Problem Context

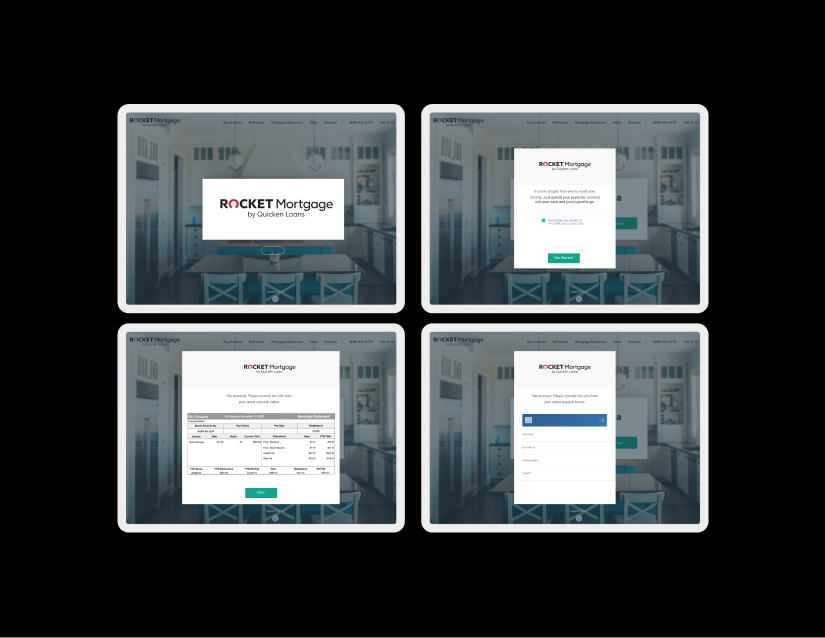

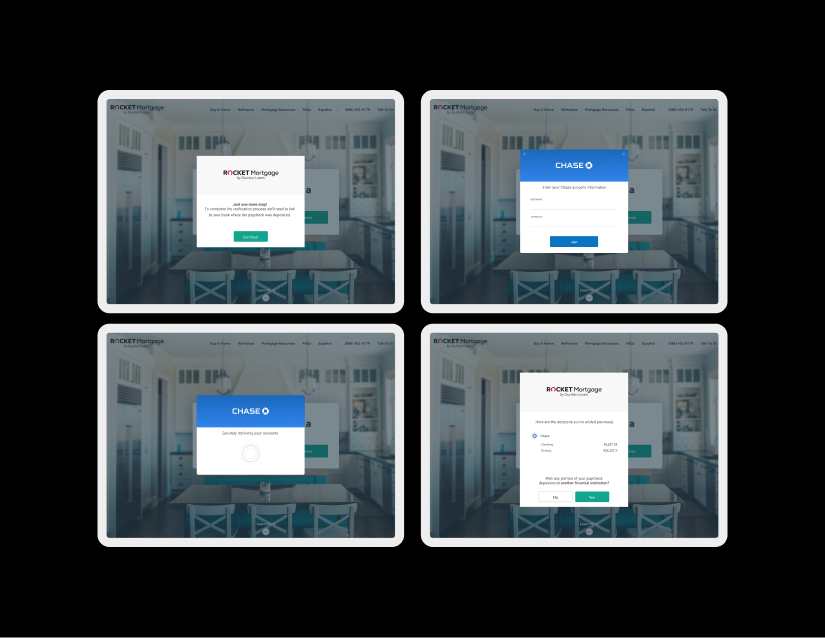

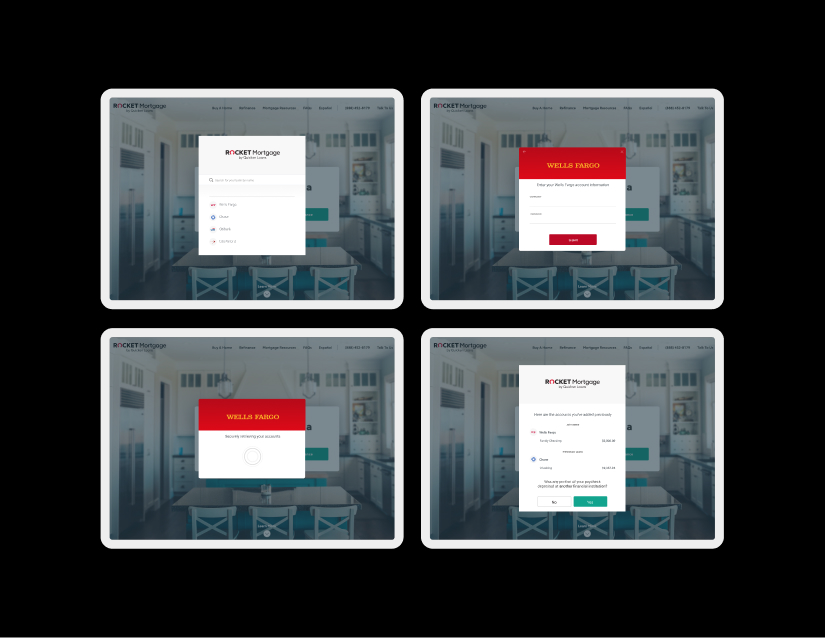

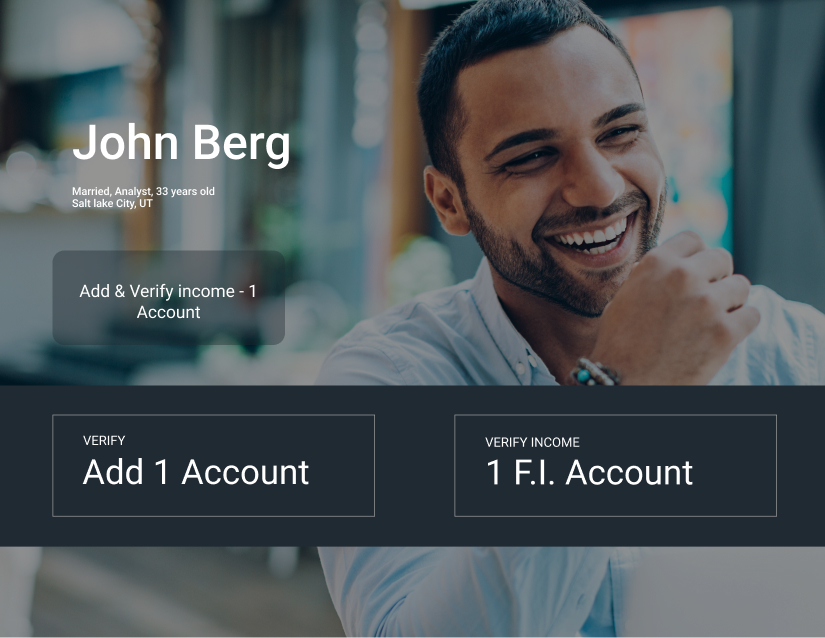

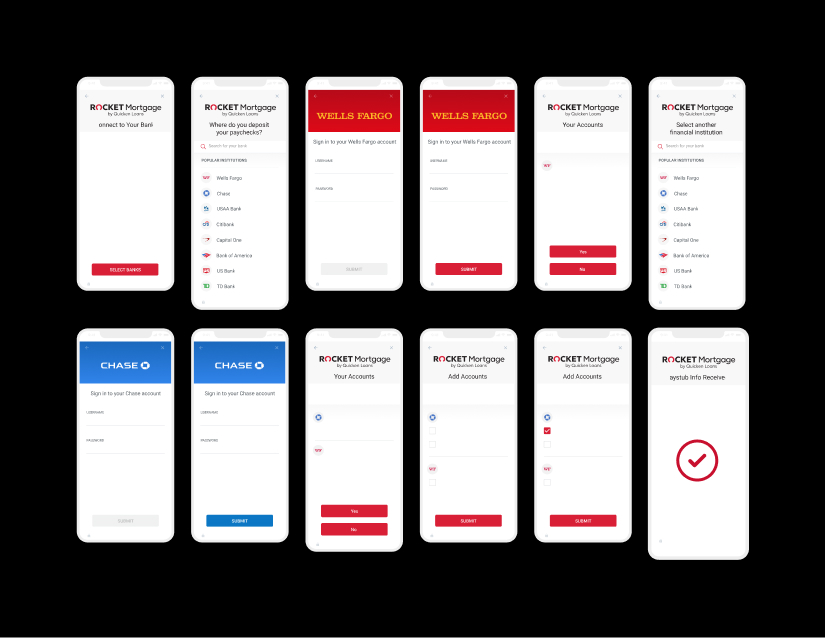

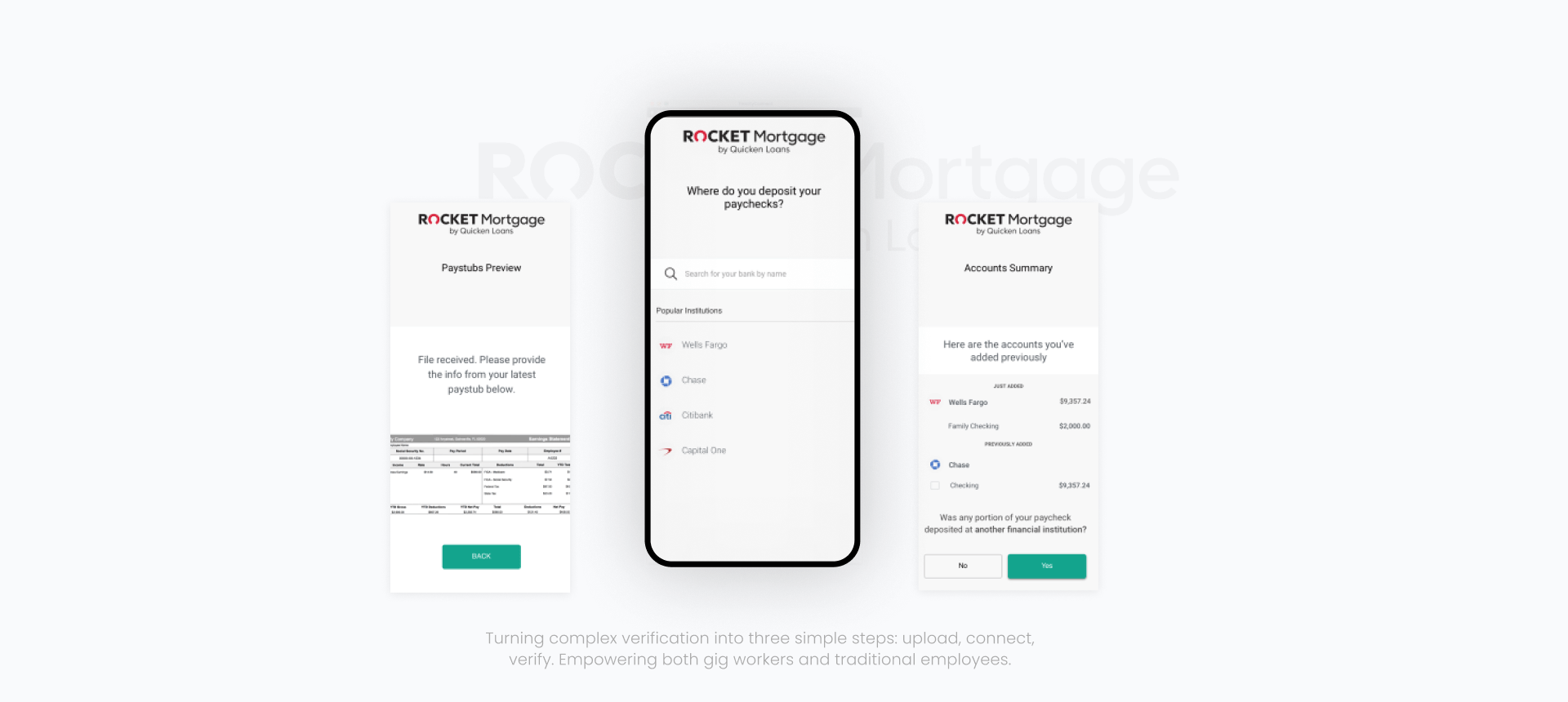

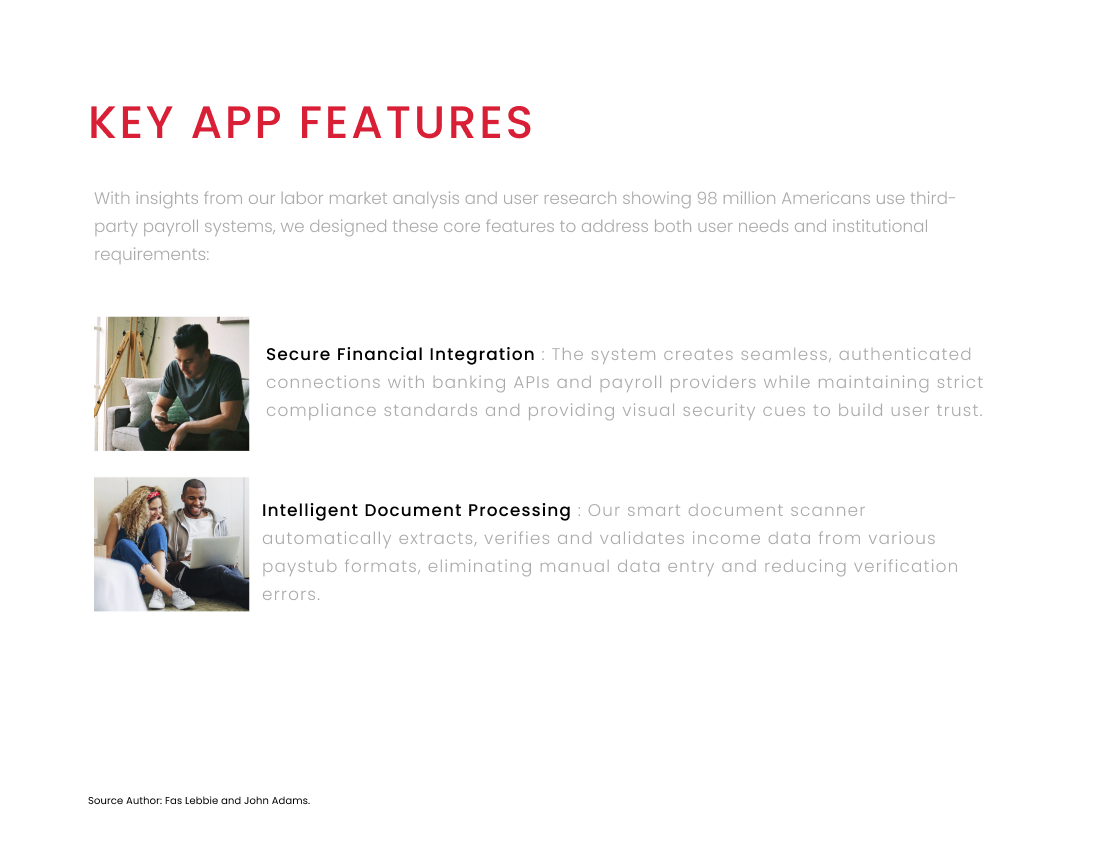

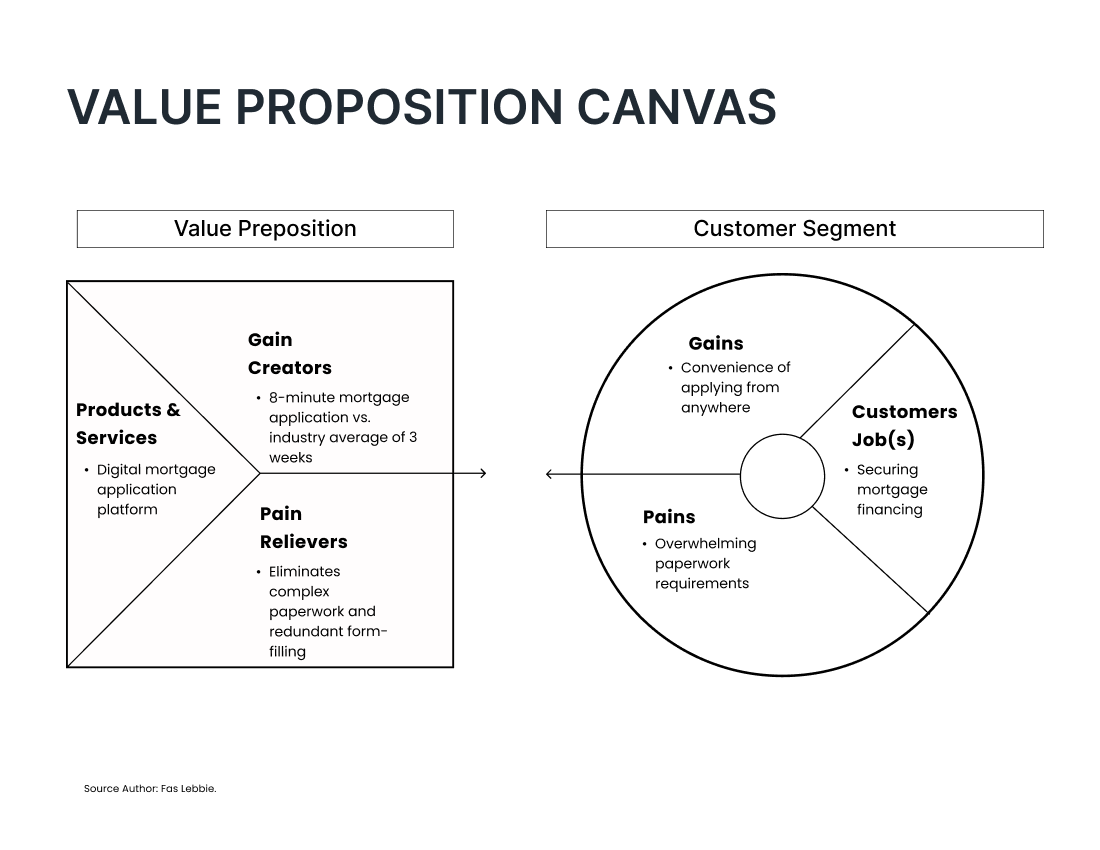

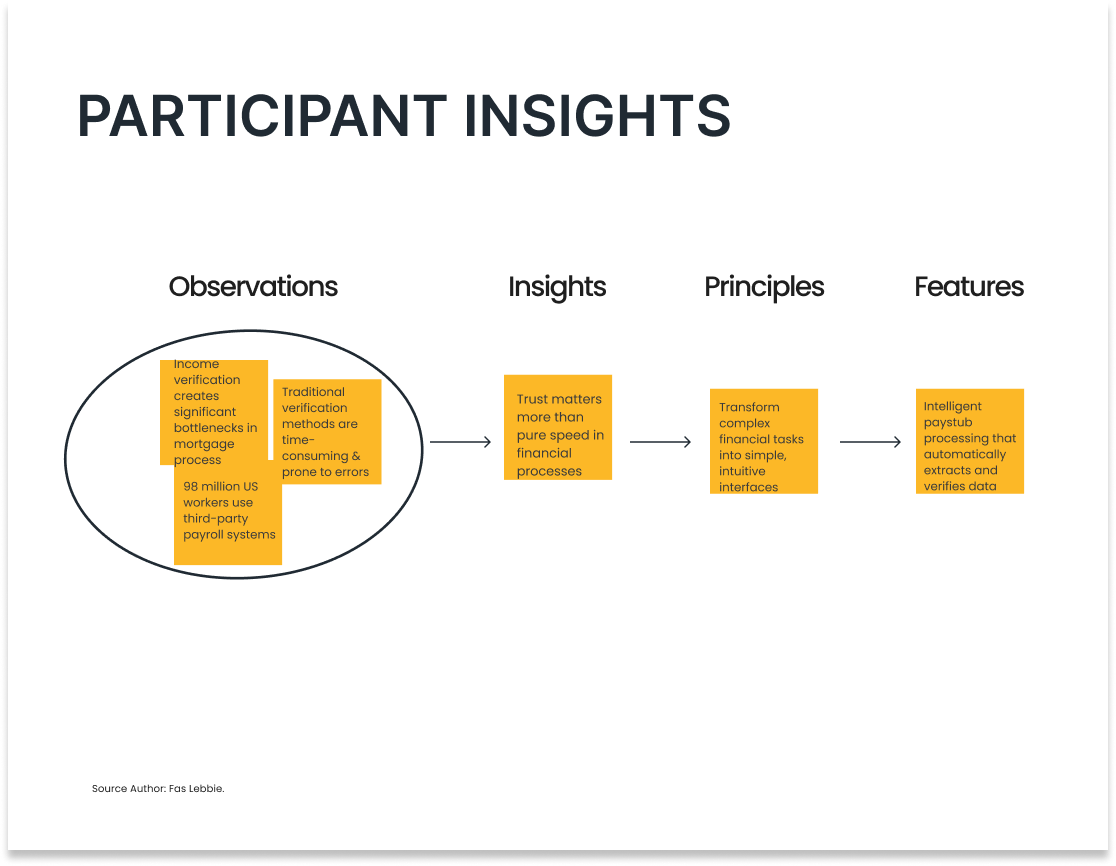

In the modern lending landscape, income verification had become a critical bottleneck. Despite the digital transformation of banking services, Rocket Mortgage’s verification process remained stubbornly complex and time-consuming. The challenge was particularly acute given that 98 million of 156 million US workers receive payment through third-party providers, creating a complex web of data sources and verification needs.

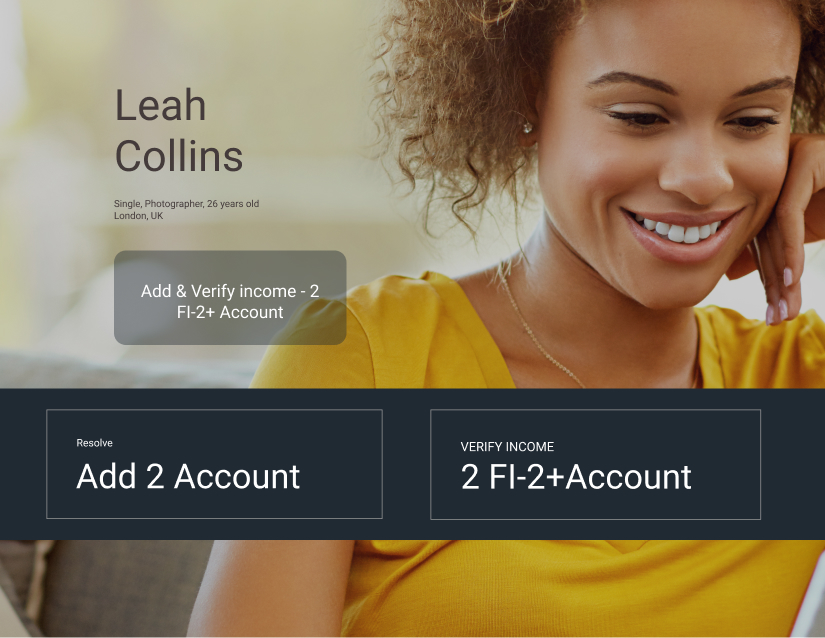

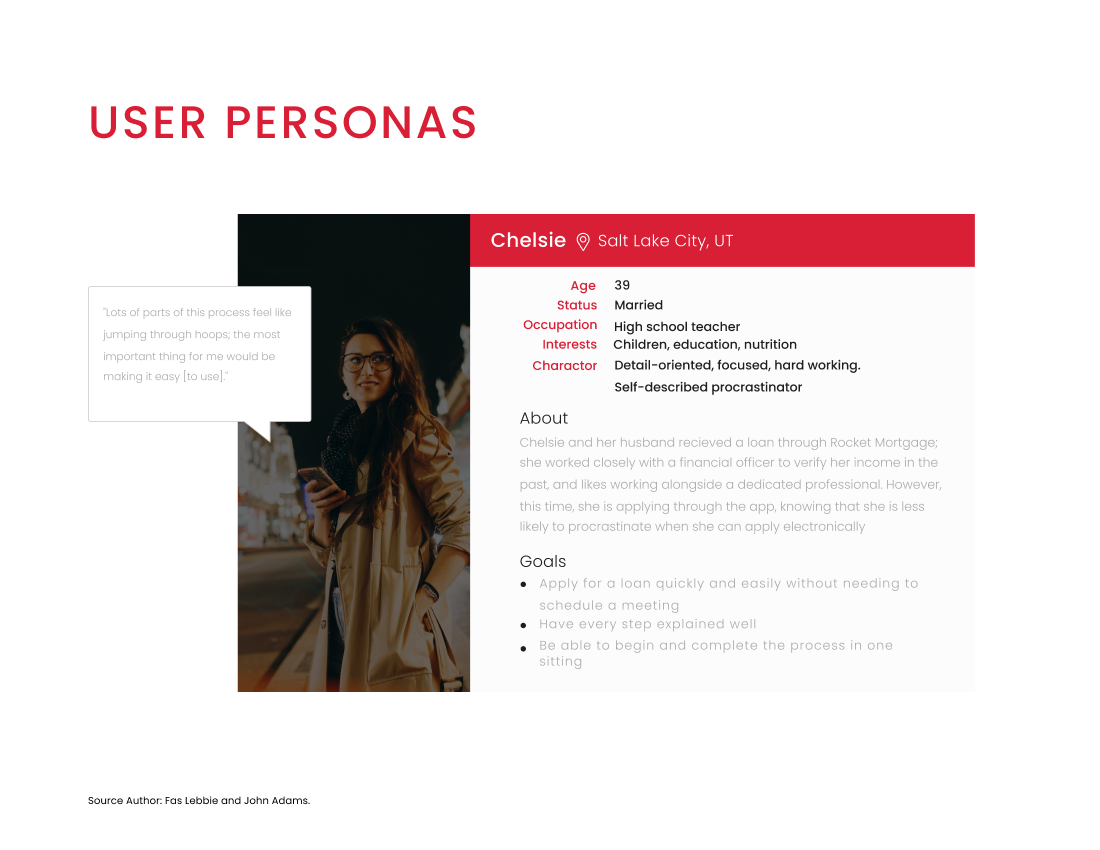

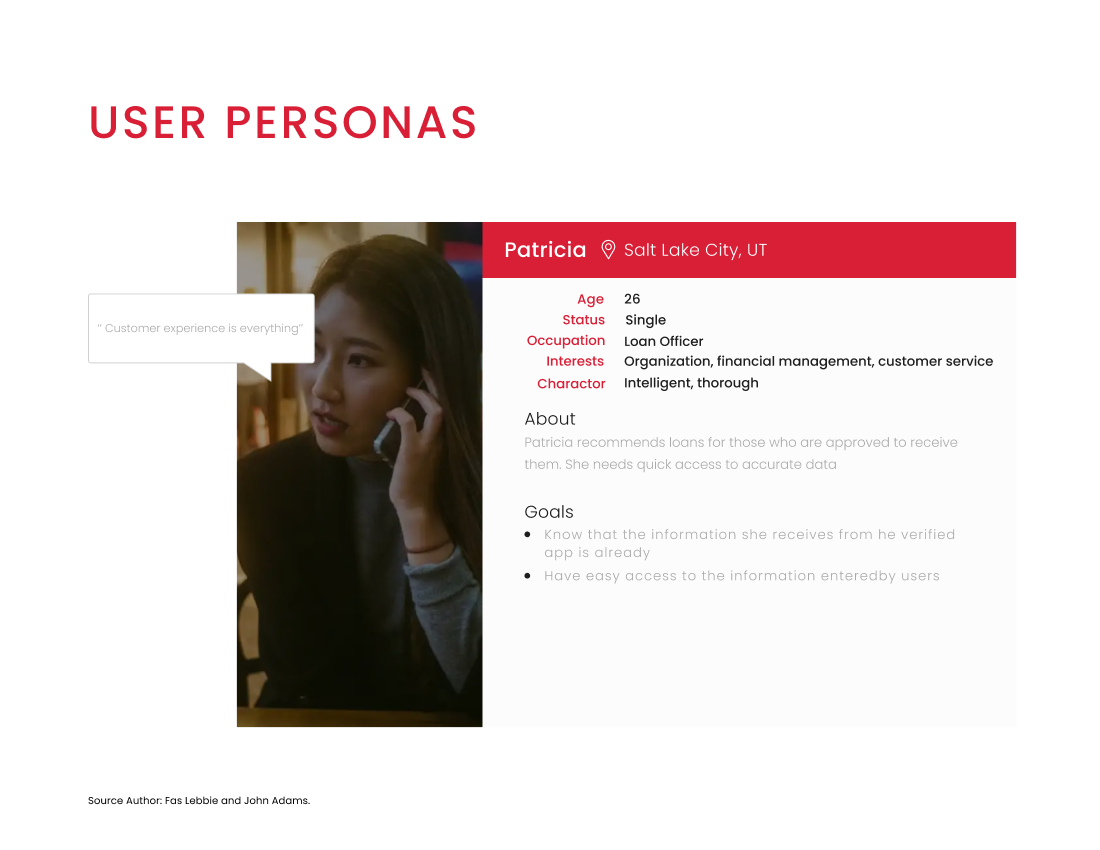

The existing system struggled with reliability and interpretation issues. For borrowers, especially self-employed individuals and gig workers, proving their income felt like solving a puzzle. Loan officers faced their own challenges, spending hours chasing documents and interpreting inconsistent data formats. The market gap was clear: traditional verification methods weren’t keeping pace with evolving employment patterns and digital expectations.

Security and compliance added another layer of complexity – the solution needed to balance rapid verification with rigorous financial regulations.