Project Summary

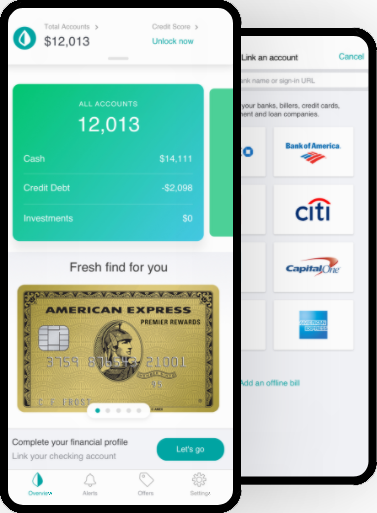

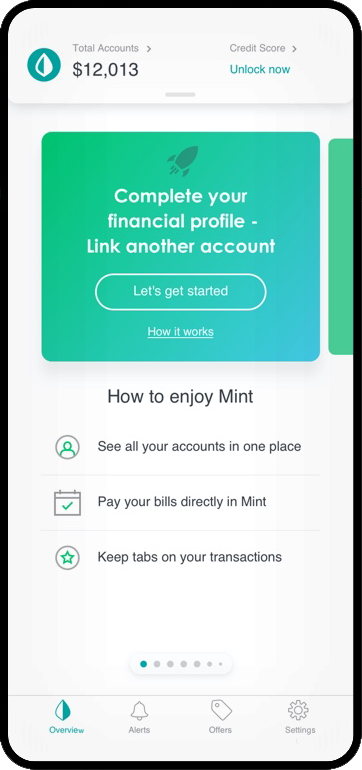

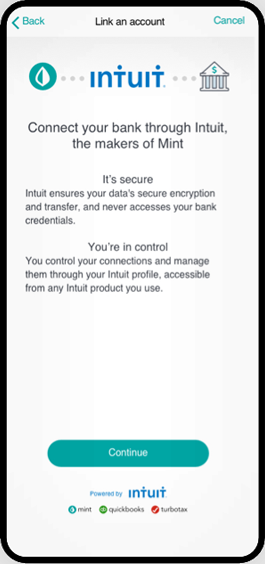

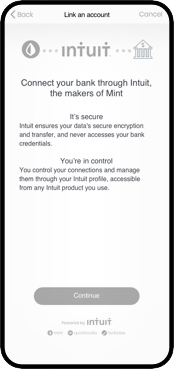

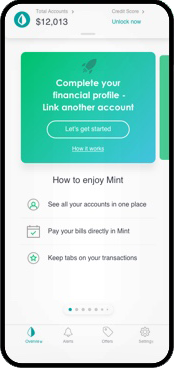

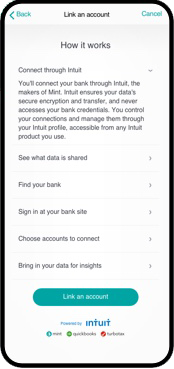

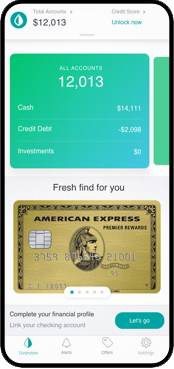

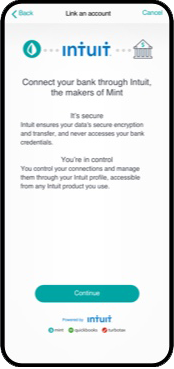

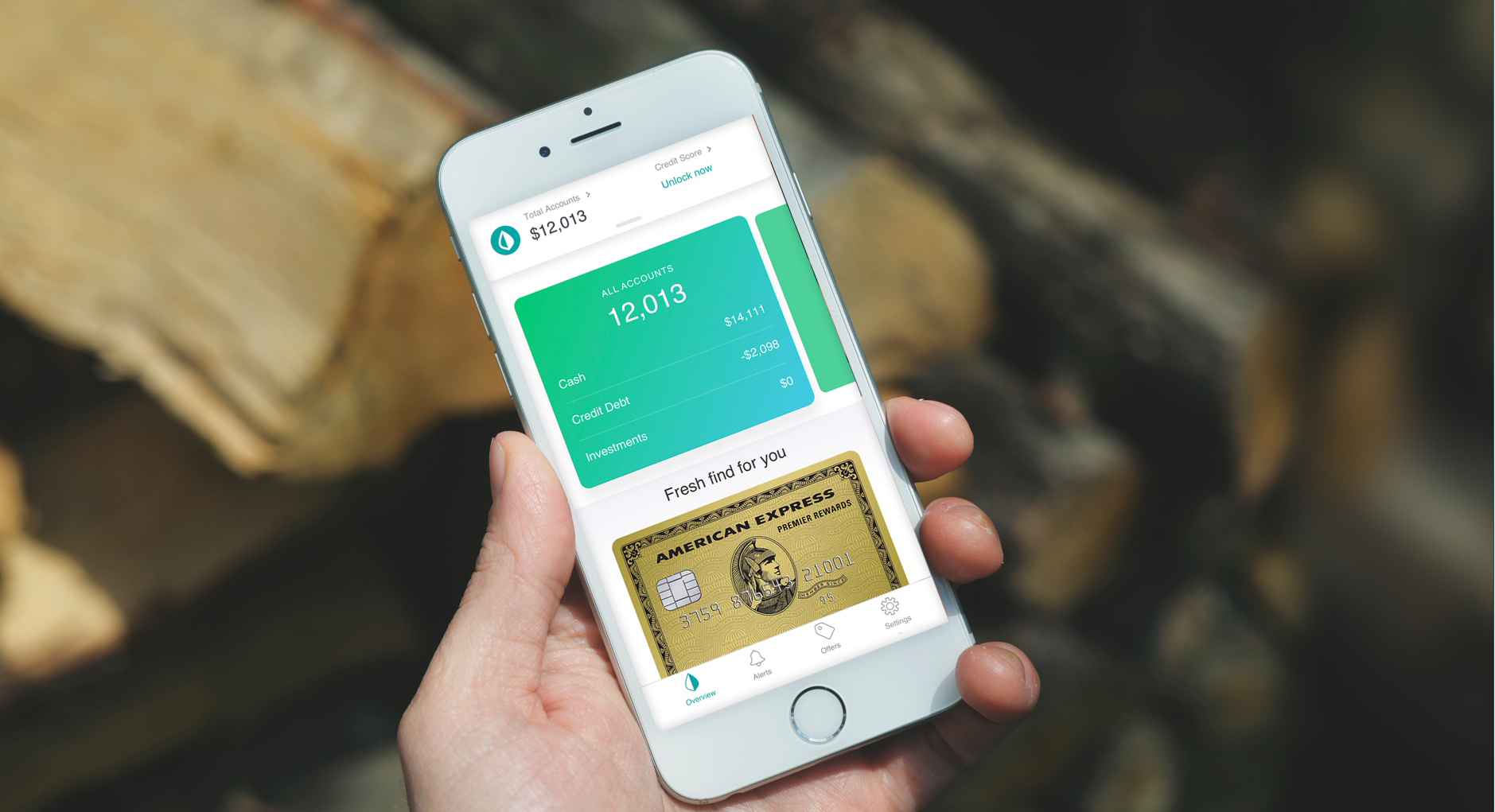

Mint.com is a free financial management service that uses Intuit’s service to connect users’ financial accounts. It encrypts users’ information and stores it in a secure database.

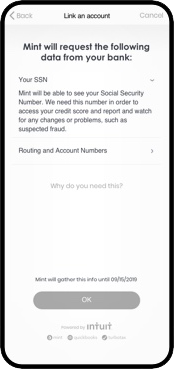

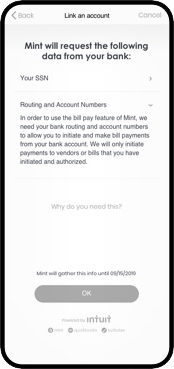

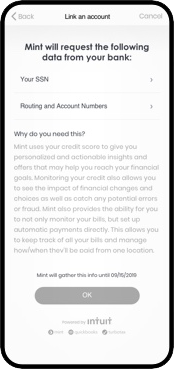

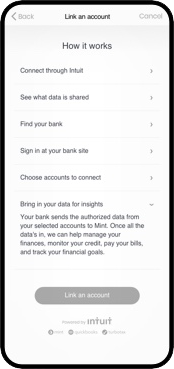

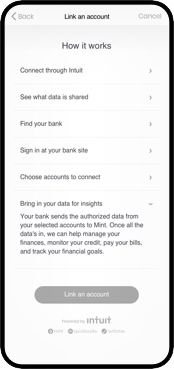

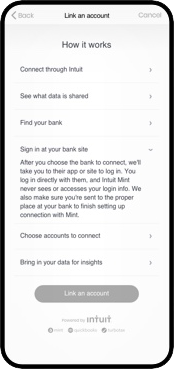

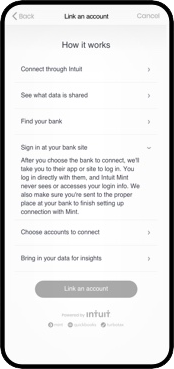

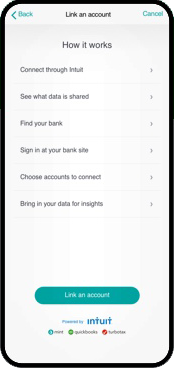

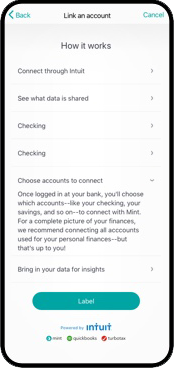

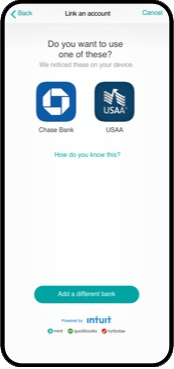

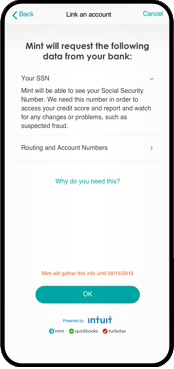

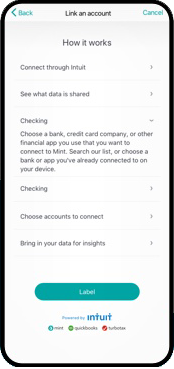

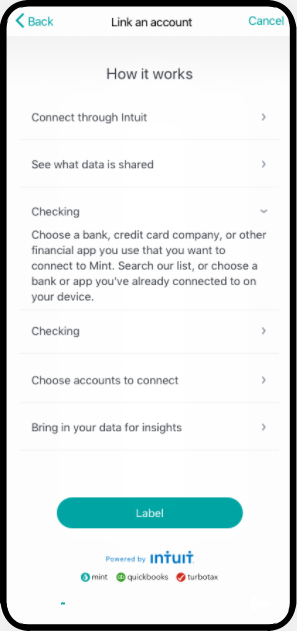

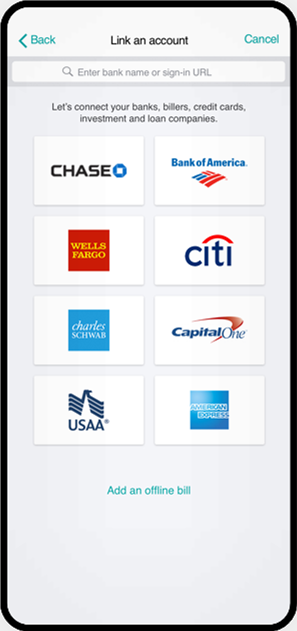

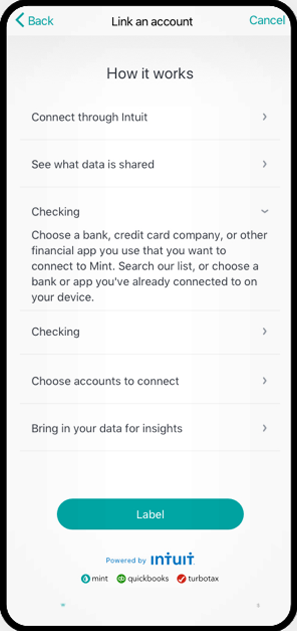

Many third party apps require access to the user's financial data in order to help them. For example, an app helping users make good spending decisions or offer users a loan must access a holistic view of the user’s finances. Each time a third-party app asks for users’ financial data, users choose whether to give consent; in the specific case of Intuit Mint, the app needed to allow users to select which financial data to offer the third party, since full access to their encrypted database would increase risks.

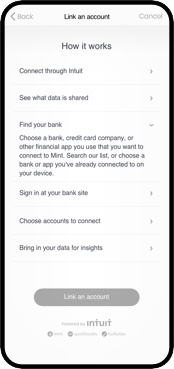

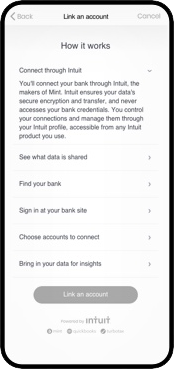

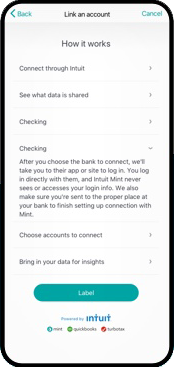

Intuit Mint's goal in this project was how to disclose to the consumer what data is being shared, with whom, for what purpose, and for how long. The new app needed to comply with FDX guidelines for transparency, clearly disclosing what data is being shared with whom, why, and for how long.

Project Objective

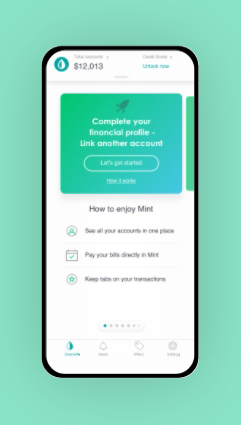

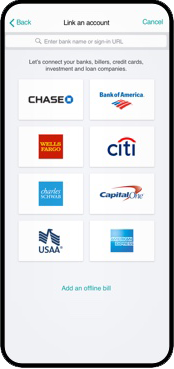

Our task choice architecture design was to develop the Intuit Mint experience within the Financial Data Exchange platform. What will the experience design look like for consumers who have an account with Intuit Mint? How will the process of disclosing data look? What choice architecture design methods will be used to decide where and when user information is displayed, and what will the user journey be like?