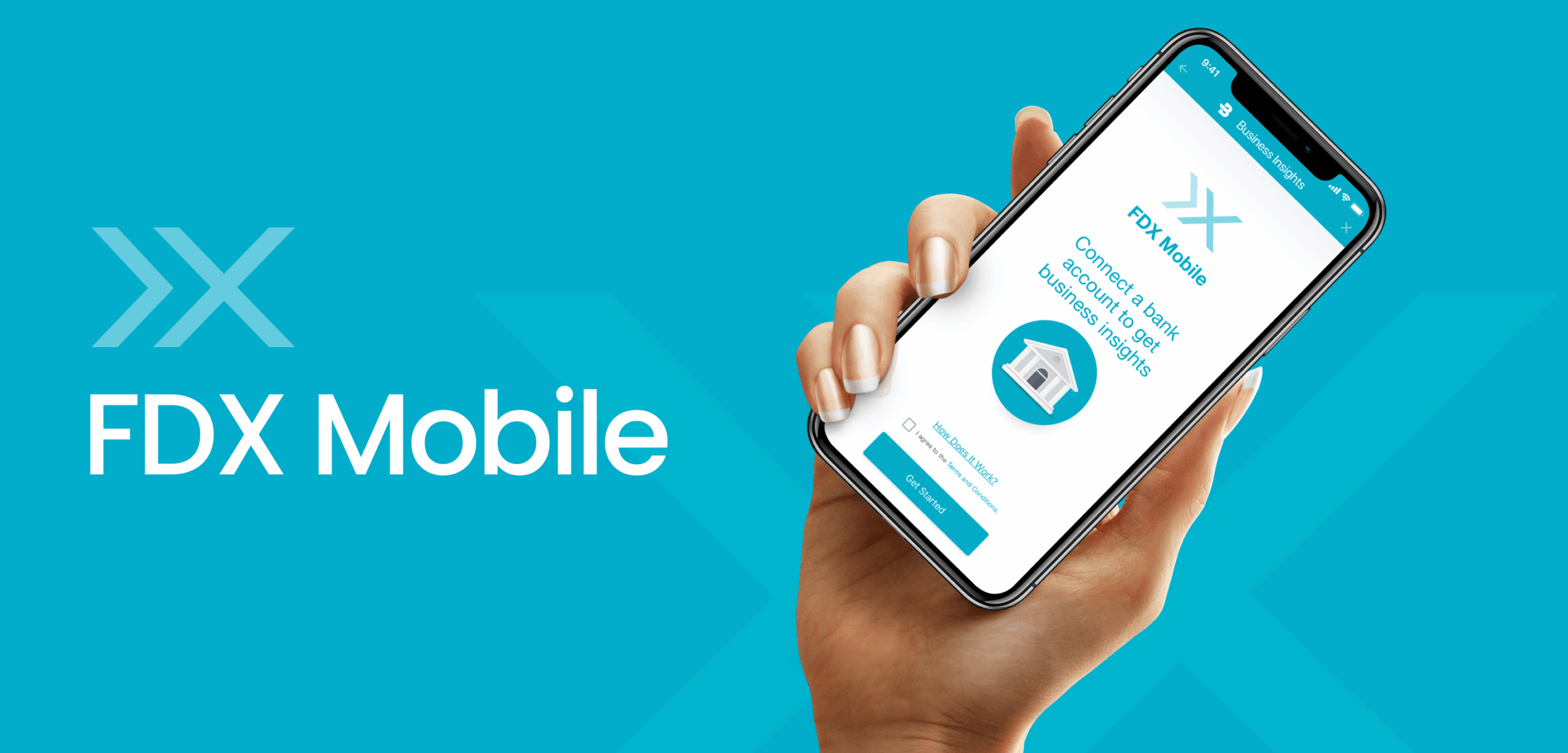

The Financial Data Exchange (FDX) isn’t just a protocol; it’s a systemic shift in how the financial ecosystem handles trust. As a designer at Finicity (an active partner during FDX’s inception), I contributed to the design of a unifying standard for secure data sharing. Our goal was to move the industry away from high-risk credential sharing toward a future enabled by consumer permission. To prove this standard worked at scale, we implemented it with Intuit Mint, de-risking the data pipeline for millions of users. The modern financial ecosystem is fragmented. Consumers and small business owners rely on multiple apps to manage their money, but the connections to banks were notoriously brittle and insecure. Before FDX, the “standard” was screen-scraping, a brute-force method where users surrendered their usernames and passwords, creating massive security vulnerabilities and operational costs. This collaboration established a framework to empower consumers and stabilize the market. Working alongside partners like Intuit Mint, Chase, and Wells Fargo, I helped define an intuitive consent flow that replaced opacity with measurable, granular control. As a core founding member of the FDX standard, the Finicity design team helped build a system that now protects over 53 million consumer accounts. We validated this framework by migrating Mint’s 20 million users to a transparent, tokenized API, boosting confidence and reducing churn.

Research & Design

Design Research & Strategy · Product design · Fintech regulatory compliance · FDX Integration · Developer API platform design · Consumer banking experiences

- Duration: April-June 2019

- Partners: FDX, Intuit Mint, Finicity/MasterCard

- Team: Fas Lebbie, John Adams, Brian Burges

My Role

Synthesized foundational behavioral research from Mint and FDX partners, mapping trust indicators across 1,500+ consumers. I helped translate these high-level insights into an experience design strategy that drove the adoption of API-based financial connectivity across 30+ institutions.

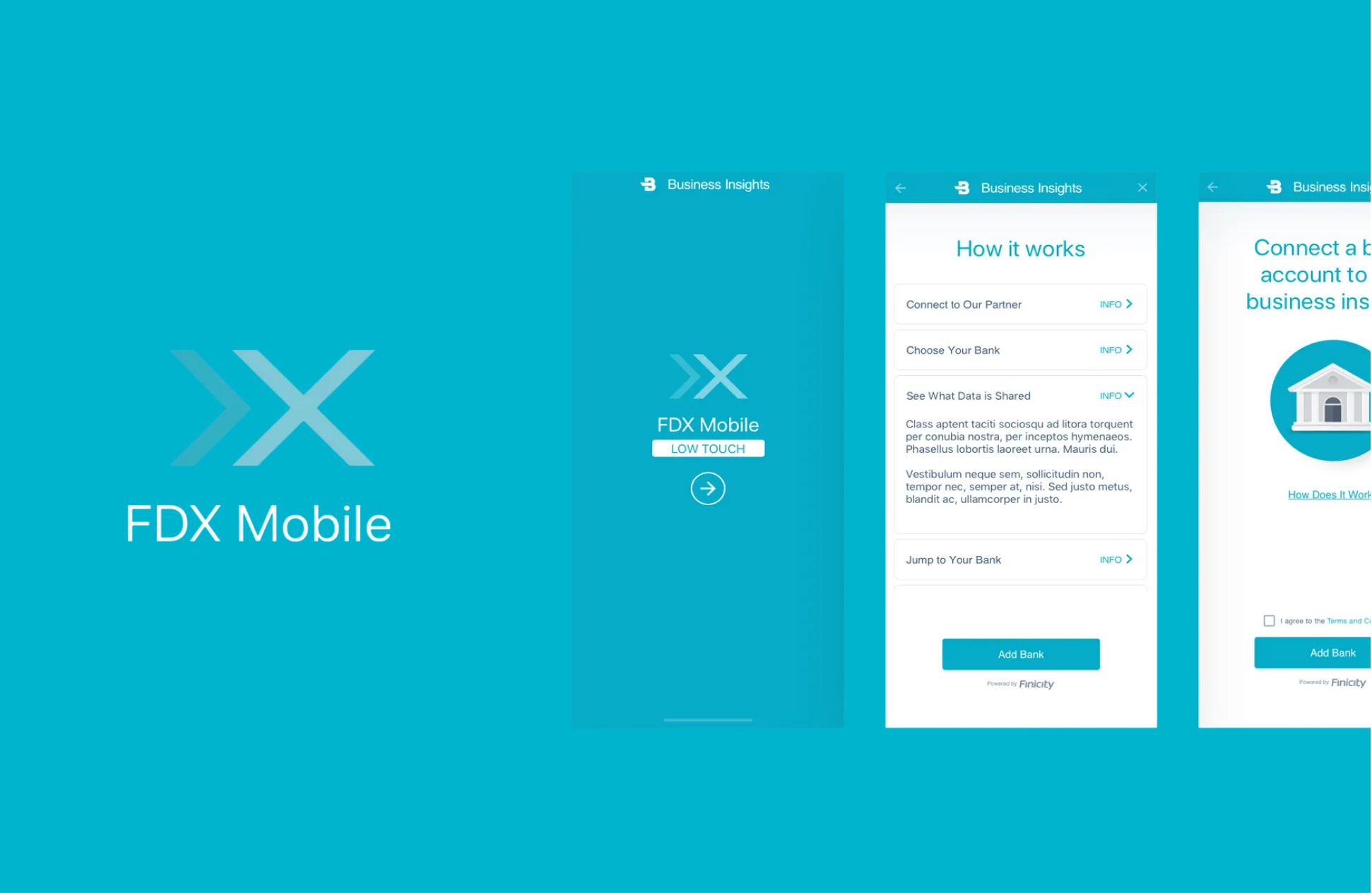

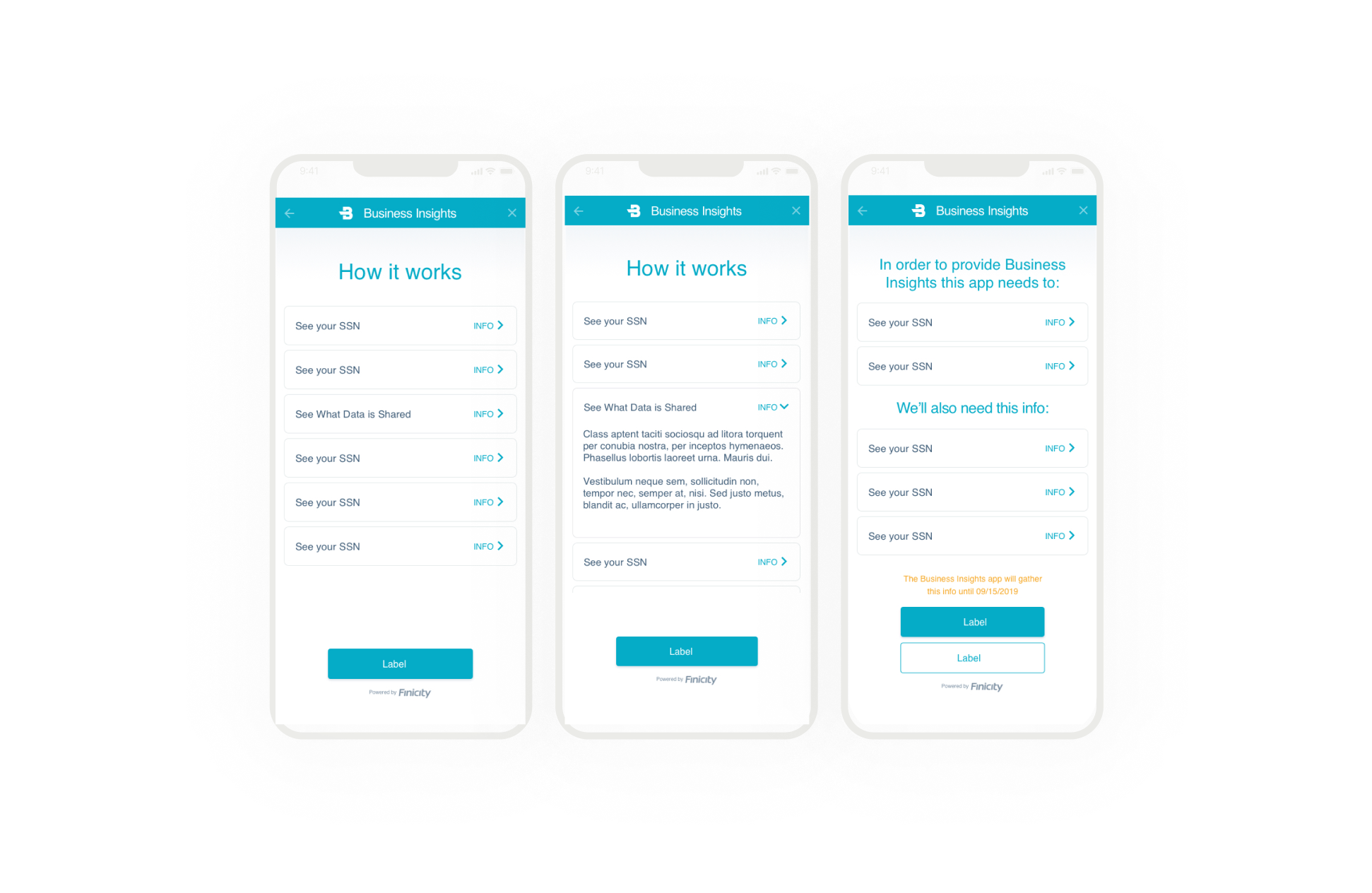

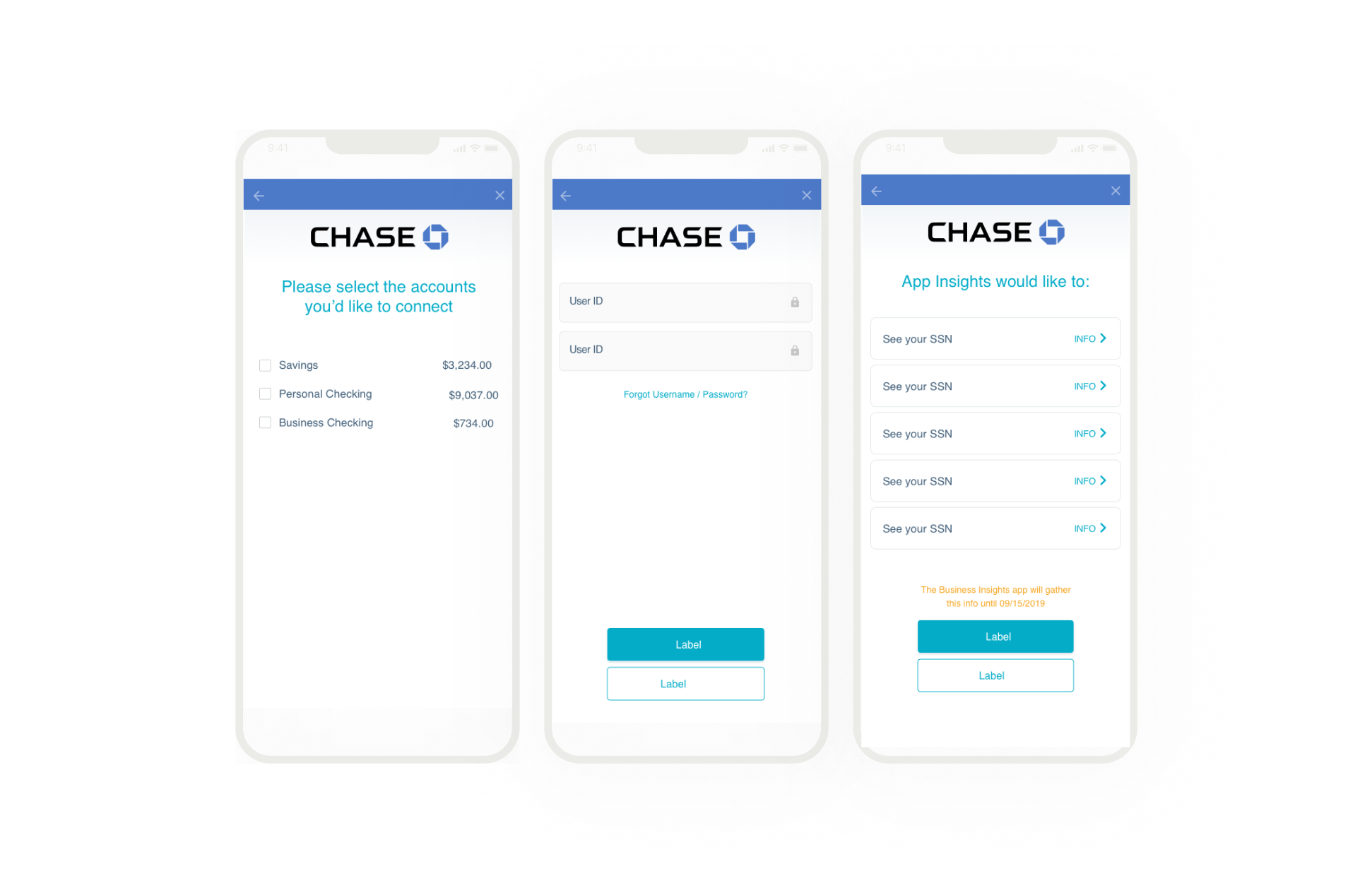

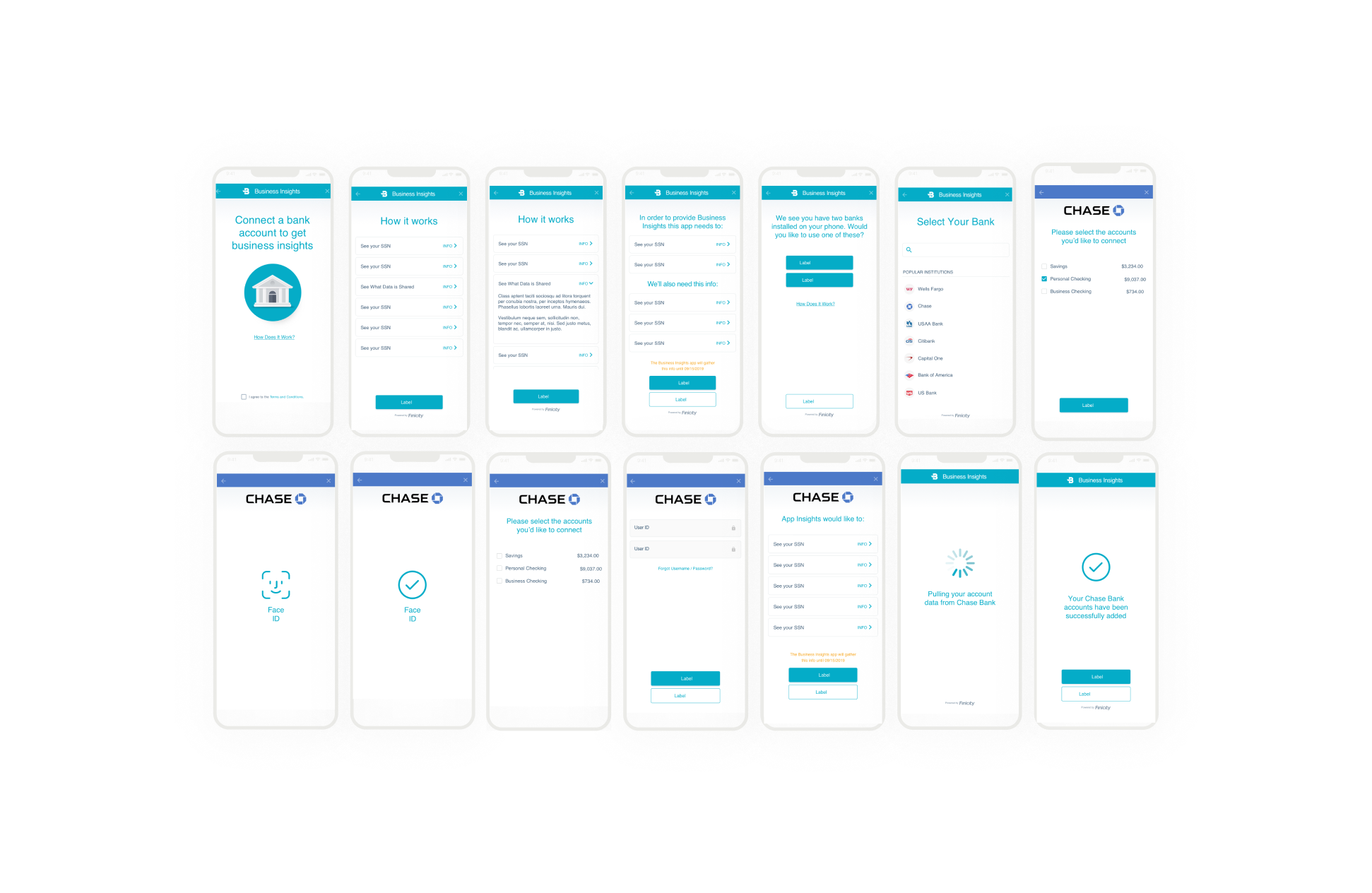

Designed "headless" consent framework that translates complex API capabilities into intuitive flows, which gave users granular control over their data (what data is shared, for how long, and with whom) while ensuring consistent, consumer-grade usability across disparate partners like Mint and Chase.

Align design solutions with strict regulatory requirements by embedding security compliance directly into the experience design.

Problem Context

The financial data ecosystem faced challenges with outdated and insecure data-sharing methods between consumers and third-party applications. Before FDX, consumers had to provide their banking credentials (usernames and passwords) to third-party financial apps through a process called screen scraping, creating serious security vulnerabilities. The Financial Data Exchange was developed as a non-profit financial organization that promotes and enhances a standard operating framework for sharing consumer financial data, empowering consumers to control their personal financial data. The backdrop of this project was a digital ecosystem held together by duct tape. For years, the industry relied on screen-scraping, a workaround where users surrendered their credentials to third-party apps. It was functional, but it stripped consumers of agency and created a “black box” liability nightmare for banks. Consumers maintained an average of more than 5 financial accounts but lacked a standardized way to connect them securely. The lack of interoperability increased support costs and abandonment. For a market leader like Mint, this was existential. Our data revealed that 63% of Mint users lacked clarity on data sharing, which was actively hindering retention. 56% of users explicitly demanded more control before connecting new accounts. We were starting from a point where security fears were actively capping growth, and the existing “user experience” of data sharing was essentially a security violation dressed up as a feature.

My Approach

Our VP of Design steered the high-level strategy, navigating the friction between Intuit’s conversion goals and the banks’ security mandates. My role as a Senior Designer was to operationalize this vision. I served as the tactical bridge, translating their regulatory agreements into tangible UI designs, working directly with engineering and external partners to deliver consent UX flows.

Design Process

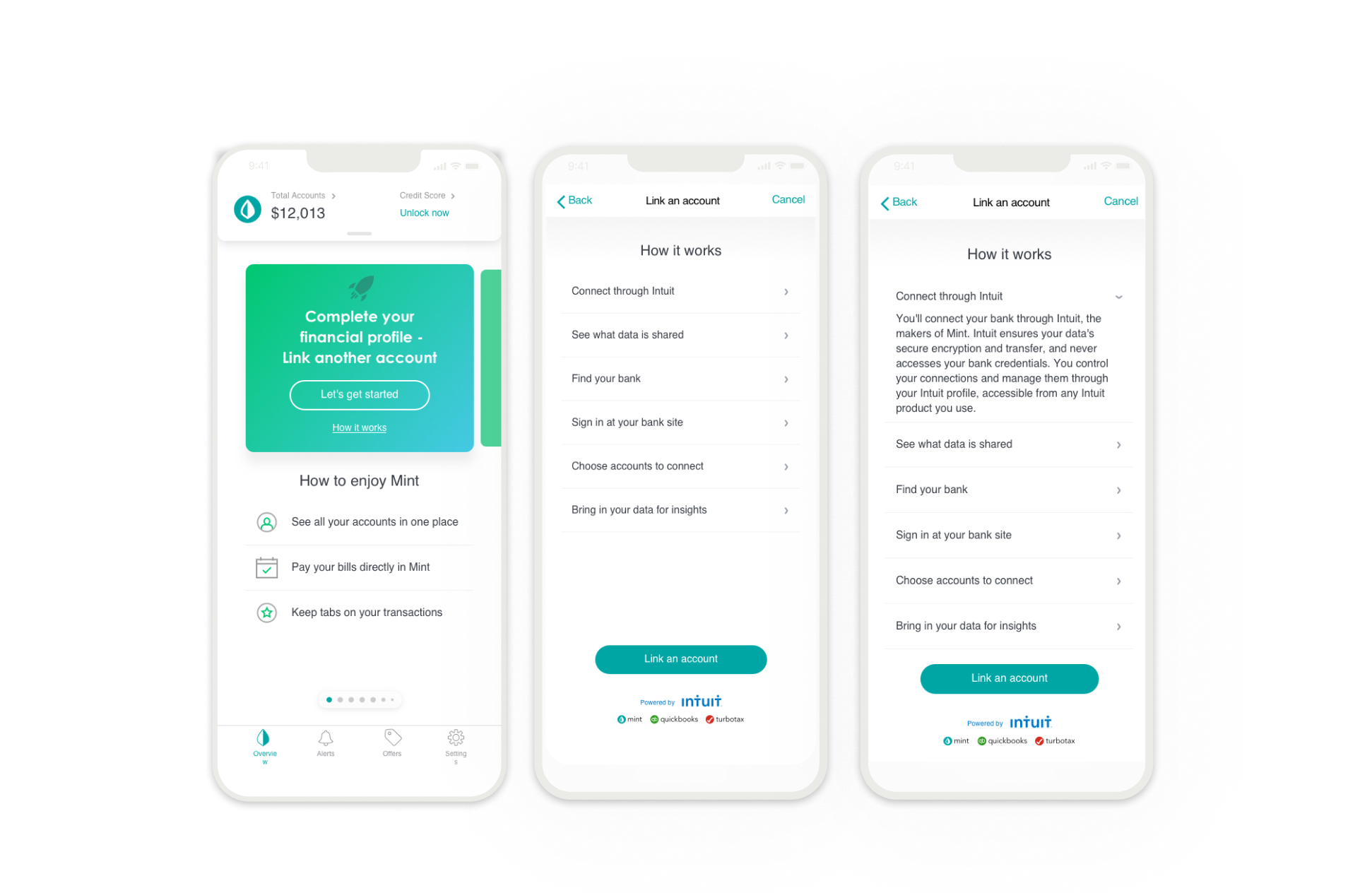

My research began by building on the foundational work of our partners at Intuit Mint and the FDX consortium. The Finicity data and product teams synthesized these insights, handing our design team a clear directive: users were hesitating not because the technology failed, but because the interface lacked transparency. We analyzed aggregate data from Mint’s users, specifically, the “financially proactive” segment (70% of whom pay off their cards monthly). This partner data revealed that while these users were tech-savvy, they experienced high “credential anxiety” at the moment of connection. FDX’s own industry surveys reinforced this, showing that 56% of consumers explicitly demanded greater control over data sharing. My role was to translate these high-level findings into a tangible UX strategy and designs. We used a trust heuristic framework to interpret the partner data, finding that users weren’t looking for a faster connection but for a safer one. We worked backwards from the concept of informed consent, using the partner research to justify adding intentional friction to the consent flow, shifting our strategy from optimizing for speed (conversion efficiency) to optimizing for clarity (retention stability).

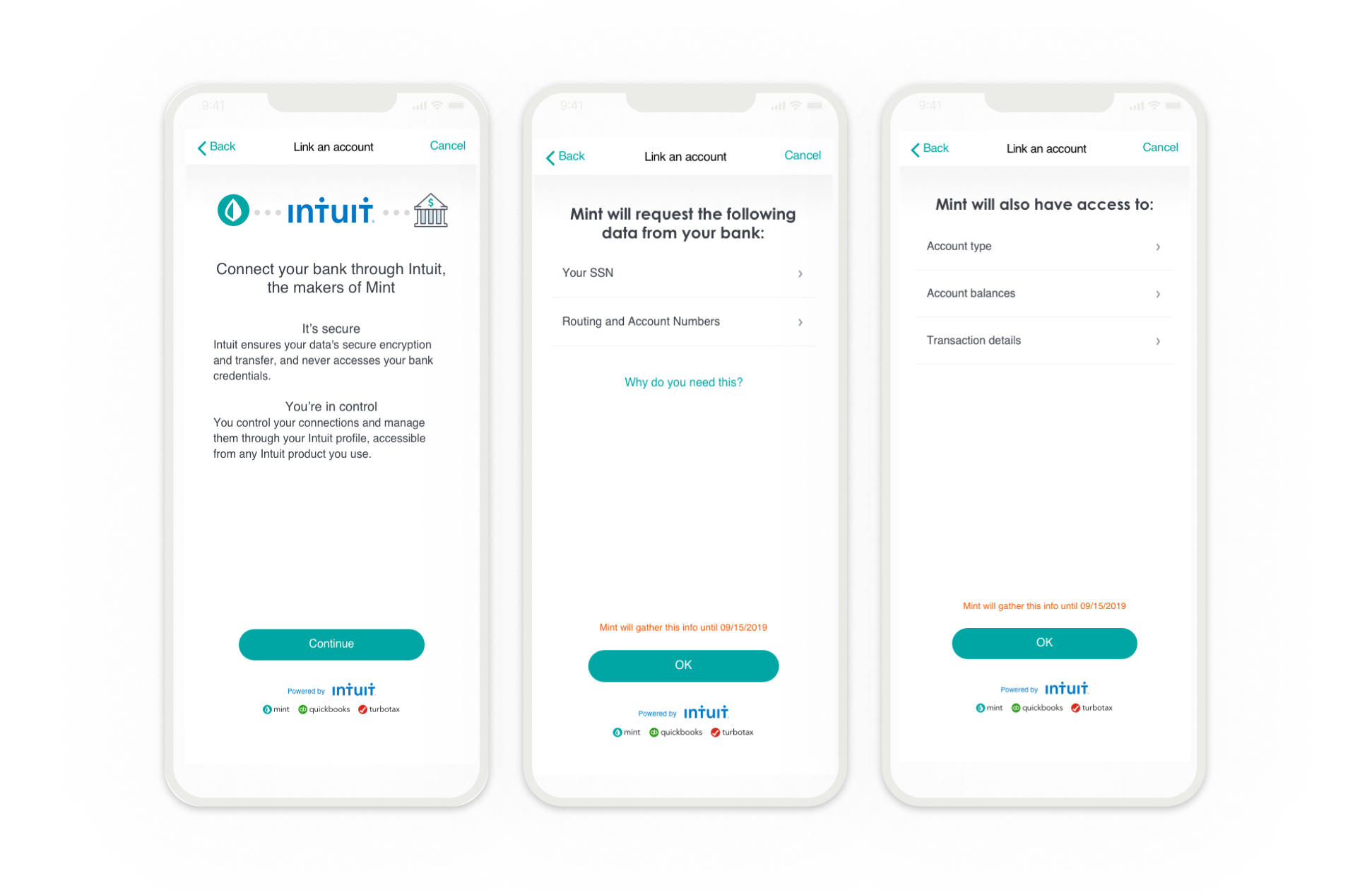

We synthesized broad behavioral data from our partners with tactical design explorations to uncover how interaction design could dismantle user anxiety. First, we challenged the assumption that speed equals success. While Mint prioritized time-to-complete, our testing revealed that users were willing to spend up to 45 seconds reviewing permissions if it resulted in greater control. Consequently, we introduced “positive friction,” intentionally slowing the flow down to ensure higher-quality, durable consents rather than rushing users through a blind acceptance.

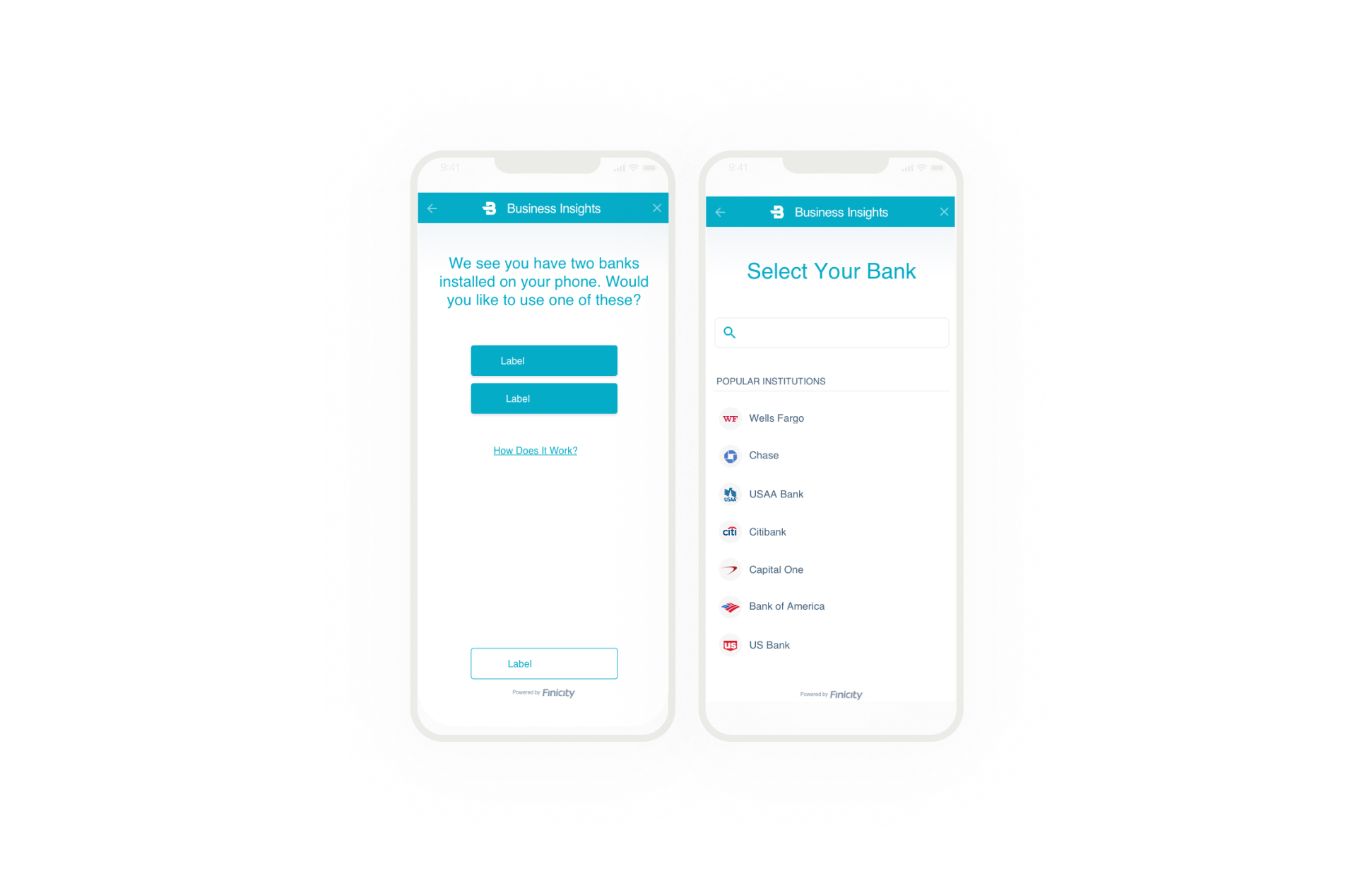

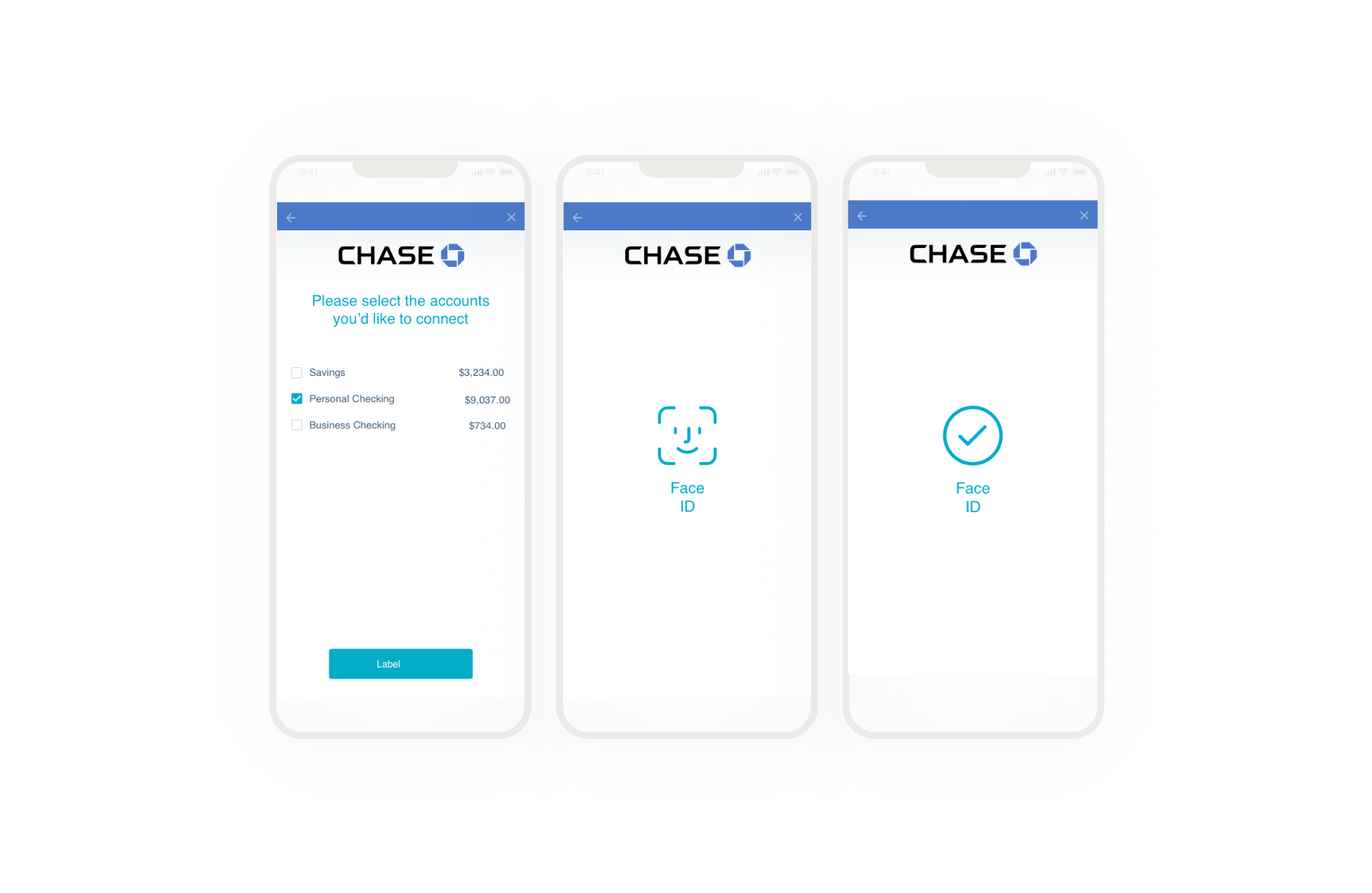

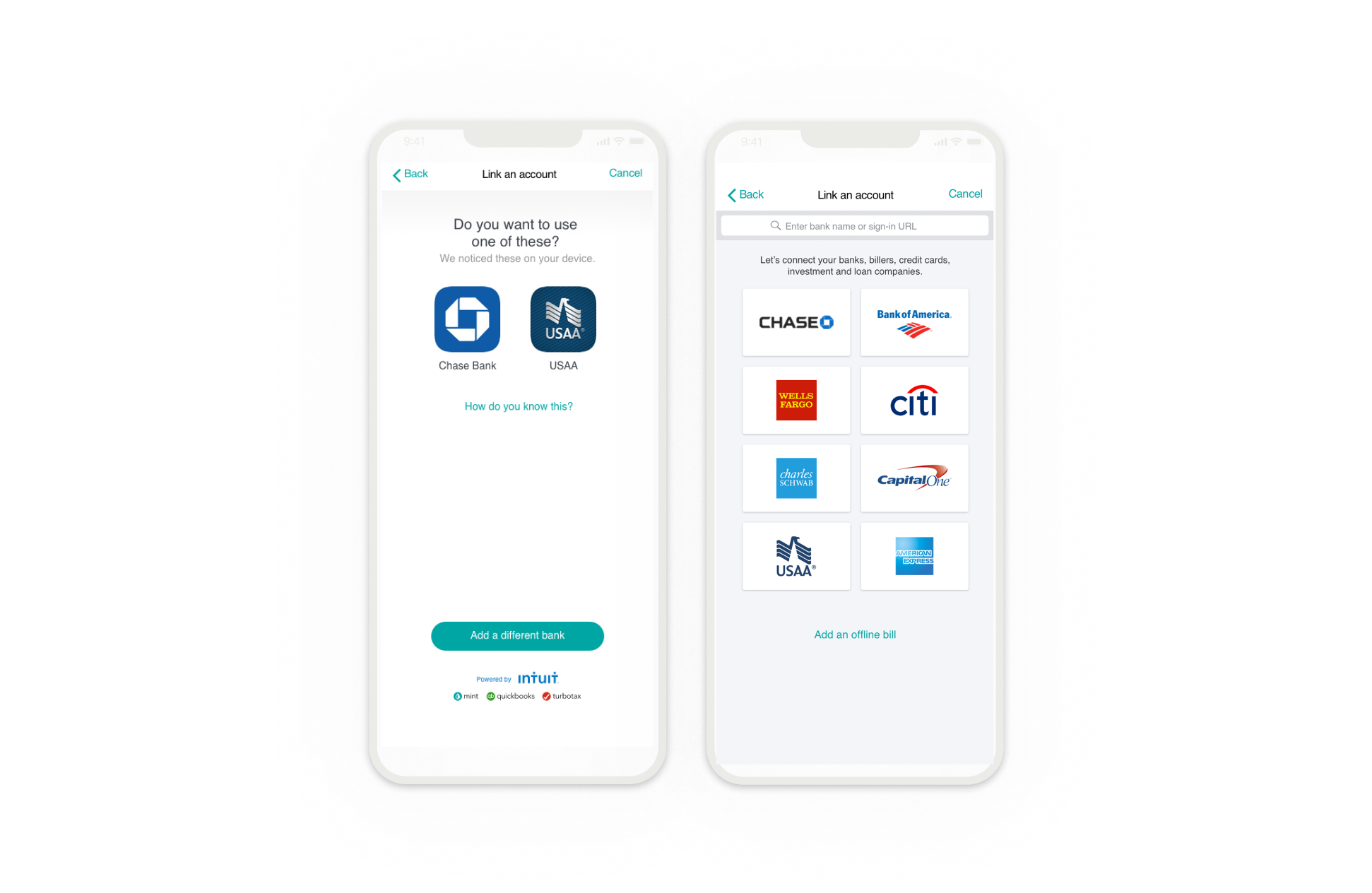

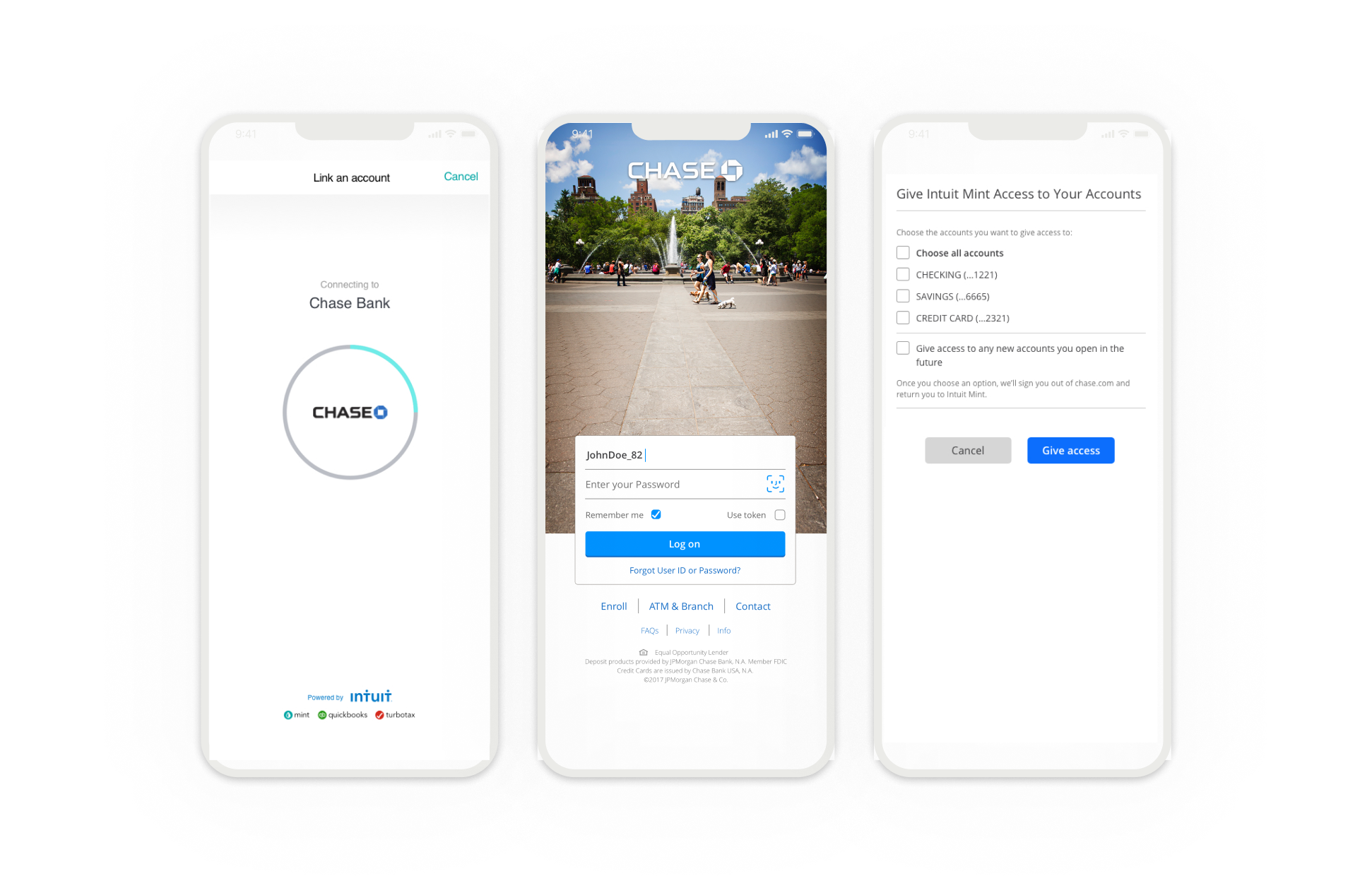

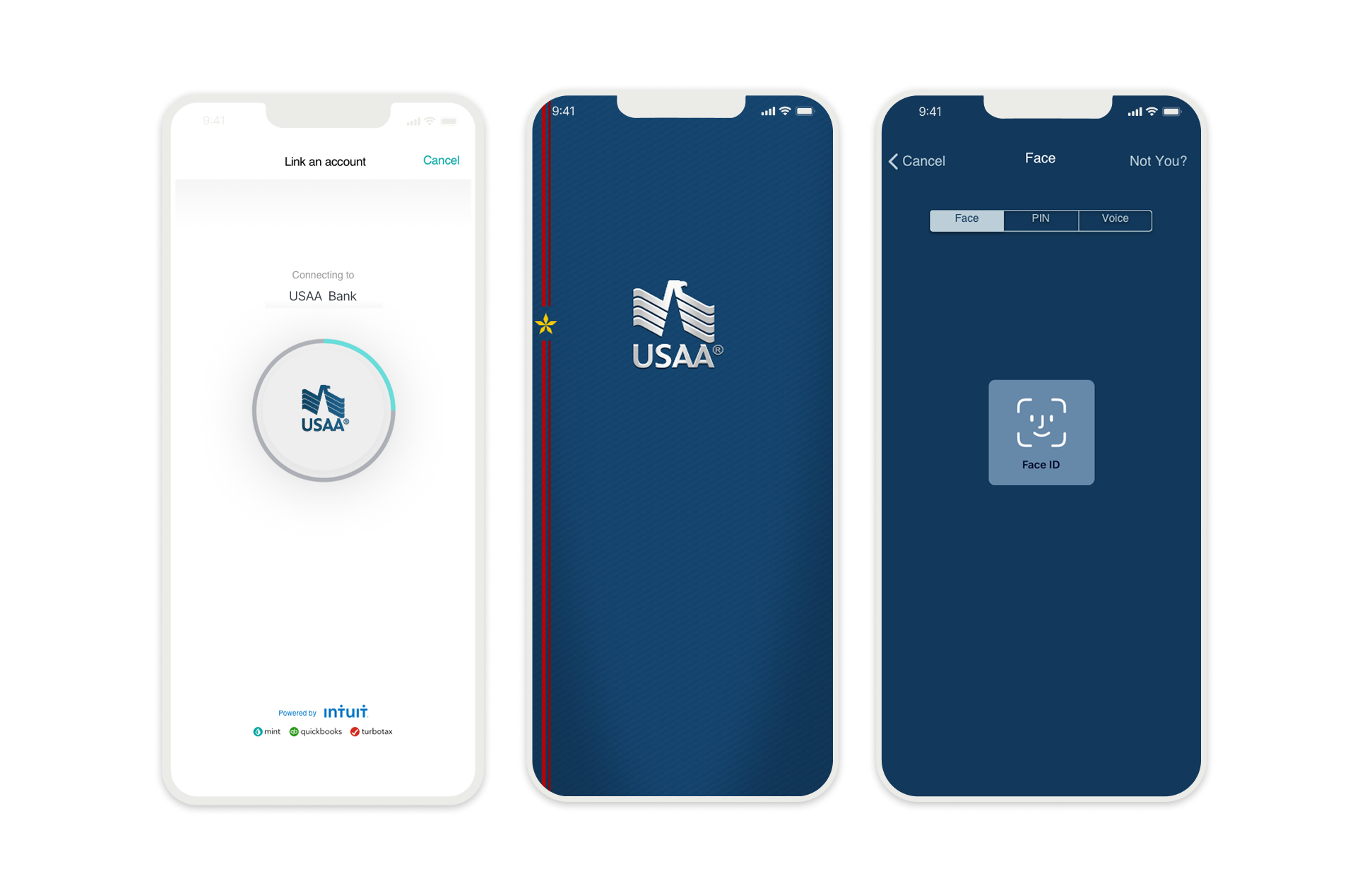

Second, we found that transparency and recognition were the anchors of trust. With 63% of users lacking clarity on what was being shared, we mandated that the UI display real-time account balances, turning a blind submission into a grounded confirmation of known facts. We further bolstered this by prioritizing app-to-app authentication; detecting an installed banking app increased trust by 67%, allowing us to effectively “borrow” the bank’s existing brand equity to validate our own flow.

Finally, we addressed the “all-or-nothing” churn that was capping growth. With 56% of consumers explicitly demanding control over specific accounts, we found that binary choices forced users to abandon the flow entirely rather than risk over-sharing. We re-architected the system to support unbundled permissions, allowing users to toggle specific accounts. This captured security-conscious users who would otherwise have churned, proving that granularity was a prerequisite for engagement.

We translated our research findings into a measurement framework that prioritized long-term retention over short-term conversion speed, aligning design decisions with specific behavioral outcomes.

Goal: To combat the high drop-off caused by “credential anxiety,” we established the Trust Transfer Rate as a primary success metric. Instead of just measuring completion, we tracked the specific adoption of app-to-app authentication. Our strategy was to leverage the psychological anchor of the user’s existing bank app, such as FaceID, hypothesizing that this familiarity would lower the cognitive cost of entry and increase conversion rates compared to legacy manual entry.

Goal: We redefined “performance” from raw Time-on-Task to “Time-to-Valid-Consent”. Recognizing that “all-or-nothing” permissions forced users to either churn or connect blindly (and revoke access later), we tracked the utilization of granular controls as a positive signal. We aimed to show that offering more choices or introducing intentional friction led to higher-quality connections that users were less likely to disconnect from in the future.

Goal: Beyond UX metrics, the standard had to address the significant liability and support costs associated with screen scraping. We measured business health through Migration Volume, specifically the shift from insecure scraping to API tokens. The ultimate strategic goal was to lower the “Cost of Fraud” for partners like Intuit and Chase, validating that a standardized, liability-reduced framework could expand the ecosystem while protecting the bottom line.

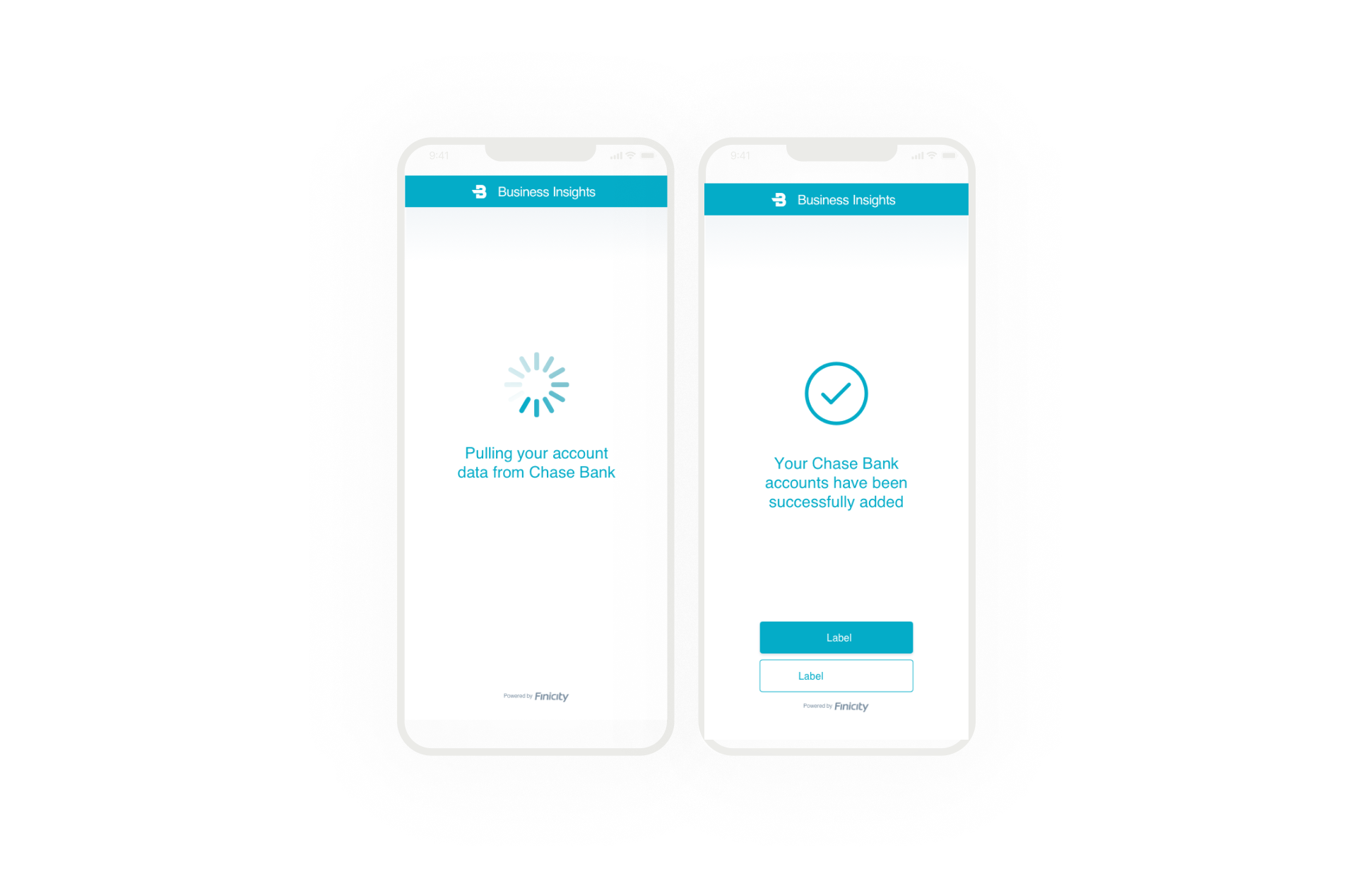

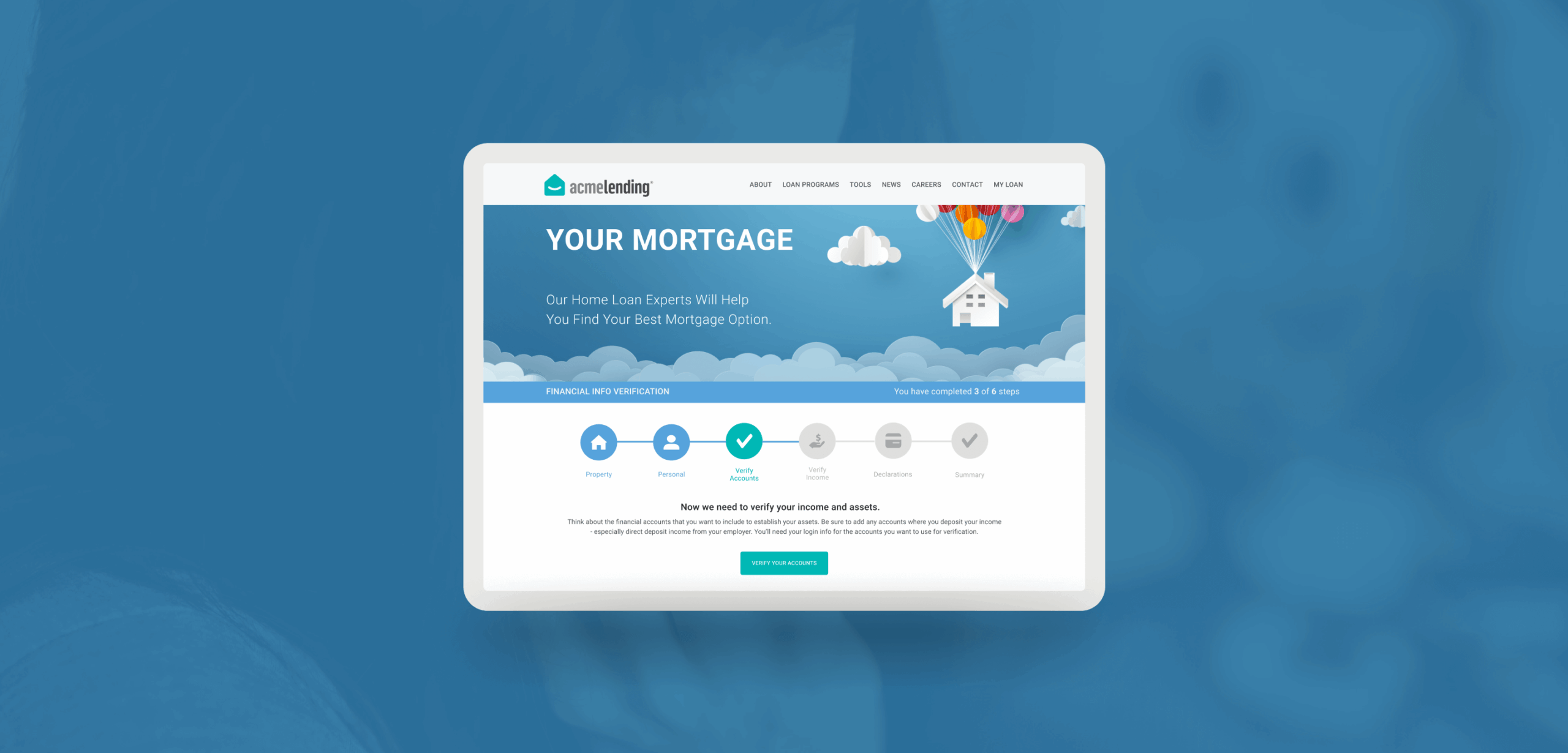

We deployed it first with Intuit Mint. We replaced their legacy screen-scraping logic with our new API-driven flow.

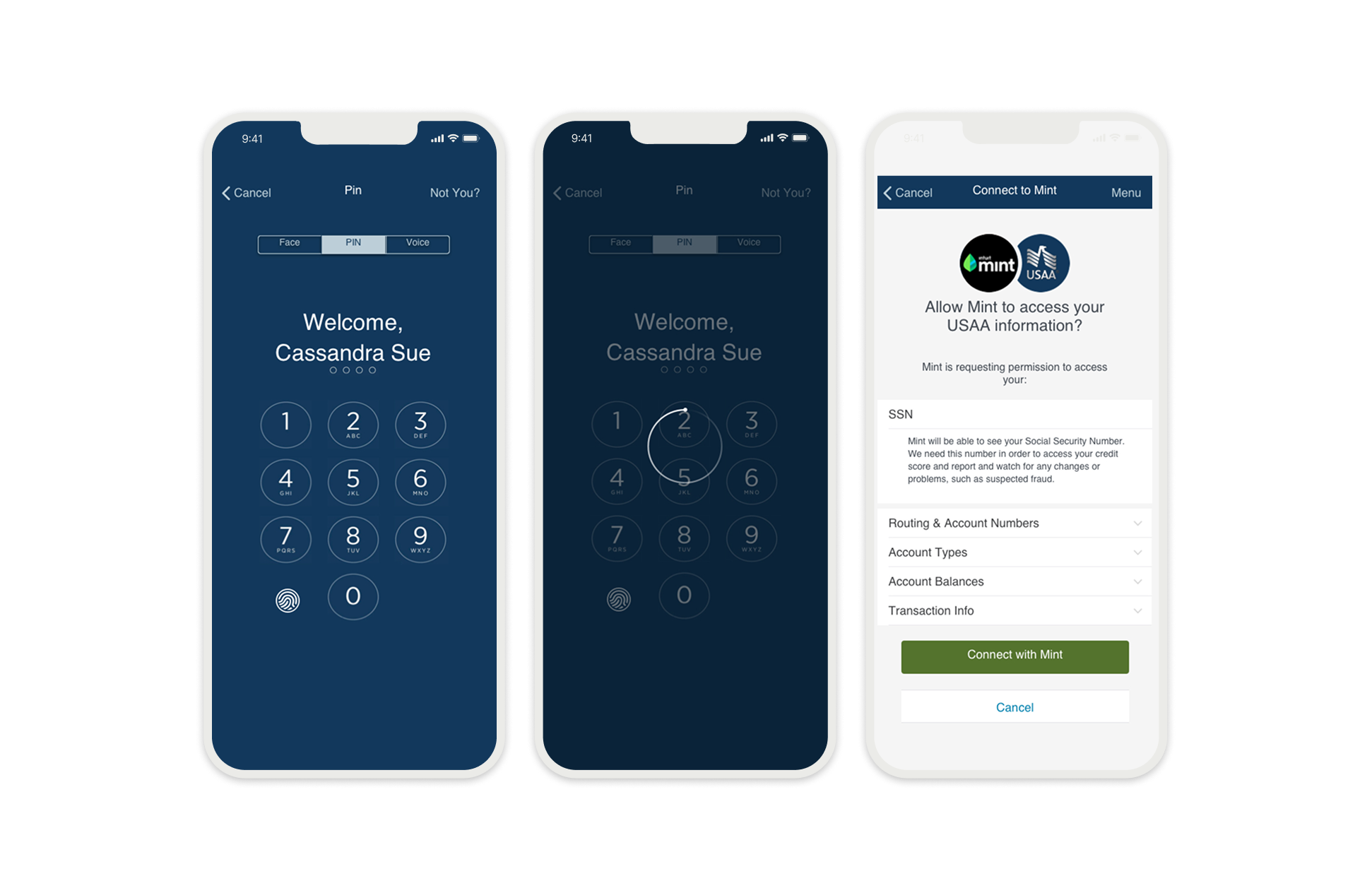

We applied the FDX standard as a "Headless UI Framework" directly within the Mint experience. The solution progressively discloses specific data requests, explicitly listing sensitive items such as SSNs and routing numbers. We introduced granular controls that allow users to toggle individual accounts and view precise access expiration dates.

Consumer Accounts Protected

Transitioned Intuit’s active user base from insecure screen-scraping to FDX-compliant APIs

Increase in User Trust Signals

Achieved by replacing screen-scraping with app-based authentication

Institutions Standardized

Implemented FDX principles (Transparency, Granularity, Control) across banking institutions like Chase, Wells Fargo, etc.

Reflections & Impact

The Financial Data Exchange recognized early on that the industry’s reliance on screen-scraping was a ticking time bomb for consumer trust. We aligned our vision around a simple premise: if we give users control, they will give us access. We validated this by rigorously measuring the “Trust Signal” and found that our transparent authentication flows increased user confidence by 67% compared to legacy methods. This sentiment shift drove massive behavioral change. By proving that transparency reduces churn, we scaled the FDX standard to protect over 53 million consumer accounts across 30+ financial institutions, including 20 million Mint users. The FDX initiative is now an established new industry benchmark for liability reduction, transforming “compliance” from a legal hurdle into a competitive advantage for the entire ecosystem.

Next Steps

- Develop advanced permission management features allowing users to set time-based and usage-based data access controls.

- Implement real-time monitoring and notification systems for data access activities and permission changes.

- Develop educational resources and onboarding flows to increase consumer understanding of the benefits of data sharing.