Problem Context

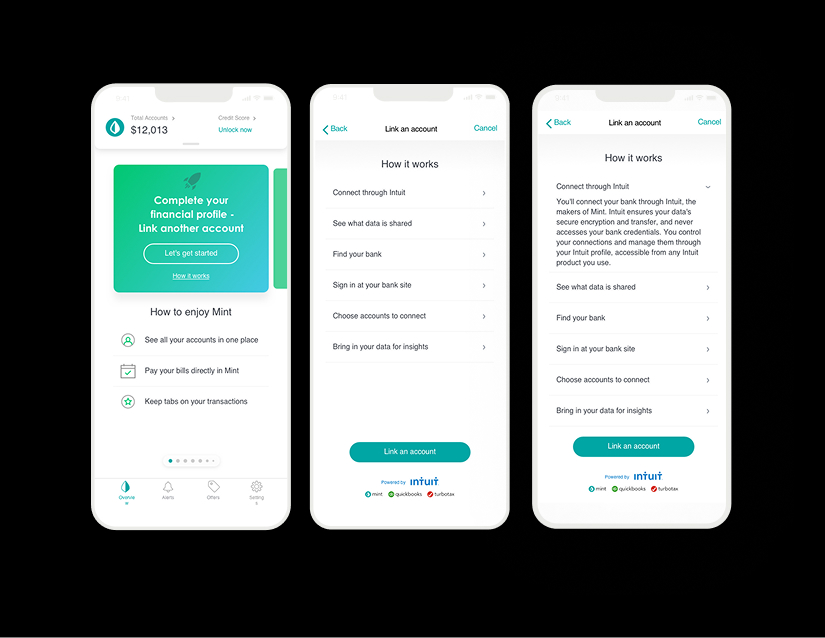

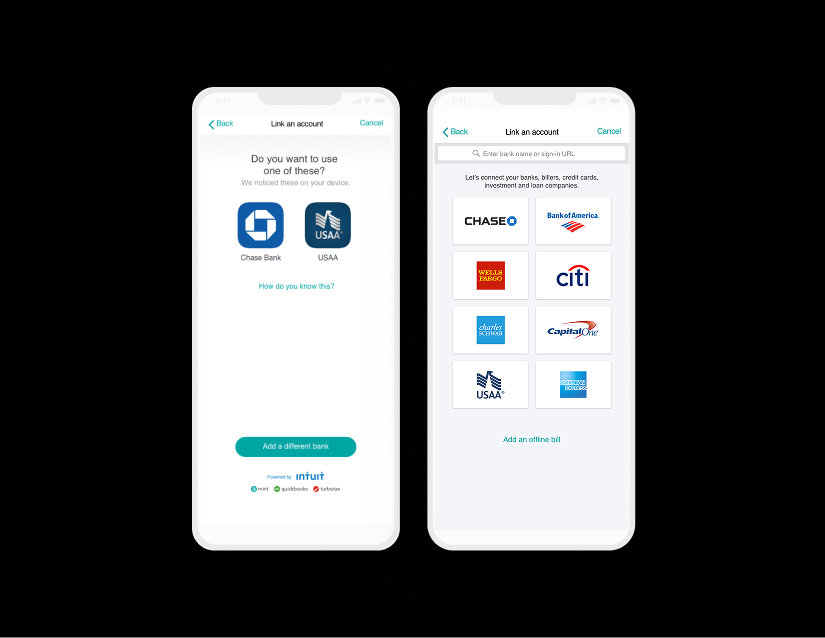

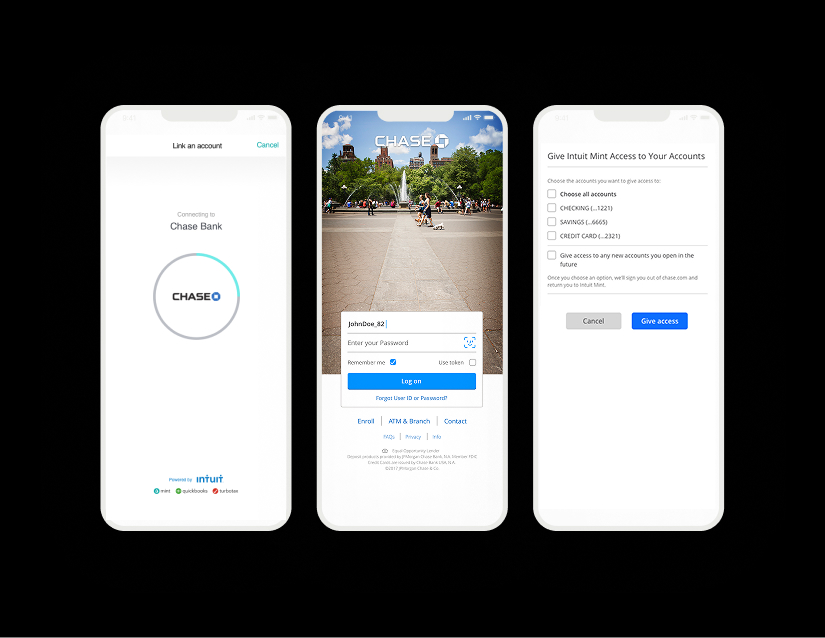

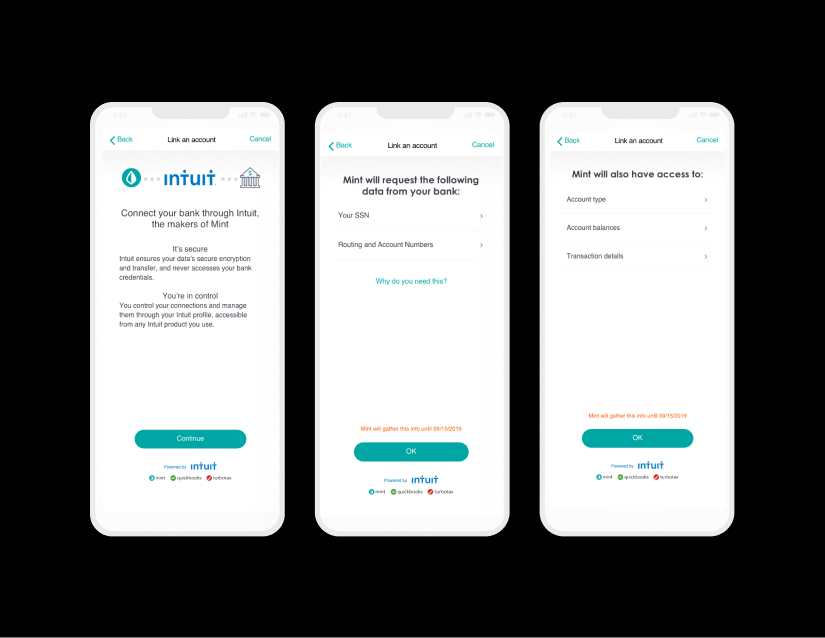

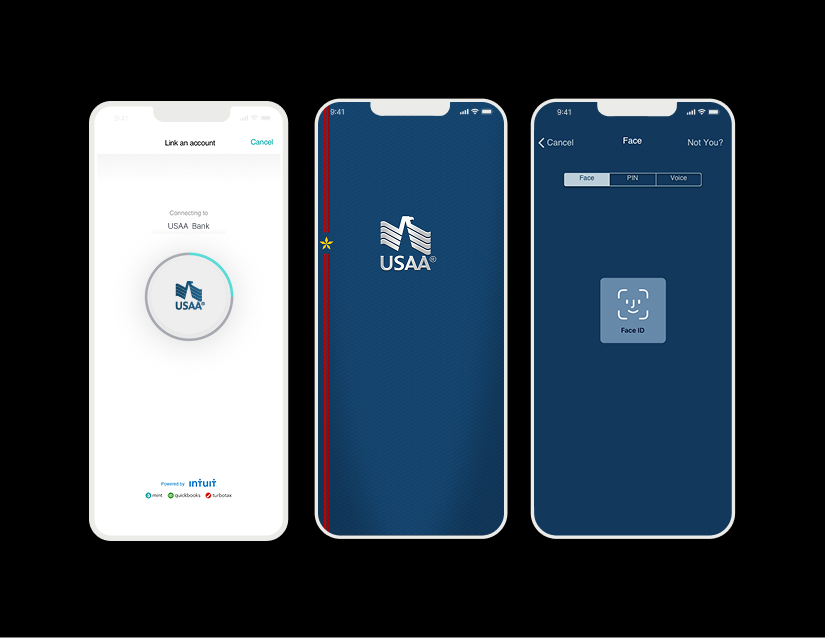

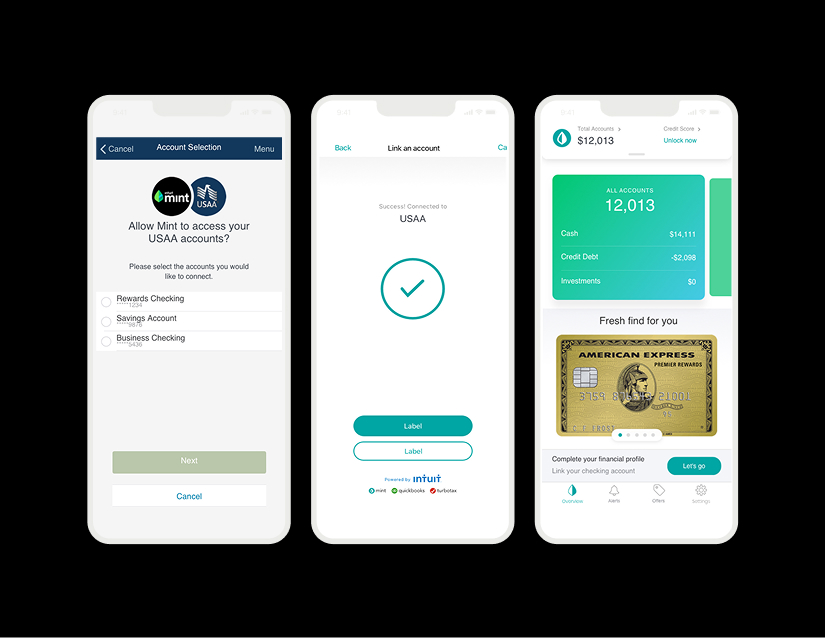

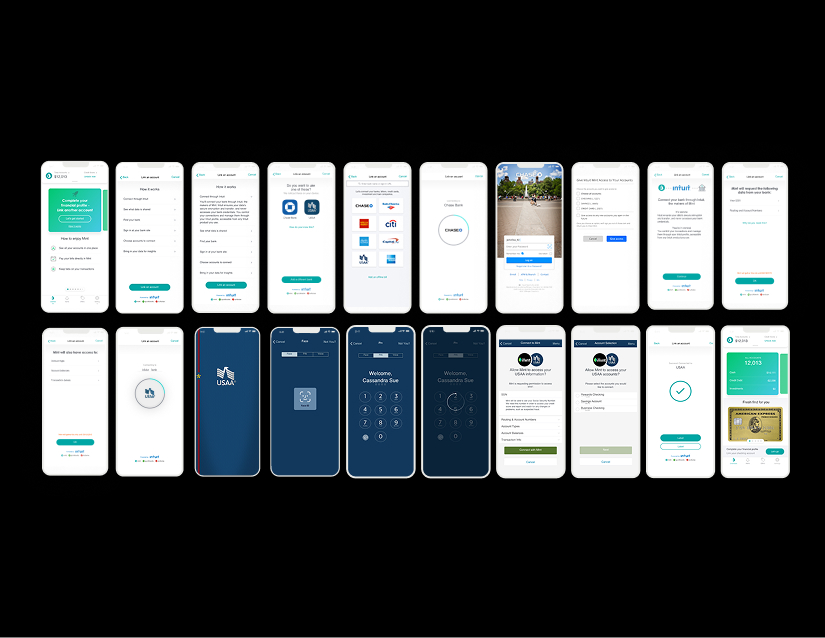

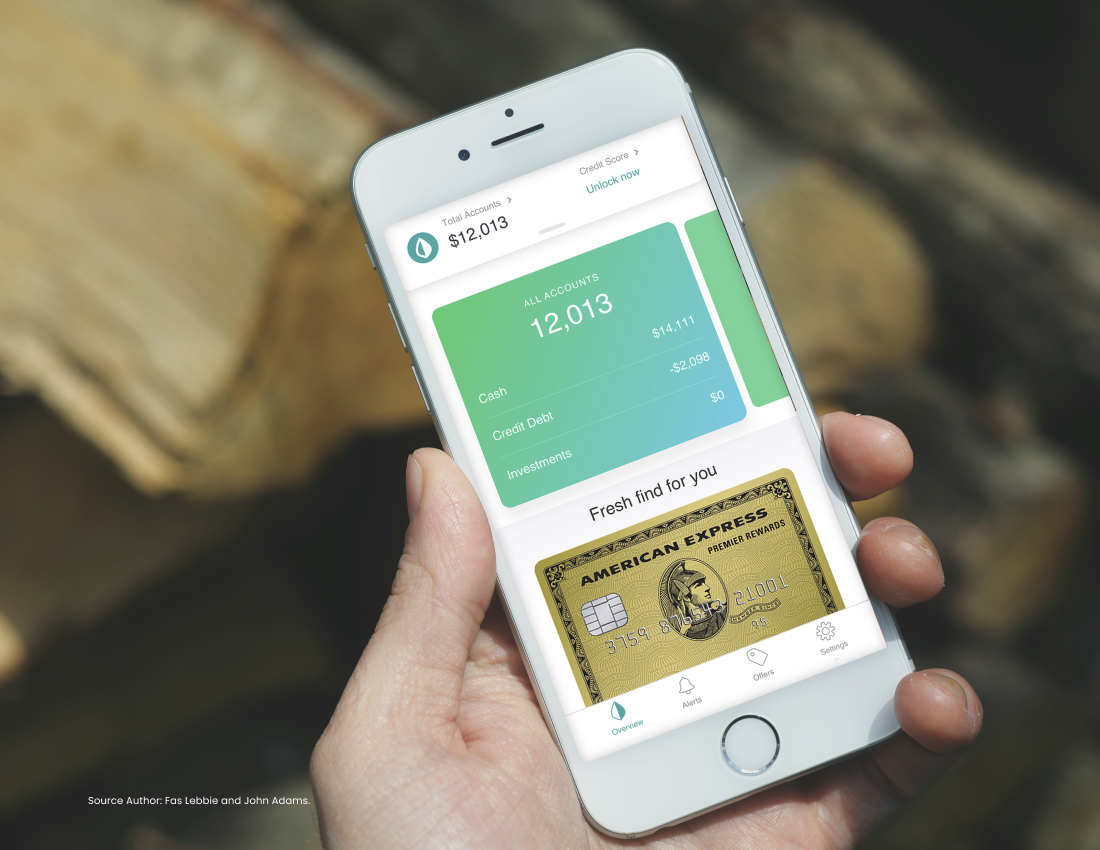

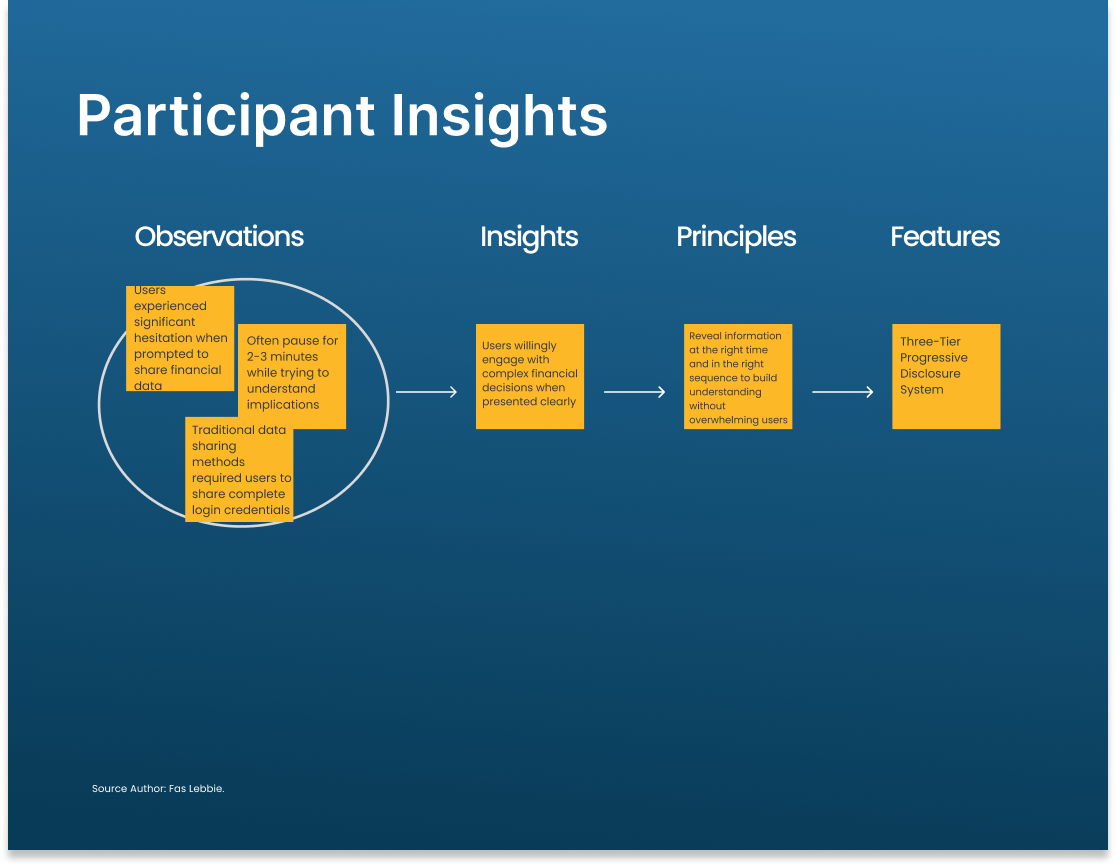

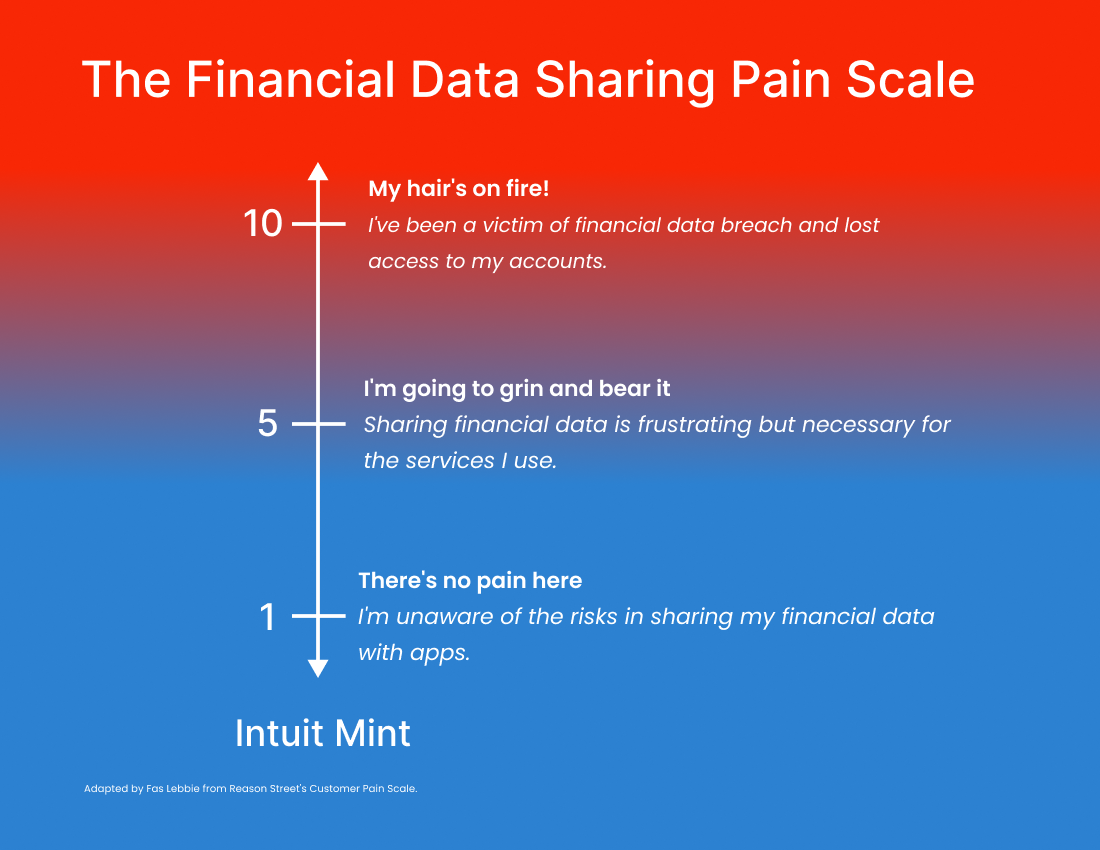

Intuit Mint is a free personal financial management service used by over six million consumers in the US and Canada. It consolidates financial information—such as bank accounts, credit cards, and bills—into one platform. Mint updates and categorizes information in real-time, allowing users to track spending and monitor investments. It also provides bill reminders and payment services, enabling users to manage finances, as shown in the app’s home screens. Given Mint’s central role in managing users’ financial lives, the financial data ecosystem presents challenges, with consumers concerned about sharing personal information, especially after major data breaches. In 2019, as part of Finicity’s open banking initiative (later acquired by Mastercard), I was tasked with creating a secure interface for Intuit Mint to address data security concerns while maintaining compliance with Financial Data Exchange (FDX) standards. FDX, founded in 2018, is a non-profit organization unifying the financial sector around secure data exchange, with Intuit and Finicity as founding board members. Authorized data sharing enables various personal finance apps that have transformed financial management. Research shows 63 percent of smartphone users have at least one financial app, highlighting the tension between data security concerns and financial technology convenience. This discrepancy stems from a lack of transparency in how financial data is shared. Users must make consent decisions without fully understanding the implications when third-party apps request access to their financial data. This was evident in traditional methods where users shared login credentials with third-party apps without clarity on data access.